- Home

- Income Tax

- _Income Tax Articles

- _Income Tax Circulars and Notifications

- FCRA

- _FCRA Articles

- _FCRA Circulars

- Forms

- _Income Tax Returns

- _Income Tax Forms

- _Challans

- Case Laws

- Act and Rules

- _Income Tax Act

- _Income Tax Rules

- _Equalisation Levy 2020

- _Equ. Levy Rules 2016

- _Bank TD Scheme, 2006

- _ELSS, 2005

- _Finance Act

- _PPF Act, 1968

- _PPF Scheme, 1968

- _New PPF Scheme, 2019

- _KVP Rules, 2014

- _New KVP Scheme, 2019

- _SCSS,2004

- _New SCSS, 2019

- _SSA, 2014

- _SSA, 2016

- _New SSA Scheme, 2019

Showing posts from 2019Show All

CBDT Sets Last Date for Prescribed Electronic Modes of Payment Section 269SU

Sujit Talukder

Tuesday, December 31, 2019

CBDT by Notification dated 30.12.2019 prescribed modes of payments for the…

Read moreCBDT Notified Prescribed Modes of Payment for Section 269SU

Sujit Talukder

Tuesday, December 31, 2019

CBDT has finally notified by Notification No. 105/2019 dated 30.12.2019 pr…

Read moreCBDT once again extended the PAN-Aadhaar Linking Date

Sujit Talukder

Tuesday, December 31, 2019

The due date for linking of PAN with Aadhaar as specified under sub-sect…

Read moreLaw and Procedure of TDS Payment Challan and Returns under 194M

Sujit Talukder

Monday, December 30, 2019

The Law and Procedure of TDS Payment Challan and Returns under section…

Read moreCBDT Instructions for Speedy Disposal of Old Appeals

Sujit Talukder

Sunday, December 29, 2019

The CBDT has issued a directive on 27.12.2019 to all the Pr. CCITs for sp…

Read moreCBDT Circulars on TDS

Sujit Talukder

Sunday, December 29, 2019

CBDT issues from time to time various clarificatory Circulars for clarify…

Read moreCBDT Notification for TDS Challan and TDS Return under 194M and 194N

Sujit Talukder

Friday, December 27, 2019

/ CBDT has issued a Notification No. 98/2019 dated 18.11.2019 to amend th…

Read moreIs Cash or Cheque Payment or Receipt Banned-Section 269SU

Sujit Talukder

Thursday, December 26, 2019

After the introduction of a new section 269SU in the Income Tax Act, 1961 …

Read moreCBDT Order Extended the Due Date for Filing of Return in J&K

Sujit Talukder

Thursday, December 26, 2019

By an Order dated 24.12.2019, the CBDT has further extended the due date f…

Read moreNeAC extended time limit to file response u/s 142(1) E-assessment Scheme 2019

Sujit Talukder

Thursday, December 26, 2019

NeAC vide communication dated 24.12.2019 extended the time limit for filin…

Read moreLayman Guide to PPF Laws and Rules

Sujit Talukder

Sunday, December 22, 2019

The Public Provident Fund or PPF is one of the most popular small saving…

Read moreExtension of due date of TDS payment under 194M

Sujit Talukder

Thursday, December 19, 2019

Budget 2019 has introduced a new section 194M is introduced under which an…

Read moreAdvance tax December Instalment Due Date extended for North Eastern States

Sujit Talukder

Thursday, December 19, 2019

CBDT has extended the due date for payment of advance tax for the Instalmen…

Read moreHRA Tax Exemption for Rent Paid to Parents and Spouse

Sujit Talukder

Thursday, December 19, 2019

HRA or House Rent Allowance tax exemption is available from rent paid to p…

Read moreHRA Exemption is allowed on actual payment of rent

Sujit Talukder

Thursday, December 19, 2019

HRA income tax exemption for rent paid to self by the assessee is not all…

Read moreCritical Analysis of Issues in Taxation Laws (Amendment) Bill, 2019

Sujit Talukder

Monday, December 16, 2019

It is very important to analyze the issues of the provisions contained…

Read moreNew Higher Rate of Depreciation on Motor Car

Sujit Talukder

Wednesday, December 11, 2019

CBDT has issued a Notification No. 69/2019 dated 20.09.2019 and amended…

Read moreNew Corporate Income Tax Rates after Taxation Laws (Amendment) Bill, 2019

Sujit Talukder

Tuesday, December 10, 2019

The Taxation Laws (Amendment) Bill, 2019, which seeks to amend the Inc…

Read moreUnderstanding Amended Surcharge on Income Tax

Sujit Talukder

Monday, December 09, 2019

The Taxation Laws (Amendment) Bill, 2019 has not only reduced the cor…

Read moreHighlights of Key Income Tax Amendments by Taxation Laws (Amendment) Bill, 2019

Sujit Talukder

Friday, December 06, 2019

Highlights of Key Income Tax Amendments by Taxation Laws (Amendment) Bill…

Read moreKey Changes in The Taxation Laws (Amendment) Bill, 2019

Sujit Talukder

Tuesday, December 03, 2019

Key Changes in the Taxation Laws (Amendment) Bill, 2019: The Taxation La…

Read moreFull Text of The Taxation Laws (Amendment) Bill, 2019 with Statement of Objects and Memorandum

Sujit Talukder

Sunday, December 01, 2019

Full Text of The Taxation Laws (Amendment) Bill, 2019 with Statement of …

Read moreCabinet Approves Taxation Laws (Amendment) Bill, 2019

Sujit Talukder

Saturday, November 30, 2019

Cabinet approves Taxation Laws (Amendment) Bill, 2019: On 20th September …

Read moreNew Income Tax Rates for Domestic Companies from AY 2020-21

Sujit Talukder

Saturday, November 30, 2019

New Income Tax Rates for Domestic Companies from AY 2020-21: On 20th …

Read morePress Release of Government on reduced Corporate tax rates under section 115BAA

Sujit Talukder

Friday, November 22, 2019

The Ministry of Finance issued a Press Release dated 20.09.2019 highligh…

Read moreCBDT Circular on Section 115BBA on MAT Credit and Additional Depreciation

Sujit Talukder

Friday, November 22, 2019

CBDT Circular on Section 115BBA on MAT Credit and Additional Depreciation…

Read moreMandatory Quoting of Communication Number in Income Tax Letters

Sujit Talukder

Tuesday, August 20, 2019

Mandatory Quoting of Communication Number in Income Tax Letters: With a vi…

Read moreNew Monetary Limit for Filing of Appeals by the Income Tax Department

Sujit Talukder

Friday, August 16, 2019

New Monetary Limit for Filing of Appeals by the Income Tax Department - A…

Read moreCBDT Circular Clarifying Questions on ITR Filing

Sujit Talukder

Tuesday, August 13, 2019

CBDT Circular Clarifying Questions on ITR Filing: CBDT has issued a Circul…

Read moreIncome tax department launched new lighter version of website e-Filing Lite

Sujit Talukder

Thursday, August 01, 2019

Income tax department is launching 'e-Filing Lite', a lighter ver…

Read moreNo Penalty for Late Filing of Income Tax Return

Sujit Talukder

Thursday, August 01, 2019

No Penalty for Late Filing of Income Tax Return: The Income Law prescribes…

Read moreCheck Income Tax Refund Status Online

Sujit Talukder

Sunday, July 28, 2019

Check Income Tax Refund Status Online: After filing of the income tax retu…

Read moreHRA Tax Exemption Not Allowed for Rent Paid to Mother–ITAT

Sujit Talukder

Sunday, July 28, 2019

HRA tax exemption for rent paid to mother (parents) is not allowed by the …

Read moreHRA Tax Exemption Allowed for Rent Paid to Spouse - ITAT

Sujit Talukder

Saturday, July 27, 2019

HRA tax exemption for rent paid to the spouse (wife) of the assessee is al…

Read moreCBDT Extended the Due Date for Filing of Return for AY 2019-20

Sujit Talukder

Tuesday, July 23, 2019

Finally, after a lot of suspense, the CBDT on 23.07.2019 extended the due…

Read moreImportant aspects of TDS on Cash Withdrawal under Section 194N after Union Budget 2019

Sujit Talukder

Friday, July 19, 2019

Important aspects of TDS on Cash Withdrawal under Section 194N after Union…

Read moreNo Extension of ITR Filing Due Date AY 2019-20

Sujit Talukder

Thursday, July 18, 2019

Image courtesy: https://www.incometaxindiaefiling.gov.in/home No Exten…

Read moreUnderstanding Sch TDS 2 in ITR 1 AY 2019-20

Sujit Talukder

Saturday, July 13, 2019

While filing ITR 1 we often face a problem in filling Sch TDS 2 titled &…

Read moreChanges in TDS Rates and Provisions in Union Budget 2019

Sujit Talukder

Friday, July 12, 2019

The Union Budget 2019 has proposed certain amendments in the TDS rates of…

Read moreNo extension in due date for filing ITR

Sujit Talukder

Thursday, July 11, 2019

The Finance Ministry on 9th July 2019 issued a Press Release and clarifie…

Read more80EEB of Income Tax Act for deduction of interest on Electric Vehicle loan

Sujit Talukder

Wednesday, July 10, 2019

In the Union Budget 2019, the government has announced a deduction from th…

Read moreIncome Tax Slab for AY 2020-21 Update after Union Budget 2019

Sujit Talukder

Wednesday, July 10, 2019

Every year after the presentation of Union Budget by the Finance Minister…

Read moreTax on Income from Life Insurance Policy Clarified in Union Budget 2019

Sujit Talukder

Tuesday, July 09, 2019

There was a lot of confusion among the taxpayers about the computation of …

Read more80EEA of Income Tax Act for deduction of interest on affordable housing loan

Sujit Talukder

Tuesday, July 09, 2019

Finance minister Nirmala Sitharaman in her Union Budget 2019 announced tha…

Read moreChanges proposed in Income-Tax by the Finance Bill 2019

Sujit Talukder

Sunday, July 07, 2019

The changes proposed in the income tax law by the Finance (No. 2) Bill, 20…

Read moreIncome Tax Union Budget 2019 Highlights

Sujit Talukder

Saturday, July 06, 2019

Finance Minister Nirmala Sitharaman presented the Union Budget 2019 along …

Read moreUnion Budget 2019 - Income Tax announcements in Budget Speech

Sujit Talukder

Saturday, July 06, 2019

Finance minister Nirmala Sitharaman presented the Union Budget 2019 in th…

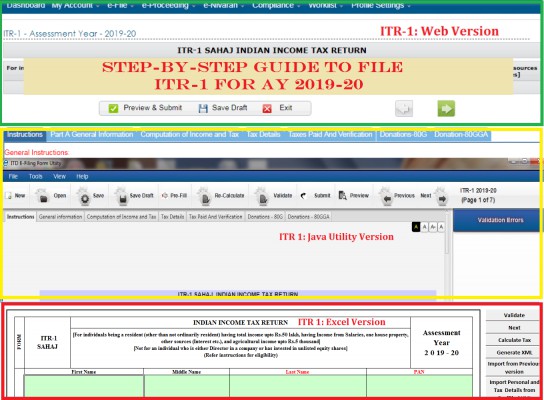

Read moreHow to Independently File ITR 1 for AY 2019-20

Sujit Talukder

Friday, July 05, 2019

Income Tax Return in ITR-1 for Assessment Year AY 2019-20 or Financi…

Read morePrefilled ITR for taxpayers convenience

Sujit Talukder

Monday, July 01, 2019

The income-tax department has introduced the facility to pre-fill the inco…

Read moreTDS u/s 194-IA not applicable for joint buyers having individual share less than Rs 50 Lakh

Sujit Talukder

Sunday, June 30, 2019

Recently, the Delhi Bench of the Income Tax Appellate Tribunal in the ca…

Read moreBuy from Amazon India-Do online Shopping

CLOSE ADS

CLOSE ADS

Popular Posts

What is Seventh proviso to section 139(1)

Tuesday, June 23, 2020

Is ITR and Tax Audit Due Date Extended till 31.03.2021

Saturday, September 19, 2020

A Guide to Depreciation Rates as per Income Tax for AY 2020-21

Sunday, May 03, 2020

Search This Blog

Recent Posts

5/recent/post-list

Recent in Articles

3/Income Tax Articles/post-list

Interested in Online Shopping

Recent in Case Laws

3/Income Tax Case Laws/post-list

Recent in Circulars

3/Income Tax Circulars/post-list

Close

Footer Menu Widget

Crafted with by TemplatesYard | Distributed by MyBloggerThemes