The income-tax department has introduced the facility to pre-fill the income tax returns or ITRs for making the filing of ITRs more convenient for the Assessment Year 2019-20. Earlier, the features were not enabled. Now the ITRs will be prefilled for Salary Income, FD Interest Income and TDS details. However, taxpayers are cautioned that this is the facility to make the filing of ITRs easier and taxpayers should verify the same before filing the ITR. A communication to this effect was published on the income tax e-filing portal https://www.incometaxindiaefiling.gov.in/home on 26th June.

The CBDT had notified the Income Tax Returns or ITRs for Assessment Year 2019-20 relevant to Financial Year 2018-19 vide Notification No. 32/2019 dated 01.04.2019.

Subsequently, since April 2019 the new ITR utilities are being made available by the e-filing website in a phase-wise manner and till the date of publishing this article software utility for all the ITRs (ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-7 and ITR-V) except ITR-6 (applicable for companies) are available for the filing.

There are two modes of submission for filing of income tax returns in ITR 1 and ITR 4.

One is the offline mode in which the software utility is downloaded from the e-filing website and then data is filled. Thereafter an XML file is generated and then the same is uploaded on the e-filing website after logging into the taxpayer's account.

The other mode is the online submission of filing of ITR-1 and ITR-4. In this mode, the taxpayer fills the data in the ITR form directly on the e-filing website and submits the same. The data can be saved for future use until filing is completed. This is the convenient mode of submission since it does not require any software utility.

If one files ITR in any other form other than ITR-1 or ITr-4 then the only option is the offline mode of submission of the ITR.

When the ITR forms were made available on the e-filing website, all the data related to income, TDS and Bank details were required to be filled manually by the taxpayer. No data was auto-filled in the ITR forms except the 'Part-A General Information' of the taxpayer.

Now the income tax department has introduced the facility of pre-filling the ITR forms directly from various sources, the primary source being the Form 26AS. It is also taking the data from the previous returns filed.

As per communication uploaded on the income tax e-filing website, the following details shall be prefilled in the ITR form:-

• PAN, Name, Date of Birth shall be prefilled from PAN database.

• Address. Aadhaar Number, mobile number and e-mail ID shall be prefilled from e-Filing Profile (Please update e-Filling Profile before proceeding).

• Tax Payment. TDS and TCS details shall be prefilled from Form 26AS.

• Details of Salary Income, allowances and deductions shall be prefilled from Annexure II of Form 24Q.

• Type of House Property shall be prefilled from last filed ITR.

• Details of Income from House property shall be prefilled from Form 26AS.

• Details of Interest income from Term Deposit shall be prefilled from Form 26AS.

• Details of Interest income details (u/s 244A) from Income Tax Refund.

• Tax relief u/s 89 shall be prefilled from Annexure II of Form 24Q.

• Bank account details shall be prefilled from last filed ITR and e-Filing Profile.

• Verification Details - Self/Representative PAN details as applicable based on Logged in PAN.

The prefilled facility is only available for ITR-1 and ITR-4 whether submitted in the online mode or offline mode with software/utility. For other ITRs, the feature of prefilled data is not extended and hence are required to be filled manually.

The purpose of the prefilling the ITR forms is to provide convenience to a taxpayer in filing his income tax return. It is cautioned by the portal that taxpayers should verify the pre-filled data carefully and add any other taxable income which is not pre-filled.

These facilities were also available in the preceding year. Now this year also, this feature is reintroduced with some modifications. In this year, the salary income is being prefilled from Annexure II of Form 24Q which is filed by the employer. In the last year, the same was prefilled from the quarterly statements of Form 24Q and was matching with the 'Amount Paid' column in Part-A of Form 16 issued by the employer. In the initial period of this assessment year, when these forms were newly launched, data were not prefiling and a taxpayer was required to fill the data manually.

The software will use the taxpayers PAN to fill the data from the Form 26AS. However, these fields are editable and user or taxpayer can modify the prefilled data if found wrong or incorrect. Primarily, data will be prefilled from the Form 26AS, Form 24Q and last year/available ITR.

For a salaried individual taxpayer, the salary data, Standard Deduction, Professional tax and deductions claimed and reported to the employer by the employee will be taken from the Form 24Q which is filed by the employer. The taxpayer shall match the same with the Form 16 issued by the employer and if any discrepancy is found shall take the matter to the employer for filing a revised return by the employer.

Similarly, the prefilled data will fill the TDS data from Form 26AS. The tax deducted by the employer as well as other deductors during the FY 2018-19 will be taken from Form 26AS itself.

Read Also: How Form 26AS is made

In case the taxpayer has earned any interest income on any Fixed deposits with a bank or other financial institutions, the income, as well as TDS, will be auto-filled in the ITR. If the taxpayer had furnished Form 15G or Form 15H with the deductor like bank etc. even the reported income will be auto-fetched.

It is therefore very important to verify the Form 26AS before filing of the income tax return. In case of any mismatch, one may get a notice from the income tax department.

The prefilled data in the income tax forms shall not be taken as sacrosanct to the income of the taxpayer. It is just a facility for convenience to the taxpayer. Ultimately, the taxpayer is responsible for the income reported in the income tax return. If there is no TDS or no Form 15G or Form 15H is filed, there will be no reporting of income in the Form 26AS unless the deductor voluntarily reports the same. This does not mean that the taxpayer should not show this income in his ITR. The taxpayer is under a legal obligation to disclose the income in the income tax return else it will amount to non-disclosure of income which may invite penalty under the income tax law.

This year the income tax returns are not only filling the income data but also prefilling the deductions. However, in many cases, it is seen that deductions are not prefilling properly. The taxpayer may claim such deduction on his own in the income tax return if otherwise eligible. For example, if the prefilled ITR does not take into account the Standard Deduction for salary income or deduction for Professional tax paid, but the same is shown in Form 16, the taxpayer shall claim the deduction by filling the data in the appropriate field/cell in the ITR.

Similarly, if the employee does not make a declaration of any deduction to the employer or if the employer did not consider any deduction which is actually available to the employee and the employee possesses the evidence for the same, he can claim the same in the IT on his own.

In case of interest income, it is seen that the Schedule-TDS is fetching the income and TDS data from the Form 26AS but not filling the income in 'Income from Other Sources'. One should fill the appropriate fields in the 'Income from Other Sources'. Prefilling of data also auto-filling the interest on income-tax refund under 'Income from Other Sources'. This brought relief to many taxpayers who either ignored it while filing the ITR or face difficulty in finding the interest on income-tax refund.

In case a taxpayer is using the online version of ITR-1 or ITR-4, then the ITR forms are auto-populating the prefilled data in the appropriate fields. If the same is not reflecting or any mistake in the prefilled data, one should fill or rectify the same manually.

In case a taxpayer is using the offline mode of submission of ITR by using the software utility, then one needs to download the Prefilled XML first from the e-filing website after logging into the account and then import the downloaded XML file into the software or utility.

Guide to download the Prefilled XML for importing into the software utility-

Step 1: Log in to e-filing account with your User-ID (which is the PAN) and password at -

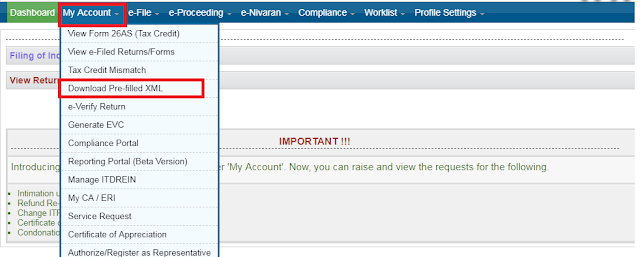

Step 2: Go to or click 'My Account' Menu. In the list, there is an item named 'Download Pre-filled XML'. Click on the item.

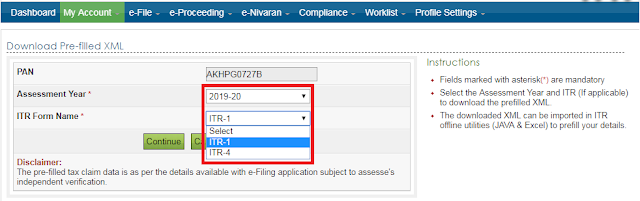

Step 3: A window will open. Therefrom select the Assessment Year as '2019-20' and ITR Form Name - ITR-1 or ITR-4. Click Continue.

Step 4: You will be shown the following window with Bank details. Select the account in which you wish to get the refund. The selected bank must be 'Prevalidated' else no refund will be credited.

Click on 'DownloadXML'.

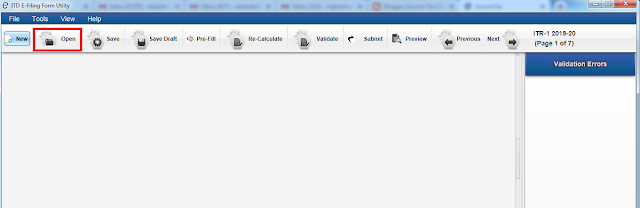

Step 5: Open or Run the ITR-1 or ITR-4 utility as downloaded from the income tax e-filing website. Select the downloaded XML file from the computer.

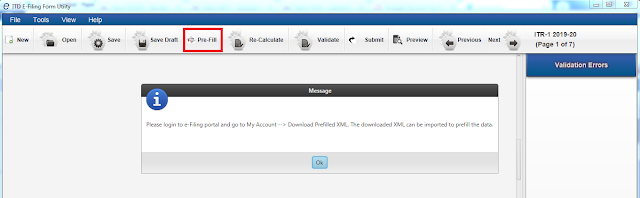

Note: You can get the info by clicking the 'Pre-Fill' item on the utility.

Get all latest content delivered straight to your inbox

0 Comments