CBDT has issued a Notification No. 98/2019 dated 18.11.2019 to amend the Rule 30, Rule 31 and Rule 31A of the Income Tax Rules, 1962 to notify the challan, TDS return and due date of TDS payment under the newly inserted TDS provisions - section 194M and section 194N vide Finance (No. 2) Act, 2019.

Section 194M deals with TDS on payment to a resident Contractor and a resident Professional by an Individual in excess of Rs. 50 Lakh in a financial year. The rate of TDS is 5 percent. In this case, no TAN is required to be taken by the deductor. The deductor can deposit the TDS with his PAN.

Section 194N deals with TDS on cash withdrawals from a bank account including a cooperative bank and from an account held with the Post Office in excess of Rs. 1.0 crore during a financial year. The rate of TDS is 2 percent.

Read the full text of the Notification.

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 18th November, 2019

INCOME-TAX

G.S.R.858(E).- In exercise of the powers conferred by section 295 read with section 194M and 194N of the Income- tax Act, 1961, the Central Board of Direct Taxes, hereby, makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. Short title and commencement.- (1) These rules may be called the Income-tax (14th Amendment) Rules, 2019. (2) They shall come into force from the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 30, -

(a) after sub-rule (2B), the following sub-rule shall be inserted, namely:-

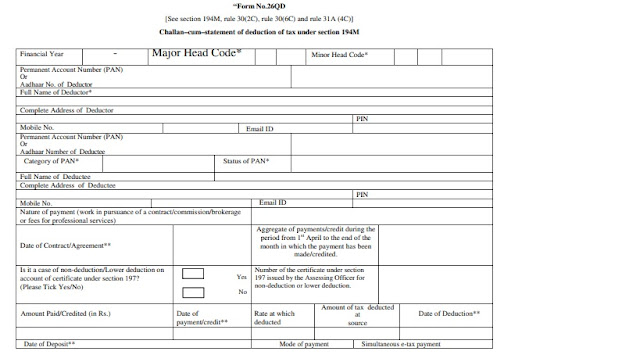

“ (2C) Notwithstanding anything contained in sub-rule (1) or sub-rule (2), any sum deducted under section 194M shall be paid to the credit of the Central Government within a period of thirty days from the end of the month in which the deduction is made and shall be accompanied by a challan-cumstatement in Form No. 26QD.”;

(b) after sub-rule (6B), the following sub-rule shall be inserted, namely:—

“(6C) Where tax deducted is to be deposited accompanied by a challan-cum-statement in Form No.26QD, the amount of tax so deducted shall be deposited to the credit of the Central Government by remitting it electronically within the time specified in sub-rule (2C) into the Reserve Bank of India or the State Bank of India or any authorised bank.”.

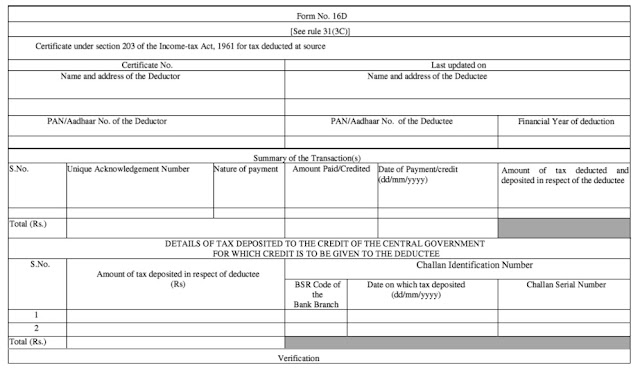

3. In the principal rules, in rule 31, after sub-rule (3B), the following sub-rule shall be inserted , namely:— "

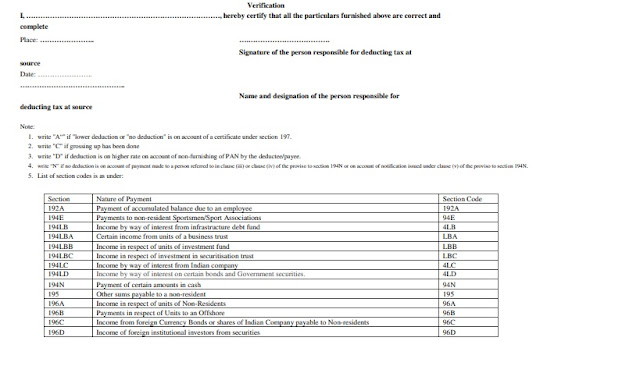

“(3C) Notwithstanding anything contained in sub-rule (1) or sub-rule (2) or sub-rule (3), every person responsible for deduction of tax under section 194M shall furnish the certificate of deduction of tax at source in Form No.16D to the payee within fifteen days from the due date for furnishing the challan-cum-statement in Form No.26QD under rule 31A after generating and downloading the same from the web portal specified by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or the person authorised by him.”

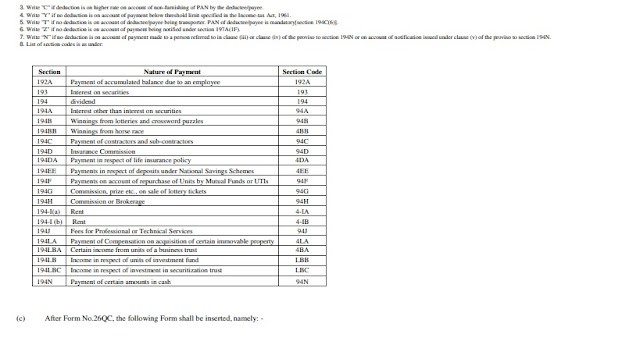

4. In the principal rules, in rule 31A, in sub-rule (4), after clause (viii) the following clause shall be inserted, namely:—

“(ix) furnish particulars of amount paid or credited on which tax was not deducted in view of the exemption provided in clause (iii) or clause (iv) of the proviso to section 194N or in view of the notification issued under clause (v) of the proviso to section 194N.”

5. In the principal rules in rule 31A, after sub-rule(4B), the following sub-rule shall be inserted, namely: -

“(4C) Notwithstanding anything contained in sub-rule (1) or sub-rule (2) or sub-rule (3) or sub-rule (4), every person responsible for deduction of tax under section 194M shall furnish to the Principal Director General of Income-tax (Systems) or Director General of Income-tax (System) or the person authorised by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) a challan-cumstatement in Form No.26QD electronically in accordance with the procedures, formats and standards specified under sub-rule (5) within thirty days from the end of the month in which the deduction is made.”

6. In the principal rules, in Appendix II — (a) after Form No.16C, the following Form shall be inserted, namely: —

Download the Notification No. 98/2019 dated 18.11.2019.

Get all latest content delivered straight to your inbox

0 Comments