The income-tax department has informed that deduction under section 80G of the Income-tax Act, 1961 (‘Act’) for donation shall be allowed on the basis of the amount of deduction claimed in the return of income (ITR) and not on the basis of the certificate of donation in Form 10BE except where the deduction is claimed for donation to such fund or institution or Trust which are approved under section 80G(2)(iv) of the Act and is classified under Category D – Donation entitled for 50% deduction without qualifying limit in the income tax return (ITR).

This information has been published on the e-filing portal of the income-tax department.

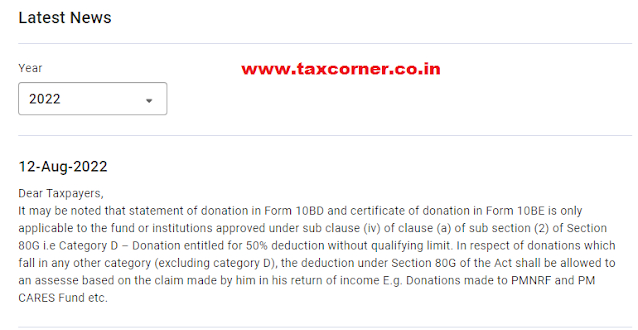

The update on the portal says it may be noted that statement of donation in Form 10BD and certificate of donation in Form 10BE is only applicable to the fund or institutions approved under sub-clause (iv) of clause (a) of sub-section (2) of Section 80G i.e Category D – Donation entitled for 50% deduction without qualifying limit. In respect of donations which fall in any other category (excluding category D), the deduction under Section 80G of the Act shall be allowed to an assessee based on the claim made by him in his return of income E.g. Donations made to PMNRF and PM CARES Fund etc.

Section 80G(2) of the Act lists many funds or institutions donations to which can be claimed as a deduction. All of these funds or institutions are not required to file a statement of donation in Form 10BD and as such are not required to issue any certificate of donation in Form 10BE to the donors.

Out of these, only those funds or institutions which are approved under section 80G(2)(iv) of the Act are required to furnish a statement of donation in Form 10BD as per the provisions of section 80G(2)(viii) and issue a certificate of donation in Form 10BE as per the provisions of section 80G(2)(ix) of the Act.

The donors are eligible to claim a deduction in respect of donations made to these funds or institutions only if the donee has furnished Form 10BD with the income-tax department.

It is pertinent to note that normally charitable trusts are approved under section 80G(2)(iv) of the Act and such charitable trusts are required to furnish a statement of deduction in Form 10BD and also required to issue a certificate of donation in Form 10BE to the donor to make them eligible for claiming a deduction for the donation made to such trusts.

It is also important to note that as per the provisions of section 80G(3) of the Act, deduction under section 80G(2)(iv) is subject to an overall ceiling of 10% of gross total income before allowing any deduction under section 80G which is called as ‘qualifying limit’. Further, as per section 80G(1), the deduction to charitable trusts or other institutions approved under section 80G(2)(iv) shall be allowed at 50%.

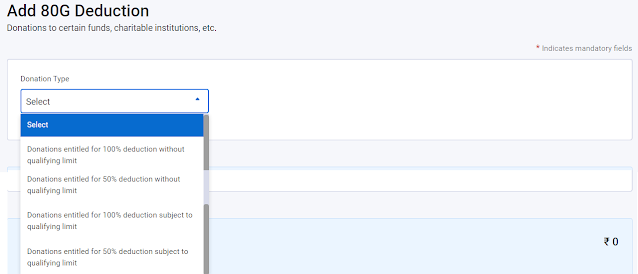

All the donations and deductions thereof are categorized in four parts in the return of income (ITR)-

A. Donations entitled for 100% deduction without qualifying limit

B. Donations entitled for 50% deduction without qualifying limit

C. Donations entitled for 100% deduction subject to qualifying limit

D. Donations entitled for 50% deduction subject to qualifying limit

The ITR forms notified for AY 2022-23 have the serial numbers ‘A’ to ‘D’, however, the utility released by the income-tax department for filing of ITR forms does not contain the same, but the order of deduction criteria is kept same, as shown below-

Thus, as per the information so published, the deduction for donations to charitable trusts or institutions which are approved under section 80G(2)(iv) will be allowed on the basis of online information submitted by the donee institutions in Form 10BD. These donations are categorized as ‘D. Donations entitled for 50% deduction subject to qualifying limit’ in the ITR forms.

In other cases, as those funds or institutions are not required to furnish Form 10BD, the deduction for donation will be allowed on the basis of the deduction claimed by the taxpayer in his return of income (ITR). For example funds like Prime Minister’s National Relief Fund (PMNRF) and PM CARES Fund are not required to furnish any statement of donation in Form 10BD and issue any donation certificate in Form 10BE to the donor. Thus, any donation to these funds will be allowed on the basis of the deduction claimed in ITR.

Read also: Statement of Donation in Form No. 10BD and Certificate of Donation in Form 10BE

It is important to note that even though the charitable trusts or institutions which are approved under section 80G(2)(iv) are required to furnish Form 10BD electronically online, no information of donation is shown either in Form 26AS or in the Annual Information Statement (AIS) of the donor.

Read Also:

Income Tax Department Rolls out new Annual Information Statement (AIS)

CBDT issues Order to Upload GST Return Information in the Annual Information Statement in Form 26AS

Annual Information Statement to replace Form 26AS-Budget 2020

Note: There seems to be a typographical error in the information published in the sentence ‘Category D – Donation entitled for 50% deduction without qualifying limit’. It says category D is related to deduction without any qualifying limit whereas category D deals with deduction @ 50% subject to qualifying limit. Even otherwise, the deduction for a donation to a fund or institution approved u/s 80G(2)(iv) is allowed at 50% subject to the qualifying amount. Hence, in the author’s view, it should be read as ‘D-Donations entitled for 50% deduction subject to qualifying limit’.

Hence, the sum and substance of the information is that there will be no online matching of deduction claimed under section 80G in the ITR by an assessee for the donations covered in the three categories i.e. Category A, Category B and Category C. In case of deduction claimed under category D, the same will be allowed on the basis of online matching of data furnished by the donee through Form 10BD.

Any Trust or NGO approved under section 80G has to comply with two new compliances from the FY 2021-22:

I. Mandatory furnishing of statement of donations (Donation Returns)

II. Issue of donation certificates to each donor

Section 80G(5)(viii) requires the furnishing of a statement of donation received by an approved trust or an NGO or an institution from each donor.

Section 80G(5)(ix) requires the issue of donation certificates to each of the donors for claiming deduction from the gross total income.

Clauses (viii) and (ix) of section 80G(5) were initially introduced by the Finance Act, 2020 but deferred to 1-4-2021 due to the outbreak of COVID-19 pandemic. Later on, vide the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, the provisions were reintroduced in the statute with effect from 1-4-2021.

CBDT in its Notification No. 19/2021 dated 26.03.2021 has laid down the procedure for furnishing the particulars of donation in Form 10BD and issuing of a donation certificate to each donor in Form No. 10BE which shall be mandatory for all the Trusts, NGOs, and other organisations approved u/s 80G(5)(viii) and u/s 80G(5)(ix) respectively of the Income Tax Act, 1961. For this purpose, Rule 18AB is inserted in the Income Tax Rules, 1962 by the Income-tax (Sixth Amendment) Rules, 2021, w.e.f. 1-4-2021.

Also Read:

Donation to PM CARES FUND and CM Relief Fund qualifies for CSR Expenditure amid COVID-19

Section 80G deduction for Donation to West Bengal State Emergency Relief Fund

Deduction for Collective Donation under section 80G to Employees through Employer

Deduction under section 80G for Donation to PM CARES Fund

Donation to PM CARES Fund to fight COVID-19

CBDT allows deduction under section 80G for donation to Shri Ram Janmabhoomi Teerth Kshetra

0 Comments