The CBDT in its Notification No. 19/2021 dated 26.03.2021 has laid down the procedure for furnishing the particulars of donation in Form 10BD and issuing of a donation certificate to each donor in Form No. 10BE which shall be mandatory for all the Trusts, NGOs, and other organizations approved u/s 80G(5)(viii) and u/s 80G(5)(ix) respectively of the Income Tax Act, 1961 (“Act”). For this purpose, Rule 18AB is inserted in the Income Tax Rules, 1962 (“Rules”) by the Income-tax (Sixth Amendment) Rules, 2021, w.e.f. 1-4-2021.

Introduction

Clauses (viii) and (ix) of section 80G(5) were initially introduced by the Finance Act, 2020 but deferred to 1-4-2021 due to the outbreak of COVID-19 pandemic. Later on, vide the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020, the provisions were reintroduced in the statute with effect from 1-4-2021.

Any Trust or NGO approved under section 80G has to comply with two new compliances from the FY 2021-22:

I. Mandatory furnishing of statement of donations (Donation Returns)

II. Issue of donation certificates to each donor

Summary of the Provisions related to the filing of a statement of donation (Donation returns) and the issue of donation certificates:

1. Mandatory furnishing of statement of donations (Donation Returns) by trusts or institutions approved under section 80G

2. A new 1rule 18AB is introduced in the Income Tax Rules, 1962 to provide the rules for furnishing statement of donation

3. Such a statement of donation is required to be furnished annually by 31st May.

4. The prescribed form to furnish such a statement of donation is Form No. 10BD

5. This rule for furnishing a statement of donation in Form 10BD is applicable from the FY 2021-22. Hence, every organization approved u/s 80G shall furnish the statement in respect of each and every donation received during FY 2021-22..

6. The first statement of donation is required to be furnished by 31st May 2022.

7. All the organizations receiving donations are required to issue donation certificates to each donor after furnishing the statement of donation.

8. The certificate of donation is required to be issued in Form 10BE by 31st May.

9. All the above mentioned procedures are online.

The new Rule 18AB relates to the furnishing of Statement of particulars of donation received u/s 80G(5)(viii) and issue of a donation certificate to each donor u/s 80G(5)(ix) shall be applicable from the FY 2021-22 and the due date prescribed for furnishing such statement and the issue of donation certificate is 31st May of the immediately following financial year.

Section 80G(5)(viii) requires the furnishing of a statement of donation received by an approved trust or an NGO or an institution from each donor. Section 80G(5)(viii) reads as under:

(viii) the institution or fund prepares such statement for such period as may be prescribed and deliver or cause to be delivered to the prescribed income-tax authority or the person authorised by such authority such statement in such form and verified in such manner and setting forth such particulars and within such time as may be prescribed:

Provided that the institution or fund may also deliver to the said prescribed authority, (a) correction statement for rectification of any mistake or to add, delete or update the information furnished in the statement delivered under this sub-section in such form and verified in such manner as may be prescribed; and

Therefore, CBDT is empowered to prescribe rules on the followings matters related to furnishing of statement of donation received by the institution or fund u/s 80G(5)(viii)-

1. Period: The period for which such a statement is required to be furnished by the institution or fund.

2. Prescribed income-tax authority: The CBDT shall notify the prescribed income-tax authority for the purpose of furnishing such a statement. The prescribed income-tax authority shall have the power to delegate the authority.

3. Prescribed Form: The CBDT shall prescribe the Form in which the institution or fund shall furnish the statement.

4. Verification: The CBDT shall prescribe the procedure to verify the statement.

5. Particulars: The Board shall notify the particulars to be furnished in the statement by the organizations receiving the donation.

6. Due Date: Further, the Board shall also notify the due date within which the statement of donations received shall be furnished by the organizations receiving the donation.

7. Correction statement: The first proviso to section 80G(5)(viii) provides for filing of correction of original statement to rectify any mistake therein.

Section 80G(5)(ix) requires the issue of donation certificates to each of the donors for claiming deduction from the gross total income. Section 80G(5)(ix) reads as under:

(ix) the institution or fund furnishes to the donor, a certificate specifying the amount of donation in such manner, containing such particulars and within such time from the date of receipt of donation, as may be prescribed:

Section 80G(5)(ix) casts a new obligation to the organizations receiving the donation. Such organizations are required to issue a ‘Certificate of Donation’ to each donor. CBDT is empowered to prescribe rules on the followings matters related to furnishing of Certificate of Donation to each donor u/s 80G(5)(ix)-

1. Manner of issuing donation certificates: The Board shall specify the manner in which such certificates will be required to be issued to the donors.

2. Particulars: The Board shall notify the particulars to be furnished in such certificates by the organizations receiving the donation.

3. Due Date: Furthermore, the Board shall also notify the due date within which such certificates are required to be issued by the organizations receiving the donation to each of the donors.

By virtue of the powers conferred by section 80G(5)(viii) and (ix), CBDT issued Notification No. 19 on 26.03.2021 and prescribed Rule 18AB for this purpose.

How to furnish statement of donation in Form 10BD

Rules related to Filing or Furnishing of statement of donation u/s 80G(5)(viii)

1. Prescribed income-tax authority: For the purpose of section 80G(5)(viii), the prescribed authority shall be the Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems). [Rule 18AB(1)]

2. Period: The statement for donation shall be furnished in respect of each financial year, beginning with the financial year 2021-2022. [Rule 18AB(2)]

3. Form 10BD for furnishing statements: Statement of particulars required to be furnished by any institution or fund (“reporting person”) under clause (viii) of sub-section (5) of section 80G in Form No. 10BD and shall be verified in the manner indicated therein. [Rule 18AB(2)]

4. Online furnishing of statement in Form 10BD: Such statements in Form No. 10BD are required to be filed electronically. The Principal Director General of Income Tax (Systems) or Director General of Income Tax (Systems) have been made responsible for laying down:

Procedure and standards for furnishing and verifying the details filled in Form No. 10BD

Procedure to submit correction statement for allowing rectification of of any mistake or to add, delete or update the information furnished in Form No. 10BD

[Rule 18AB(4)]

Read Also: A step-by-step guide on How to File Form 10BD Online on e-filing portal

5. Verification of Form 10BD: Form No. 10BD shall be verified by the person who is authorised to verify the return of income under section 140 of the Act with digital signature (DSC) or EVC.

If the return of income of the applicant is required to be furnished mandatorily under digital signature, then furnishing Form 10BD with DSC is compulsory else the forms can be furnished with EVC. [Rule 18AB(4)/(5)]

6. Due Date: Annual filing of the statement of donations received in Form 10BD: The statement of donations received in a financial year shall be required to be furnished annually by 31st May, immediately following the financial year in which the donation is received. [Rule 18AB(9)]

7. Reporting of the aggregate amount of donation for each person: The reporting person shall report the aggregate amount of donation received from each person in the financial year for which the statement is furnished. [Rule 18AB(3)(i)]

8. Reporting of donation received from more than one person: Where a donation is received from more than one person, the proportionate amount of each person shall be reported. Where no proportion is specified by the donors, the same shall be proportioned equally. [Rule 18AB(3)(ii)]

How to issue donation certificate to donors in Form 10BE

Rules related to issue of certificate of donation u/s 80G(5)(ix)

1. Manner of Issuing donation Certificates to donors: The reporting person is required to furnish a certificate of donation (as referred to in clause (ix) of sub-section (5) of section 80G) to the donor in Form No. 10 BE specifying the amount of donation received during financial year from such donor, beginning with the financial year 2021-2022. [Rule 18AB(6)]

2. Online generated donation certificates: The certificate of donation in Form 10BE is required to be generated and downloaded from the income tax portal to be implemented by the Pr. DGIT/DGIT (Systems). [Rule 18AB(7)]

The Principal Director General of Income Tax (Systems) or Director General of Income Tax (Systems) have been made responsible for laying down the procedure, format and standards for generating and downloading the certificates in Form 10BE.

[Rule 18AB(4)]

3. Due Date for issuing Donation Certificate in Form 10BE: The certificate of donation is required to be furnished to the donor on or before the 31st May, immediately following the financial year in which the donation is received. [Rule 18AB(8)]

Note: Incidentally, the due date for both the actions-furnishing statement of donation and issuing donation certificates to donors is 31st May. As per rules, the trusts or NGOs need to generate and download the certificates from the online portal. Hence, practically, the statement needs to be furnished well before 31st May so that certificates can be issued by 31st May. For the financial year 2021-22, the due date for filing and issuing these forms will be 31st May 2022.

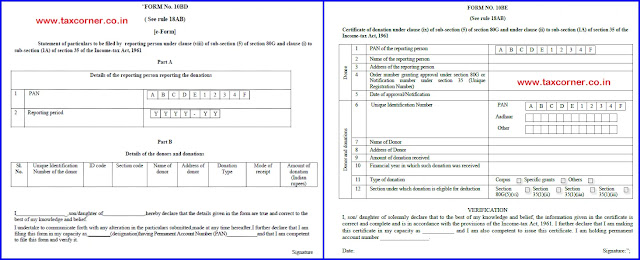

Overview of Form 10BD

Any Charitable Trust or an NGO is required to submit a statement of donation in Form No. 10BD setting forth the following particulars-

1. Structure of the Form: Form No. 10BD is divided in two parts-

Part A: Details of the reporting person reporting the donations

Part B: Details of the donors and donations

Part A has only PAN and the reporting period information. The reporting period is nothing but the financial year for which the statement is being furnished. The address and contact details of the reporting person filing the statement, as per the latest Income Tax Return filed by the reporting person, will be displayed on the screen and if there is a change, the reporting person will be provided an option to change the details. Rest details are in Part-B.

Read Also:

FAQs on Reporting of Donations in Form 10BD for Statement of Donation

2. Unique identification number of the donor: In Form No. 10BD, it is mandatory to state the Unique Identification Number of the donor. Any one of the following may be used as “Unique identification number of the donor”:

If PAN or Aadhaar number is available, one of that should be mandatorily filled and the following ID code shall be filled

If PAN or Aadhaar is not available, any one of the following should be filled:

3. Section Code: In the field titled “section code: of Form No. 10BD, the section under which donor is allowed to claim deduction for the donation needs to be filled out of the following options:

a) Section 80G

b) Section 35(1)(iia)

c) Section 35(1)(ii)

d) Section 35(1)(iii)

4. Donation Type: In ‘Donation Type’, any one of the followings may be filled:

a) Corpus

b) Specific Grant

c) Others

5. Mode of receipt: In the field titled ‘mode of receipt’, the followings needs to be selected:

Note: 1. In the case of a donor who have given donations, which are eligible under different sections or which are of different types or in different modes, separate rows should be filled for each such combination electronic modes including account payee cheque/draft

2. Multiple form 10BD may be filed by the same reporting person, as per the procedures laid down by the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems), as the case may be.

Update:

CBDT notifies changes in Form 10A, Form 10AB, Form 10BD, form 10BE and Form 3CF

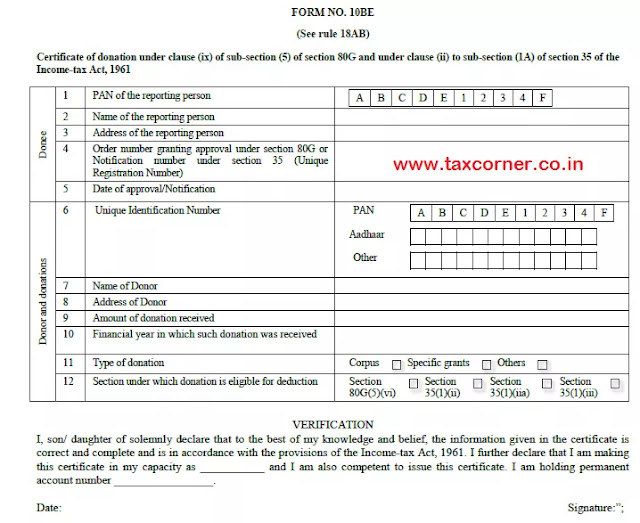

Overview of Form 10BE

Any Charitable Trust or an NGO is required to issue a certificate of donation to each donor in Form No. 10BE setting forth the following particulars-

1. Structure of Form No. 10BE: This form is divided into two sections: In the first section details of Doneness' are given and in the second section details of donors and donations are given.

2. URN and date of approval of the donee: The donation certificate in Form No. 10BE contains the Unique Registration Number (URN) and date of approval of the charitable trust/NGO. Since the certificate is generated online from the income tax portal, it appears this information will be prefilled.

Note: Readers are aware that every trust of institution which is registered or approved under section 80G is mandatorily required to seek reapproval under the amended provisions of section 80G after making an application for the same in Form 10A in line with the new registration regime of section 12AB.

3. Details of donors and donations: Similarly, the second section on details of donors and donations will be prefilled from the data given by the trust or institutions in the statement of donation in Form 10BD.

4. Digital Signature on the certificate: The notified Form 10BE only requires singing the certificate by the donor. It is not stated whether the same can be issued under a digital signature. The Pr. DGIT(Sys.)/ DGIT(Sys.) may notify the same later on.

Note: Through the Notification, the CBDT has notified Form No. 10BD and Form No. 10BE, but the same has not yet been made available on the income tax portal. Once the same is made available, the same will be published on the blog. So, stay tuned to this blog for updates.

Deduction to be allowed on the basis of statement furnished

Henceforth, deduction under section 80G to a donor shall be allowed only if a statement is furnished by the donee who shall be required to furnish a statement in respect of donations received. This donation will be reflected in the donors Annual Information Statement or Form 26AS from where he can claim the deduction u/s 80G.

Consequences of failure to furnish statement of donation

The income-tax law has provided the following two penalty provisions in case of failure to furnish the statement of donation and issuing donation certificates to donors. One is Late Fees under section 234G and another is Penalty under section 271K.

Section 234G: Late Fees for default in furnishing statement of donation or issuing certificates to donors

The provisions of the income tax law related to deduction under section 80G has been revamped and henceforth any deduction under section 80G to a donor shall be allowed only if a statement is furnished by the donee who shall be required to furnish a statement in respect of donations received and hence, in the event of failure to do so, fee and penalty shall be levied.

Section 234G of the Act provides for payment of a fee for default relating to furnishing of statement as per section 80G(5)(viii) and donation certificate as per section 80G(5)(ix).

Section 234G(1)(b) provides that where the institution or fund fails to deliver a statement within the prescribed time under section 80G(5)(viii) or furnish a certificate prescribed under section 80G(5)(ix), it shall be liable to pay fees of Rs. 200 for every day during which the failure continues.

However, there is a ceiling prescribed in the amount of late fees so payable. The amount of late fees shall not exceed the amount of donation as contained in the statement of donation if the failure is related to the furnishing of the statement. In case, the failure is happening for the delay in issuing the donation certificate, the amount of late fees cannot exceed the amount of donation as mentioned in the certificate. [Section 234G(2)]

Thus, if there is a delay in furnishing the statement of donation by one day, the trust or NGO has to shell out Rs. 400/- in aggregate. Rs. 200 for the delay in furnishing the statement and Rs. 200 for issuing the certificates.

It is further provided that the fees shall be required to be paid before furnishing the statement of donation in Form 10BD with the income tax authority. Therefore, the late fee is first required to be paid through challan (which is yet to be notified) and then after the payment of late fees, the statement of donation needs to be furnished.

Note: In the Form No. 10BD there is no option to furnish the details of any patent of late fees under section 234G. It appears that the same will be notified by the Pr. DGIT(Sys.)/DGIT(Sys.).

The prescribed due date for furnishing the statement of donation and issuing a donation certificate is 31st May as per Rule 18AB(8)/(9).

Section 234G reads as follows-

Fee for default relating to statement or certificate.

234G. (1) Without prejudice to the provisions of this Act, where,—

(a) the research association, university, college or other institution referred to in clause (ii) or clause (iii) or the company referred to in clause (iia) of sub-section (1) of section 35 fails to deliver or cause to be delivered a statement within the time prescribed under clause (i), or furnish a certificate prescribed under clause (ii) of sub-section (1A) of that section; or

(b) the institution or fund fails to deliver or cause to be delivered a statement within the time prescribed under clause (viii) of sub-section (5) of section 80G, or furnish a certificate prescribed under clause (ix) of the said sub-section,

it shall be liable to pay, by way of fee, a sum of two hundred rupees for every day during which the failure continues.

(2) The amount of fee referred to in sub-section (1) shall,—

(a) not exceed the amount in respect of which the failure referred to therein has occurred;

(b) be paid before delivering or causing to be delivered the statement or before furnishing the certificate referred to in sub-section (1).

Processing of statement of donation

There is no provision made in the income-tax law to process the statement of donation. Unlike TDS statements, there is no requirement to process the statement of donation furnished in Form No. 10BD.

Section 271K: Penalty for failure to furnish statement of donation or issuing certificates to donors

section 271K relates to imposition of penalty for failure to furnish statements of donation and issuing certificates.

Section 271K provides that without prejudice to the provisions of the Act, the Assessing Officer may direct that a sum not less than Rs. 10,000 but which may extend up to Rs. 1 Lakh shall be paid by way of penalty by the institution or fund, if it fails to deliver or cause to be delivered a statement within the time prescribed under clause (viii) of sub-section (5), or furnish a certificate prescribed under clause (ix) of sub-section (5) of section 80G.

In other words, if the Charitable Trust or NGO fails to furnish the statement of donation or issue donation certificates to the donors within the prescribed due date of 31st May as per Rule 18AB(8)/(9), it may be liable to pay a penalty which may range from Rs. 10,000 to Rs. 1 Lakh. The penalty shall be imposed by the Assessing Officer.

Note: The Assessing Officer is not bound to issue show cause to the institution or fund before imposing the penalty. The provisions related to proving the reasonable cause of the failure is missing in section 273B of the Act in case of penalty imposable under section 271K. Although, section 271K is inserted into the Act there is no corresponding amendment in section 237B to cover section 271K.

It may be recalled that section 273B provides that no penalty under the specified sections shall be imposable if the assessee proves that there was reasonable cause for the failures/ defaults as envisaged under those provisions. In other words, section 273B grants immunity from levy of penalty for failure in compliance of any provision, if the assessee proves that there was a reasonable cause.

However, it should be noted that section 271K uses the word “may” which signifies that the AO has to follow the Principle of Natural Justice before levying the penalty u/ 271K.

Section 271K reads as follows-

Penalty for failure to furnish statements, etc.

271K. Without prejudice to the provisions of this Act, the Assessing Officer may direct that a sum not less than ten thousand rupees but which may extend to one lakh rupees shall be paid by way of penalty by—

(i) the research association, university, college or other institution referred to in clause (ii) or clause (iii) or the company referred to in clause (iia) of sub-section (1) of section 35, if it fails to deliver or cause to be delivered a statement within the time prescribed under clause (i), or furnish a certificate prescribed under clause (ii) of sub-section (1A) of that section; or

(ii) the institution or fund, if it fails to deliver or cause to be delivered a statement within the time prescribed under clause (viii) of sub-section (5) of section 80G, or furnish a certificate prescribed under clause (ix) of the said sub-section.

Conclusion

Henceforth, the institutions or funds including Charitable Trusts and NGOs must be very vigilant in accepting the donation from the donors. Complete KYC details of each and every donor must be obtained, how so over is the amount of donation.

Read Also:

Key Highlights of Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

Section 12AB: Amendments in Procedure for Registration of Charitable Trusts and NGOs

New Section 12AB to replace Section 12AA and Section 12A for Charitable Trust and NGO Budget 2020

An Insight into Amendments for Charitable Trusts –Budget 2020

2 Comments

What if the donee fails to give the donation certificate.,to whom we have to make a complaint?

ReplyDeleteThanks,

Arunachalam V

No provision in the law. However, you may complaint with the jurisdictional CIT of the donee. However, if the donation gets reflected in your AIS then you will be allowed deduction.

Delete