Introduction

The government has set up a public fund namely ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ to fight with the pandemic of COVID-19 and to overcome the threat posed by the coronavirus in the country. Prime Minister is the Chairman of this trust and its Members include Defence Minister, Home Minister and Finance Minister.

Appeal from the Prime Minister

Prime Minister Narendra Modi has appealed to the public to donate generously to ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund)’ towards the government's efforts to fight coronavirus.

This is a new fund created under the current distressing situation due to COVID-19 outbreak in the country. The public appeal of the Prime Minister came on March 28, 2020.

To this effect, he also said that a new fund - Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund - is being created keeping in mind that people have been wanting to donate to the cause.

PM Modi in a tweet stated that people from all walks of life expressed their desire to donate to India’s war against COVID-19. He further stated that respecting that spirit, the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) has been constituted. This will go a long way in creating a healthier India.

His tweet is reproduced below.

People from all walks of life expressed their desire to donate to India’s war against COVID-19.— Narendra Modi (@narendramodi) March 28, 2020

Respecting that spirit, the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund has been constituted. This will go a long way in creating a healthier India.

He further appealed in a tweet to contribute to the PM-CARES Fund.

The pandemic of COVID-19 has engulfed the entire world and has posed serious challenges for the health and economic security of millions of people worldwide. In India too, the spread of coronavirus has been alarming and is posing severe health and economic ramifications for our country. The Prime Minister’s office has been receiving spontaneous and innumerable requests for making generous donations to support the government in the wake of this emergency.

Distress situations, whether natural or otherwise, demand expeditious and collective action for alleviating the suffering of those affected, mitigation/control of damage to infrastructure and capacities etc. Therefore, building capacities for quick emergency response and effective community resilience has to be done in tandem with infrastructure and institutional capacity reconstruction/enhancement. Use of new technology and advance research findings also become an inseparable element of such concerted action.

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ has been set up. Prime Minister is the Chairman of this trust and its Members include Defence Minister, Home Minister and Finance Minister.

It is my appeal to my fellow Indians,— Narendra Modi (@narendramodi) March 28, 2020

Kindly contribute to the PM-CARES Fund. This Fund will also cater to similar distressing situations, if they occur in the times ahead. This link has all important details about the fund. https://t.co/enPvcqCTw2

About the PM CARES FUND

The pandemic of COVID-19 has engulfed the entire world and has posed serious challenges for the health and economic security of millions of people worldwide. In India too, the spread of coronavirus has been alarming and is posing severe health and economic ramifications for our country. The Prime Minister’s office has been receiving spontaneous and innumerable requests for making generous donations to support the government in the wake of this emergency.

Distress situations, whether natural or otherwise, demand expeditious and collective action for alleviating the suffering of those affected, mitigation/control of damage to infrastructure and capacities etc. Therefore, building capacities for quick emergency response and effective community resilience has to be done in tandem with infrastructure and institutional capacity reconstruction/enhancement. Use of new technology and advance research findings also become an inseparable element of such concerted action.

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ has been set up. Prime Minister is the Chairman of this trust and its Members include Defence Minister, Home Minister and Finance Minister.

Update:

Recently, the details about the PM CARES FUND is published on the www.pmindia.gov.in to provide the following details-

About PM CARES Fund

About Us :

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ has been set up.

Objectives :

• To undertake and support relief or assistance of any kind relating to a public health emergency or any other kind of emergency, calamity or distress, either man-made or natural, including the creation or upgradation of healthcare or pharmaceutical facilities, other necessary infrastructure, funding relevant research or any other type of support.

• To render financial assistance, provide grants of payments of money or take such other steps as may be deemed necessary by the Board of Trustees to the affected population.

• To undertake any other activity, which is not inconsistent with the above Objects.

Constitution of the Trust :

• Prime Minister is the ex-officio Chairman of the PM CARES Fund and Minister of Defence, Minister of Home Affairs and Minister of Finance, Government of India are ex-officio Trustees of the Fund.

• The Chairperson of the Board of Trustees (Prime Minister) shall have the power to nominate three trustees to the Board of Trustees who shall be eminent persons in the field of research, health, science, social work, law, public administration and philanthropy.

• Any person appointed a Trustee shall act in a pro bono capacity.

Other details :

• The fund consists entirely of voluntary contributions from individuals/organizations and does not get any budgetary support. The fund will be utilised in meeting the objectives as stated above.

• Donations to PM CARES Fund would qualify for 80G benefits for 100% exemption under the Income Tax Act, 1961. Donations to PM CARES Fund will also qualify to be counted as Corporate Social Responsibility (CSR) expenditure under the Companies Act, 2013

• PM CARES Fund has also got exemption under the FCRA and a separate account for receiving foreign donations has been opened and it will be made operational soon. This will enable PM CARES Fund to accept donations and contributions from individuals and organizations based in foreign countries. This is consistent with respect to Prime Minister’s National Relief Fund (PMNRF). PMNRF has also received foreign contributions as a public trust since 2011.

Micro-donations accepted in PM CARES Fund

PM Modi has also tweeted and informed that the Fund accepts micro-donations.

The PM-CARES Fund accepts micro-donations too. It will strengthen disaster management capacities and encourage research on protecting citizens.— Narendra Modi (@narendramodi) March 28, 2020

Let us leave no stone unturned to make India healthier and more prosperous for our future generations. pic.twitter.com/BVm7q19R52

PM Narendra Modi has always believed and shown in actions that public participation is the most effective way to mitigate any issue and this is yet another example. This fund will enable micro-donations as a result of which a large number of people will be able to contribute with smallest of denominations.

PM CARES Fund account details

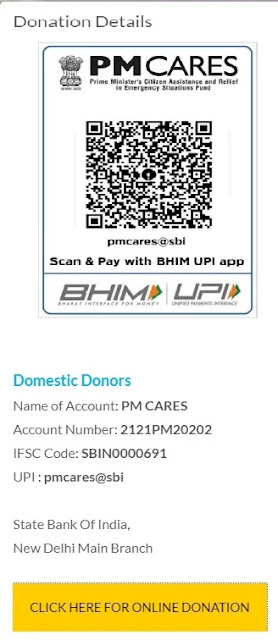

Citizens and organisations can go to the website pmindia.gov.in and donate to PM CARES Fund using the following details:

Account

Details

|

|

Name of the Account

|

PM

CARES

|

Account Number

|

2121PM20202

|

IFSC Code

|

SBIN0000691

|

SWIFT Code

|

SBININBB104

|

Name of Bank & Branch

|

State

Bank of India, New Delhi Main Branch

|

UPI ID

|

pmcares@sbi

|

Online

Modes of payments

|

|

Debit Cards and Credit Cards

|

|

Internet Banking

|

|

UPI (BHIM, PhonePe, Amazon Pay, Google

Pay, PayTM, Mobikwik, etc.)

|

|

RTGS/NEFT

|

|

Modes of payment to PM CARES Fund

There are various modes of payments for contribution to PM CARES Fund. However, all the prescribed modes are digital modes only.There is no detail on payment of a contribution in cash, neither it is directly prohibited. However, it other cases, like PM National relief fund and other governmental funds, there is no provision to pay or contribute in cash. Hence, contribution or donation to PM CARES Fund cannot be made in cash.

Similarly, contribution in kind also not available.

However, various digital modes of payments have been allowed. The bank account details are also given so that one can pay from net banking, debit or credit cards, etc. Funds can be transferred through RTGS/NEFT.

UPI ID pmcares@sbi is also given. If one visits the PM website pmindia.gov.in it displays the QR Code which can be scanned from BHIM UPI.

In addition, the following modes of payments are available on the website pmindia.gov.in -

Debit Cards and Credit Cards

Internet Banking

UPI (BHIM, PhonePe, Amazon Pay, Google Pay, PayTM, Mobikwik, etc.)

RTGS/NEFT

Presently, the donation is available for domestic donors - both individuals and institutions.

Update: As

per information from pmindia.gov.in, Account Details for Foreign Donations

will be available in 2-3 Days.

Update: Foreign Donations is now enabled in PM CARES FUND.

Update: Foreign Donations is now enabled in PM CARES FUND.

Contact Details of PM CARES FUND

Under Secretary (Funds)

Address

Prime Minister's Office

South Block, New Delhi-110011

Telephone:

+91-11-23013683

Email:

pmcares@gov.in [For Domestic Donation]

pmcares.fcra@gov.in [For Foreign Donation]

How to pay donation or contribution to PM CARES Fund

One can pay from various modes of digital payments, it is not possible to describe each and every mode in detail. However, the online method of payment given on the PM website pmindia.gov.in to give an overall idea and can be compared with other modes and can contribute accordingly.

Step 1: Visit the website pmindia.gov.in

Click on 'Click here for Donation Details' on the landing page as shown below in Pic-1.

|

| Picture-1 |

Step 2: You will be shown a pop-up page. Scroll Down and then click on the yellow button titled 'Click here for online donation'.

|

| Picture-2 |

Step 3: A new page from State Bank of India will open. Tick the 'terms and conditions' and then click 'Proceed'.

|

| Picture-3 |

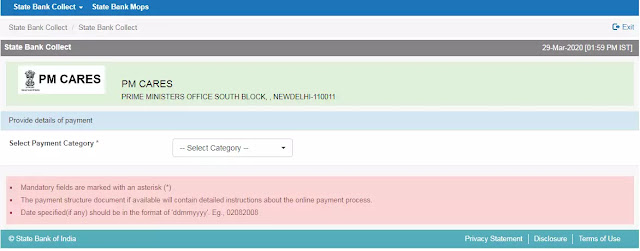

Step 4: A new page will open to select the payment category. It has only one category namely 'Donation'.

|

| Picture-4 |

Step 5: Once you select the Donation category, the page will automatically take you to the next page as shown in Step 6.

|

| Picture-5 |

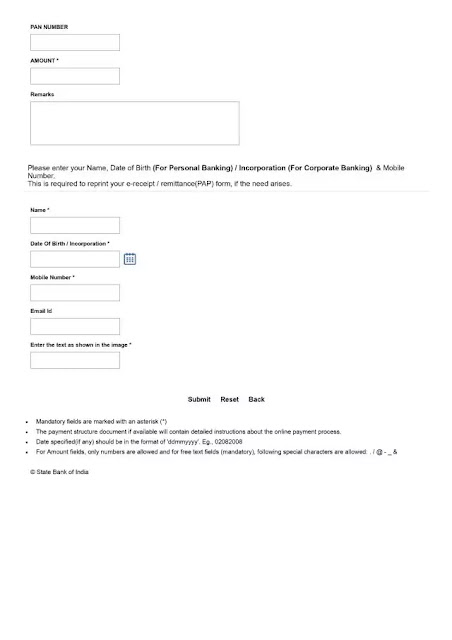

Step 6: A form will display where your name, address, PAN email, mobile number, etc are required to be filled in. In this form, the 'Amount of Donation' to the fund is required to be entered.

|

| Picture-6 |

|

| Picture-6 |

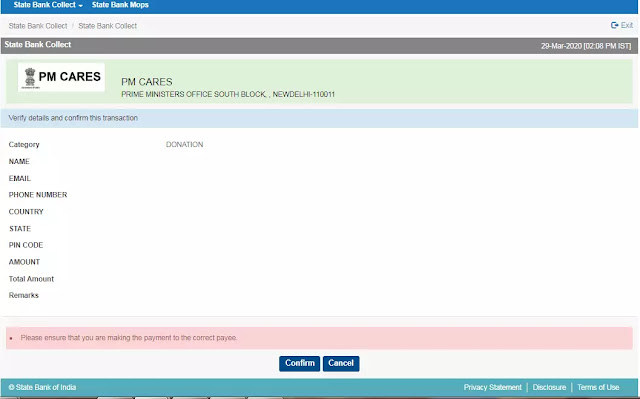

Step 7: If the data is correct, click on 'Submit'. A confirmation page will be shown as below. Click on 'Confirm' if the information is correct.

|

| Picture-7 |

Step 8: A page with all the payment option will be displayed grouped under three categories - Net Banking (for SBI and other account bank account holders), Card Payments (for SBI CArds and other Bank cards), Other modes to include payment at a branch (due to say, if no online payment facility is there in the bank account-mostly useful for companies, institutions, etc.. One may fill the data online and take the online generated acknowledgement to any SBI branch and deposit the donation amount at the branch. In this case, the deposit can be made in cash. In case, cash donation is Rs. 50,000 or more, PAN is required.), and UPI.

The attractive feature is that there will be no bank charges for making the contribution to PM CARES Fund.

|

| Picture-8 |

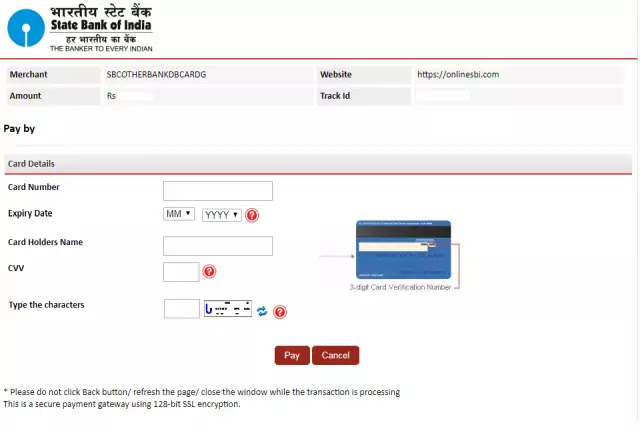

Step 9: Finally, the payment page will be displayed. This is a sample of 'Other bank card' mode of payment. The amount will be shown. One has to enter the card details and make the payment.

|

| Picture-9 |

In case one wants to pay by UPI, select the UPI. The following screen will be displayed.

|

| Picture-10 |

Enter your UPI ID and then click 'Submit'.

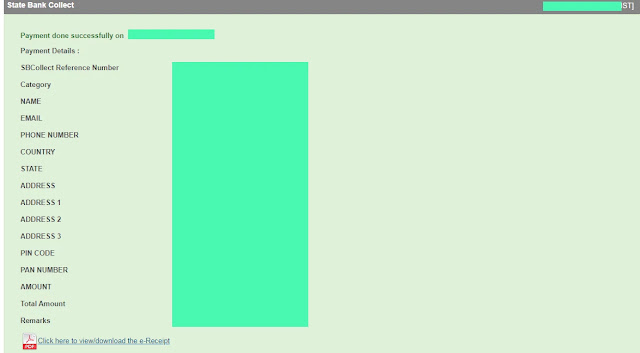

Step 10: After the successful payment, a receipt will be generated online. Save the receipt for records.

|

| Picture-11 |

Important: The

above steps or procedure and the interface is changed after a dedicated portal is for

the PM CARES FUND launched. The new procedure is detailed in this article.

How to donate directly from BHIM UPI

Those who are using BHIM UPI and wishes to donate through BHIM UPI has to update the BHIM UPI App from the Google Play Store. Once updated, it will show 'Donate' menu from where one can donate to PM CARES Fund. Option to make a donation to other funds is also available.

It is much easier to donate from the BHIM UPI but it has the limitation of payment of Rs. 20,000 per transaction with an overall limit of Rs. 40,000 per day. Hence, those who can donate within this amount range can opt to pay through BHIM UPI which gives a smooth and hassle-free experience.

Tax benefits on donation or contribution to PM CARES Fund

It is stated in the press release that the donations to PM CARES Fund will be exempted from income tax under section 80(G). However, a formal notification from the income tax department is required for legal sanctity which may be issued in due time. Further, certain information like PAN of the Fund is also required to claim the deduction u/s 80G for making the donation to PM CARES Fund.

It may be expected that the tax treatment to the PM CARES Fund will be similar to the tax benefits available to PM National Relief Fund (PMNRF).

Alternatives of making donations to Other Funds

Apart from the PM CARES Fund, one can donate to Prime Minister National Relief Fund (PMNRF) which has similar tax benefits and has the same purpose as the PM CARES Fund has. PM CARES Fund has been set up to aid the citizens of India affected by Corona Virus.

The fund consists entirely of public contributions and does not get any budgetary support. The corpus of the fund is invested in various forms with scheduled commercial banks and other agencies. Disbursements are made with the approval of the Prime Minister.

PMNRF has not been constituted by the Parliament. The fund is recognized as a Trust under the Income Tax Act and the same is managed by Prime Minister or multiple delegates for national causes. PMNRF operates from the Prime Minister’s Office, South Block, New Delhi-110011 and does not pays any license fee.

PMNRF is exempt under Income Tax Act, 1961 under Section 10 and 139 for return purposes. Contributions towards PMNRF are notified for 100% deduction from taxable income under section 80(G) of the Income Tax Act, 1961. Prime Minister is the Chairman of PMNRF and is assisted by Officers/ Staff on honorary basis.

Permanent Account Number of PMNRF is AACTP4637Q.

PMNRF accepts only voluntary donations by individuals and institutions.

Contributions flowing out of budgetary sources of Government or from the balance sheets of the public sector undertakings are not accepted. Conditional contributions, where the donor specifically mentions that the amount is meant for a particular purpose, are not accepted in the Fund.

Contribution to PM CARES Fund qualifies as CSR expenditure

Every company having the specified net worth or turnover or net profit is mandatorily required to spend 2 per cent of its average net profit of the last three years for CSR activities. There are prescribed rules and guidelines on which expenditure on which activities shall qualify as CSR expenditure.In this context, the government had earlier clarified that spending of CSR funds for fighting against the threat of COVID-19 is an eligible CSR activity.

The Ministry of Company Affairs (MCA) has issued a General Circular 10/2020 dated 23.03.2020 to this effect. The Circular states that funds may be spent on various activities related to COVID-19 under item nos. (i) and (xii) of Schedule VII relating to the promotion of health care, including preventive health care and sanitation, and, disaster management. Further, as per General Circular No. 21/2014 dated 18.06.2014, items in Schedule VII are broad-based and may be interpreted liberally for this purpose.

On March 29, 2020, Finance Minister Nirmala Sitaraman tweeted that CSR Funds can now donate to PM CARES Fund. Ministry of Corporate Affairs (MCA) notifies details. Any contribution made to the PM CARES Fund shall qualify as CSR expenditure.

CSR Funds can now donate to PM CARES Fund. Ministry of Corporate Affairs notifies details.— Nirmala Sitharaman (@nsitharaman) March 29, 2020

MCA issued an Office Memorandum dated 28.03.2020 to state that the Government of India had set up the Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund) with the primary objective of dealing with any kind of emergency or distress situation such as that posed by COVID 19 pandemic.

It further stated that the PM-CARES Fund had been set up to provide relief to those affected by any kind of emergency or distress situation. Accordingly, it is clarified that any contribution made to the PM CARES Fund shall qualify as CSR expenditure under the Companies Act 2013.

Update on 12.04.2020

A dedicated website www.pmcares.gov.in for PM CARES FUND is launched which can be accessed directly or through the earlier mentioned PMO website as pmindia.gov.in. Further, the payment interface has been changed.

PM CARES FUND is now registered under FCRA and is eligible to receive Foreign Donation.

PM CARES FUND: DONATION FAQS

Q.1 What is PM CARES Fund?

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund)’ has been set up.

Q.2 Who are the Trustees of the PM CARES Fund?

The Prime Minister is Chairperson (ex-officio) of the Fund and Minister of Defence, Minister of Home Affairs and Minister of Finance, Government of India are ex-officio Trustees of the Fund.

The Chairperson of the Board of Trustees (Prime Minister) of PM CARES Fund has the power to nominate three trustees to the Board who shall be eminent persons in the field of research, health, science, social work, law, public administration and philanthropy. However, no such appointment has been made so far.All the Trustees of the PM CARES Fund act in a pro bono capacity.

Q.3 What are the Objectives of the PM CARES Fund Trust?

The primary objectives of the Trust are:-

1. To undertake and support relief or assistance of any kind relating to a public health emergency or any other kind of emergency, calamity or distress, either man-made or natural, including the creation or upgradation of healthcare or pharmaceutical facilities, other necessary infrastructure, funding relevant research or any other type of support.

2. To render financial assistance, provide grants of payments of money or take such other steps as may be deemed necessary by the Board of Trustees to the affected population.

3. To undertake any other activity, which is not inconsistent with the above Objects.

Q.4 What type of domestic donation are accepted in PM CARES Fund?

PM CARES Fund accepts voluntary contributions by individuals/organizations as well as contributions as part of CSR from Companies/Public Sector Undertakings (PSUs). However, contributions flowing out of budgetary sources of the PSUs are not accepted.

Q.5 What are the modes through which domestic donation can be made to PM CARES Fund?

Contributions can be made by following modes:-

Net Banking (SBI and other commercial Banks)

Card Payments – SBI ATM-cum-Debit Card, Other Bank Debit Cards, Credit Card, Prepaid Card, Foreign Card

Other Payment mode: SBI Branch, NEFT/RTGS

Contributions can also be made online through the portal of PMO i.e. pmindia.gov.in as well as through the portals of the collection banks..

Further, cheque or demand draft drawn in favour of ‘PM CARES Fund’ can be sent to Under Secretary (Funds), PMO, South Block, New Delhi, Pin -110011 along with Name, Address, Mobile No. and E-mail ID of the donor.

Collection Accounts of PM CARES Fund

S.N.

|

Name of the Bank

|

Branch

|

Account Number / IFSC

|

Remarks

|

1.

|

State Bank of India

|

New Delhi Main Branch, No.11, Parliament Street, New Delhi-110001.

|

Savings Bank A/C No. 39238765008 IFSC Code: SBIN0000691

|

Donations deposited in any of these bank accounts are deposited in to PM CARES Fund at SBI, Parliament Street having Account No. ‘2121PM20202’.

|

2.

|

Central Bank of India

|

66, Janpath, New Delhi

|

Savings Bank A/C No. 3809123014 IFSC: CBIN0280318

| |

3.

|

Indian Overseas Bank

|

Parliament Street, New Delhi

|

Savings Bank A/c No. 076201003042020 IFSC: IOBA0000762

| |

4.

|

Axis Bank

|

New Delhi Main Branch

|

Savings Bank A/c No. 920010023235458 IFSC: UTIB0000007

| |

5.

|

IDBI Bank

|

K.G. Marg, Connaught Place, New Delhi.

|

Savings Bank A/c No. 0011104000631945 IFSC: IBKL0000011

| |

6.

|

HDFC Bank

|

Vasant Vihar Branch, D 1&2, D Block Shopping Complex, Vasant Vihar, New Delhi.

|

Savings Bank A/c No. 59194700000000 IFSC Code : HDFC0000011

| |

7.

|

IDFC First Bank

|

Barakhamba Road, New Delhi

|

Savings Bank A/c No. 10053939205 IFSC Code : IDFB0020101

| |

8.

|

ICICI Bank

|

Kasturba Gandhi Marg, New Delhi- 110001

|

Savings Bank A/C No.663701PMCARE IFSC: ICIC0006637

| |

9.

|

Indian Bank

|

Connaught Place, New Delhi-110001

|

Savings Bank A/C No.6873294550 IFSC: IDIB000N022

| |

10.

|

Canara Bank

|

South Block, New Delhi

|

Savings Bank A/C No. 90552010174360 IFSC: SYNB0009055

| |

11.

|

Yes Bank Ltd.

|

11/48, Diplomatic Enclave, Malcha Marg, Chankyapuri, New Delhi

|

Savings Bank A/C No.000394600001910 IFSC: YESB0000003

| |

12.

|

Kotak Mahindra Bank

|

A/24, Safdarjung Enclave, New Delhi-29

|

Savings Bank A/C No: 2020111111 IFSC: KKBK0000175

| |

13.

|

IndusInd Bank Ltd.

|

S-6, Building No18 &19, Oriental House, Gulmohar Community Centre, Yusuf Sarai, New Delhi 110016

|

Savings Bank A/c No. 100116111482 IFSC: INDB0000168

| |

14.

|

Bank of Maharashtra

|

Dholpur House, UPSC, New Delhi

|

Savings Bank A/c No. 60355358964 IFSC: MAHB0001160

| |

This list will be updated from time to time.

| ||||

Q.6 Are contributions towards the PM CARES Fund exempted from Income Tax?

Yes, all contributions towards the PM CARES Fund are 100% exempted from Income Tax under Section 80(G) of the Income Tax Act, 1961.

Q.7 Are contributions towards PM CARES Fund qualify as CSR expenditure?

Yes, any contribution made to the PM CARES Fund by any Company or a PSU shall qualify as Corporate Social Responsibility (CSR) expenditure as provided under the Companies Act, 2013.

Q.8 Does PM CARES Fund have a Permanent Account Number (PAN)?

Yes, PM CARES Fund has been allotted a Permanent Account Number (PAN) AAETP3993P.

Q.9 Who has the powers to formulate criterions for disbursal of funds held under PM CARES Fund?

The Trustees of the PM CARES Fund have powers to formulate rules/criterions for carrying out any of the Objectives of the Trust.

Q. 10 How will be the formal donation receipts issued to the donors?

The donors will be able to download formal donation receipts by visiting ‘Print Receipt’ Section of the PM CARES portal after successful transaction.

Q. 11 How do I know about the status of my payment online?

If your transaction is done through NEFT/RTGS/IMPS, the transaction would be updated based on the statement received from the concerned banks. The receipts can be generated only after this. This might take at least 30days.

If your transaction is by Cheque the transaction would be updated from the bank to PM CARES. However, the payee details would be updated only if the cheque for PM CARES is presented in the same bank. If the cheque is presented in another bank, the payee details would not be updated by the bank. In such cases, the receipt can be obtained only by updating your Name, email ID, Amount etc. with cheque number and amount in the receipt generator module. The module will match the cheque number and amount and issue the receipt. This might take at least 30days.

Q.12 Is there any transaction charge for online payment?

There is no transaction charge levied by PM CARES Fund for online payment. However some banks may levy the net-banking transaction charges, which may vary from bank to bank.

Q.13 Who is the authority to issue certificate for claiming deductions u/s 80(G) of the Income Tax Act, 1961 in respect of donations made by employees of an organisation to the PM CARES Fund?

In respect of such donations, benefit will be admissible u/s 80(G) of the Income Tax Act, 1961 on the basis of the certificate issued by Drawing and Disbursing Officer [DDO] / Employer in this behalf.

Q.14 Who audits the PM CARES Fund?

The PM CARES Fund will be audited by one or more qualified independent auditor(s) who will be appointed by the Trustees.

Q.15 Whether Foreign Donation is accepted in PM CARES Fund?

Yes. PM CARES Fund has received exemption from operation of all provisions of the Foreign Contribution (Regulation) Act, 2010. Foreign Donation is accepted from individuals and organizations based in Foreign countries through Foreign Credit / Debit Cards and also through Wire Transfer/SWIFT following the link on Home page of PM CARES Fund portal.

Conclusion

The effect of the appeal to donate can be sensed that many public figures have come out to make a donation to the Fund. Notables are donation of Rs. 25 crore by Bollywood actor Akshay Kumar. Indian Railways to donate more than Rs. 150 crore. Tata group announced to donate Rs 1500 crore to the fund. Paytm targets Rs. 500 crore contribution to PM CARES Fund and many more to come.In the end, I would like the readers not to think, but to act. Donate now. It is not necessary to donate in lakhs and crores. Even a small donation can make a big difference, particularly at the time of crisis. Every penny counts. Do whatever you can. After all, it is our country. We as a responsible citizen must act.

Read other articles on PM CARES FUND

Text of the appeal of the Prime Minister Shri Narendra Modi released by the Prime Minister Office (PMO)

Prime Minister's Office

Appeal to generously donate to ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund)’

28 MAR 2020

The pandemic of COVID-19 has engulfed the entire world and has posed serious challenges for the health and economic security of millions of people worldwide. In India too, the spread of coronavirus has been alarming and is posing severe health and economic ramifications for our country. The Prime Minister’s office has been receiving spontaneous and innumerable requests for making generous donations to support the government in the wake of this emergency.

Distress situations, whether natural or otherwise, demand expeditious and collective action for alleviating the suffering of those affected, mitigation/control of damage to infrastructure and capacities etc. Therefore, building capacities for quick emergency response and effective community resilience has to be done in tandem with infrastructure and institutional capacity reconstruction/enhancement. Use of new technology and advance research findings also become an inseparable element of such concerted action.

Keeping in mind the need for having a dedicated national fund with the primary objective of dealing with any kind of emergency or distress situation, like posed by the COVID-19 pandemic, and to provide relief to the affected, a public charitable trust under the name of ‘Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund’ (PM CARES Fund)’ has been set up. Prime Minister is the Chairman of this trust and its Members include Defence Minister, Home Minister and Finance Minister.

PM Narendra Modi has always believed and shown in actions that public participation is the most effective way to mitigate any issue and this is yet another example. This fund will enable micro-donations as a result of which a large number of people will be able to contribute with smallest of denominations.

Citizens and organisations can go to the website pmindia.gov.in and donate to PM CARES Fund using following details:

Name of the Account : PM CARES

Account Number : 2121PM20202

IFSC Code : SBIN0000691

SWIFT Code : SBININBB104

Name of Bank & Branch: State Bank of India, New Delhi Main Branch

UPI ID : pmcares@sbi

Following modes of payments are available on the website pmindia.gov.in -

1. Debit Cards and Credit Cards

2. Internet Banking

3. UPI (BHIM, PhonePe, Amazon Pay, Google Pay, PayTM, Mobikwik, etc.)

4. RTGS/NEFT

Donations to this fund will be exempted from income tax under section 80(G).

Get all latest content delivered straight to your inbox

0 Comments