Section 79 of the Income-tax Act, 1961 (‘Act’) provides conditions for carry forward and set off of losses in case of a company not being a company in which the public are substantially interested and certain other companies.

Introduction

Under section 79(1), no loss incurred in any year prior to the previous year shall be carried forward and set off against the income of the previous year, unless on the last day of the previous year, the shares of the company carrying not less than 51 per cent of the voting power were beneficially held by persons who beneficially held shares of the company carrying not less than 51 per cent of the voting power on the last day of the year or years in which the loss was incurred.

In other words, in case of change in shareholding of a closely held company which has incurred loss, at least 51% of the shareholders shall remain the same as on the end of the PY in which loss was incurred and at the end of the PY in which such loss is set off.

Section 79(2) lists out certain cases where the provisions of section 79(1) shall not apply. In other words, as per section 79(2), even if there is a change in shareholding of a closely held company and the old shareholding falls below 51%, still, carry forward and set off of losses shall be allowed to such a company.

Background of the provisions

Section 79 of the Act provides for carry forward and set-off of losses in case of certain companies. Sub-section (1) of the said section, inter-alia, provides that where a change in shareholding has taken place during the previous year in the case of a company, not being a company in which the public are substantially interested, no loss incurred in any year prior to the previous year shall be carried forward and set off against the income of the previous year, unless on the last day of the previous year, the shares of the company carrying not less than fifty-one per cent of the voting power were beneficially held by persons who beneficially held shares of the company carrying not less than fifty-one per cent of the voting power on the last day of year or years in which the loss was incurred. Sub-section (2) of the said section provides certain circumstances in which the provisions of sub-section (1) shall not apply.

There are five clauses (a) to (e) to section 79(2) which is now expanded and insert a new clause (f) thereto.

Proposed Amendment to Section 79

It is proposed to amend section 79 of the Act to provide that the provisions of sub-section (1) of section 79 shall not apply to an erstwhile public sector company subject to the condition that the ultimate holding company of such erstwhile public sector company, immediately after the completion of strategic disinvestment, continues to hold, directly or through its subsidiary or subsidiaries, at least fifty one per cent of the voting power of the erstwhile public sector company in aggregate.

It is further proposed to provide that if the above condition is not complied with in any previous year after the completion of strategic disinvestment, the provisions of sub-section (1) shall apply for such previous year and subsequent previous years.

For this purpose, Clause 18 of the Finance Bill, 2022 proposes to amend seciotn 79 in the following manner-

Amendment of section 79.

18. In section 79 of the Income-tax Act,––

(i) in sub-section (2), after clause (e), the following clause shall be inserted, namely:–

“(f) to an erstwhile public sector company subject to the condition that the ultimate holding company of such company, immediately after the completion of strategic disinvestment, continues to hold, directly or through its subsidiary or subsidiaries, at least fifty-one per cent. of the voting power of such company in aggregate.”;

(ii) after sub-section (2), the following sub-section shall be inserted, namely:–

“(3) Notwithstanding anything contained in sub- section (2), if the condition specified in clause (f) of the said sub-section is not complied with in any previous year after the completion of strategic disinvestment, the provisions of sub-section (1) shall apply for such previous year and subsequent previous years.”;

(iii) in the Explanation, after clause (i), the following clauses shall be inserted, namely:–

‘(ia) “erstwhile public sector company” shall have the same meaning as assigned to it in clause (ii) of the Explanation to clause (d) of sub-section (1) of section 72A;

(ib) “strategic disinvestment” shall have the same meaning as assigned to it in clause (iii) of the Explanation to clause (d) of sub-section (1) of section 72A;’.

Explaining the proposed amendment to the provisions of Section 79

Clause 18 seeks to amend section 79 of the Act relating to carry forward and set off of losses in case of certain companies.

Sub-section (1) of the said section, inter alia, provides that where a change in shareholding has taken place during the previous year in the case of a company, not being a company in which the public are substantially interested, no loss incurred in any year prior to the previous year shall be carried forward and set off against the income of the previous year, unless on the last day of the previous year, the shares of the company carrying not less than fifty-one per cent of the voting power were beneficially held by persons who beneficially held shares of the company carrying not less than fifty-one per cent of the voting power on the last day of year or years in which the loss was incurred.

Sub-section (2) of the said section provides certain circumstances in which the provisions of sub-section (1) shall not apply.

It is proposed to amend the said sub-section (2) by inserting a new clause (f) to provide that nothing in sub-section (1) shall apply to an erstwhile public sector company subject to the condition that the ultimate holding company of such company, immediately after the completion of strategic disinvestment, continues to hold, directly or through its subsidiary or subsidiaries, at least fifty-one per cent. of the voting power of the erstwhile public sector company in aggregate.

It is further proposed to insert a new sub-section (3) in the said section to provide that notwithstanding anything contained in sub-section (2), if the condition specified in clause (f) of the said sub-section is not complied with in any previous year after the completion of strategic disinvestment, the provisions of sub-section (1) shall apply for such previous year and subsequent previous years.

It is also proposed to amend the Explanation, inter alia, to insert the definition of the expressions “erstwhile public sector company”, and “strategic disinvestment”. The terms “erstwhile public sector company” and “strategic disinvestment” shall have the meaning assigned to in clause (ii) and (iii) of the Explanation to clause (d) of sub-section (1) of Section 72A respectively.

As per clause (ii) and (iii) of the Explanation to clause (d) of sub-section (1) of Section 72A,

(ii) "erstwhile public sector company" means a company which was a public sector company in earlier previous years and ceases to be a public sector company by way of strategic disinvestment by the Government;

(iii) "strategic disinvestment" means sale of shareholding by the Central Government or any State Government in a public sector company which results in reduction of its shareholding to below fifty-one per cent along with transfer of control to the buyer.

These amendments will take effect from 1st April, 2022 and will, accordingly, apply in relation to the assessment year 2022-2023 and subsequent assessment years.

Rationale of the proposed amendment to the provisions of Section 79

The Explanatory Memorandum states that the amendment is proposed in order to facilitate the strategic disinvestment of public sector companies.

The amendment aims at the recent disinvestment of Air India to Tata Group and the exemption from section 79 will act as an incentive for long term shareholding.

CBDT on 10th September, 2021 issued a Press Release in which the above amendment to section 79 was clarified. At that time it was stated that necessary legislative amendments shall be proposed in due course of time. This amendment proposes to give statutory recognition to the said Press Release. Interestingly, on the 10th of September, CBDT also issued 5 Notifications to facilitate the disinvestment of Air India.

Read more on 5 Income-tax Exemption and Concession to Air India

Author’s Comments

Thie proposed amendment is discussed with the help of the example of the recently concluded disinvestment of Air India.

Air India Limited is a Public Sector Undertaking (PSU) whose entire shares were held by the Government of India. In strategic disinvestment by the government, the entire shares of Air India Limited were transferred to Talace Private Limited, a subsidiary of Tata Sons Private Limited for a consideration of Rs. 18,000 crore in January 2022.

Air India’s accumulated losses as of 31st March 2021 was at around 77,953 crore. The major reasons for Air India’s losses include high-interest burden on debt, increase in competition, especially from low-cost carriers, high input cost, and the adverse impact of exchange rate fluctuation.

The present tax provisions deny the benefit of set-off and carry forward of accumulated losses to the investor or buyer of a closely held company if there is a change of shareholding in excess of 51%. This means when shares of a closely held company (alias an unlisted company) are bought and there is a change in shareholding, the company cannot carry forward its losses accumulated prior to the change in shareholding and as such, it cannot set off such losses against its future profits after the change in shareholding.

The bar on carrying forward and set-off of losses on sale by shares of an unlisted or a closely held company is to preclude “loss shopping". The intent of Section 79 is to remedy the mischief of avoidance of tax by carrying forward the losses by changing the ownership.

Going by the present position of law, Air India Limited will not be able to set-off and carry forward the losses accumulated till 31.03.2021 as there is a change in shareholding by more than 51% (100% change in shareholding in this case). As stated above, the entire shares of Air India Limited were transferred to Talace Private Limited (the buyer of the unlisted PSU Company Air India Limited) even if Air India Limited starts making profits under the leadership of the new investor i.e. Tata Group.

Hence, there is a need to relax the above restrictions as stipulated in section 79(1) for PSUs which are strategically divested. While listed companies are already outside the applicability of this provision, the proposed amendment now removes this bar in case of divestment of unlisted PSUs as well.

Due to this proposed amendment, Air India Limited (erstwhile PSU) can carry forward the losses up to 8 years even after the change in shareholding from the Government to the ultimate holding company of the erstwhile PSU, Talace Private Limited. The only condition is that the strategic investor or Talace Private Limited, acquiring the shares from the Government under disinvestment, should continue to hold at least 51% shareholding in the erstwhile PSU, Air India Limited.

It may be noted that such relaxation will be available, till the strategic investor (ultimate holding company of the erstwhile PSU), Talace Private Limited, retains at least 51 per cent shareholding in the erstwhile PSU (Air India Limited). In case, if the strategic investor’s (ultimate holding company of the erstwhile PSU, Talace Private Limited) shareholding falls below 51 per cent in Air India, such relaxation will be withdrawn.

Since Talace Private Limited is holding 100% shares of Air India, it has the option to dilute 49% of its shareholding in future. It may come up with a public issue or IPO.

An outline of Air India Disinvestment Chart

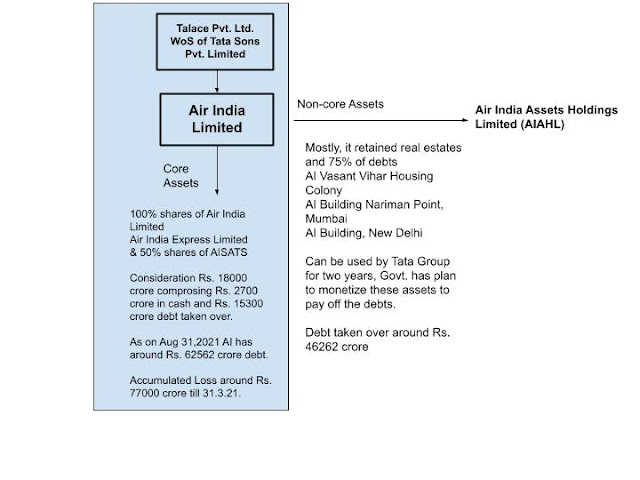

AI’s core assets alongwith 100% shares of AI Limited, AI Express Limited and 50% of AISAT were transferred to Talace Pvt Ltd which is a wholly-owned subsidiary of Tata Sons Pvt. Limited.

AI transferred its non-core assets, mostly real estate and 75% of debt (around Rs. 46262 crore) to a new entity AIAHL. Certain tax concessions were also given in these cases. See these Notificaions. This is not a part of disinvestment. Government has a plan to monetize the assets to pay off the debts in future. Tata group is allowed to use these assets for two years.

The outstanding debt of AI as on Aug 31, 2021 was around Rs. 61562 crore. Talace Pvt. Ltd. paid Rs. 18,000 crore out of which Rs. 2700 was in cash consideration and the remaining Rs. 15300 crore was in the form of debt takeover, which is around 25% of the outstanding debt.

Only the blue coloured part of the chart depicts the disinvestment of AI.

[AI stands for Air India]

Other related articles on Budget 2022

Finance Minister Presents Finance Bill 2022 after Union Budget 2022 in Loksabha

Download Finance Bill, 2022 (PDF) as introduced in Loksabha

Download Memorandum Explaining the Provisions in the Financial Bill 2022

Income Tax announcements in Budget Speech: Union Budget 2022

New Income Tax Slab Rates after Union Budget 2022

Changes in Personal Taxation by Union Budget 2022

Section 139(8A): Filing of Updated Return - Budget 2022

Corporate Tax Proposals: Union Budget 2022

Changes in TDS and TCS Provisions by Finance Bill, 2022

Tax Exemption on Amount Received for COVID-19: Budget 2022

Health & Education 'cess' Not Deductible as Business Expenditure: Budget 2022

Section 80DD Tax Relief to Persons with Disability: Budget 2022

Conversion of Interest into Debenture Does Not amount to Payment under Section 43B: Budget 2022

Source of Source for Loans and Borrowings Under Section 68: Budget 2022

Amendment to Section 14A to Disallow Expenses if No Exempt Income: Budget 2022

Reduced Alternate Minimum Tax u/s 115JC and Surcharge for Cooperative Societies: Budget 2022

Extension of Sunset Manufacturing Date under section 115BAB

Extension of Sunset Date of Incorporation for Start-ups Section 80-IAC

Withdrawal of Special Tax Rate on Dividend Under Section 115BBD

Drafting Error for Deduction under Section 35 Corrected

Surcharge on Long Term Capital Gains and Income Tax Reduced by Budget 2022

Definition of ‘Slump Sale’ Amended to Cover all Transfers: Budget 2022

Clarification on Transfer of Goodwill on Reduction from Block of Assets

Bonus Stripping under Section 94(8) to Cover Shares and Units

Disallowance of Expenses for Offence under section 37 further Clarified: Budget 2022

0 Comments