CBDT vide Notification No. 19/2021 dated 26th March 2021 has issued Income Tax (6th Amendment) Rules 2021 which inter alia mandates all institutions and funds to seek reapproval under section 80G in the prescribed Form 10A in accordance with the first proviso to section 80G(5).

Introduction

Readers are aware that Finance Act, 2020 had introduced sea change in the rules related to approval of charitable trusts one of which was related to discontinue the practice of perpetual approval and to introduce the rule under which the approval will remain valid for a period of five years and thereafter, the charitable trusts are required to renew the approval.

Update: Read How to file Form 10A on the new e-filing portal

How to File Form 10A on New E-Filing Portal

At that time, it was provided that all the registered institutions and funds approved under section 80G(5)(vi) are required to apply for reapproval in the period between 1-6-2020 to 31-08-2020. However, due to the outbreak of COVID-19 pandemic and nationwide lockdown imposed these provisions were postponed to 1-4-2021 by the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020. This Act has deleted the amendments introduced by the Finance Act, 2020 which were effective from 1-6-2020 and again inserted the same provisions from 1-4-2021.

Scheme of deduction under section 80G for donation to an approved fund or institution

When a person makes any donation then the donor will get the deduction only if the donee fund or institution is listed in section 80G(2) of the Act.

A Charitable Trust is covered in sub-clause (iv) of section 80G(2)(a). It states that any sums paid by the assessee in the previous year as donations to any other fund or any institution to which this section applies shall be eligible for deduction under section 80G(1).

Further, section 80G(5) provides that this section applies to donations to any institution or fund referred to in sub-clause (iv) of clause (a) of sub-section (2), only if it is established in India for a charitable purpose and if it fulfils the certain conditions. One of the conditions [as stated in clause (vi)] is that the institution or fund is approved by the Commissioner in accordance with the rules made on this behalf. CBDT has prescribed Rule 11AA in this regard.

Amended Provisions related to reapproval under section 80G

The legal framework for reapproval of an institution or a fund under section 80G(5)(vi) is stated in the four provisos to section 80G(5).

The first proviso deals with the time limit for making an application for approval under four circumstances.

The second proviso provides for the validity period of the approval granted.

The third proviso provides for the time limit within which the order for approval shall be passed.

The fourth proviso deals with the period from which the validity period of the approval should be computed.

Thus, in short, the provisos are-

The first proviso to section 80G(5) provides that the institution or fund referred to in section 80G(5)(vi) shall make an application in the prescribed form and manner to the Principal Commissioner or Commissioner, for grant of approval, in the following manner—

The second proviso to section 80G(5) provides the validity period of the approval to the institution or fund. It provides that the Principal Commissioner or Commissioner, on receipt of an application made under the first proviso, shall-

(i) where the application is made under clause (i) of the first proviso (where the trust is already approved), pass an order in writing granting it approval for a period of 5 (five) years;

(ii) where the application is made under clause (ii) or clause (iii) of the first proviso (renewal of approval after 5 years or after expiry of provisional approval) ,—

(a) call for such documents or information from it or make such inquiries as he thinks necessary in order to satisfy himself about—

(A) the genuineness of activities of such institution or fund; and

(B) the fulfilment of all the conditions laid down in clauses (i) to (v);

(b) after satisfying himself about the genuineness of activities under item (A), and the fulfilment of all the conditions under item (B), of sub-clause (a),—

(A) pass an order in writing granting it approval for a period of 5 (five) years; or

(B) if he is not so satisfied, pass an order in writing rejecting such application and also cancelling its approval after affording it a reasonable opportunity of being heard;

(iii) where the application is made under clause (iv) of the first proviso (approval to a newly established trust), pass an order in writing granting it approval provisionally for a period of 3 (three) years from the assessment year from which the registration is sought.

The Principal Commissioner or Commissioner shall also send a copy of such order to the institution or fund:

In short, the provisions of the second proviso is tabled below-

The third proviso to section 80G(5) provides for the time limit within which the Principal Commissioner or Commissioner shall pass the order of approval or rejection in the prescribed form.

It provides for-

(i) Passing of order in the case where the institution or fund is approved under clause (vi) as per Clause (i) of 1st proviso and clause (i) of the second proviso within a period of 3 (three) months from the end of the month in which the application was received.

(ii) Passing of order in the case of renewal of approval after 5 years or before granting final approval after provisional approval within a period of 6 (six) months from the end of the month in which the application was received.

(iii) Passing of order in the case of a newly established trust or institution of provisional approval within a period of 1 (one) month from the end of the month in which the application was received.

Note: The third proviso to section 80G(5) reads as under-

Provided also that the order under clause (i), sub-clause (b) of clause (ii) and clause (iii) of the first proviso shall be passed in such form and manner as may be prescribed, before expiry of the period of three months, six months and one month, respectively, calculated from the end of the month in which the application was received:

The word appearing as ‘first’ refers to first proviso but it should actually be ‘second’ proviso. It's a typographical error which needs correction. Since the law is enacted, the same can happen only through an amendment. Till then a clarification should be issued by the government in this regard.

In short, the provisions of the third proviso is tabled below-

The last and fourth proviso to section 80G(5) provides for the period from the validity period of 5 years of the approval is required to be computed under the following circumstances-

(a) Where the institution or fund is approved as per clause (i) of the 1st proviso (where the trust is already approved), approval granted under the second proviso shall apply to an institution or fund, from the assessment year from which approval was earlier granted to such institution or fund.

(b) Where the institution or fund is approved as per clause (iii) of the 1st proviso (renewal of approval the after expiry of provisional approval), approval granted under the second proviso shall apply to an institution or fund, from the first of the assessment years for which such institution or fund was provisionally approved.

(c) In any other case approval granted under the second proviso shall apply to an institution or fund (renewal after 5 years or in case of provisional approval to a newly established fund), from the assessment year immediately following the financial year in which such application is made.

Pending Applications for Approval

The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 has inserted a new sub-section (5E) in section 80G to provide that all the applications, pending before the Commissioner on which no order has been passed under section 80G(5)(vi) and was pending for approval before 1-4-2021, shall be deemed to be applications made under clause (iv) of the first proviso to sub-section (5) on that date. In other words, such applications shall be treated as an application by a newly established trust and the provisions related to provisional approval shall apply.

Procedure for obtaining approval under section 80G and How to file Form 10A

Ax existing approved or a newly established trust shall be required to obtain approval from the Principal Commissioner or Commissioner under section 80G(5)(vi).

The procedure for obtaining and granting the approval is contained in the four provisos to section 80G(5) and Rule 11AA. The prescribed form for making an application for approval is Form No. 10A and the order for approval will be given in Form No. 10AC.

The details of the approval procedure are described below.

Application for Approval

1. An existing approved Charitable Trust/NGO or a newly established trust or institution is required to make an online application in Form No. 10A from its e-filing account after logging with the User-ID and password. [Rule 11AA(1)(a)]

2. The online application in Form No. 10A in the following cases is required to be made in the time limit mentioned below-

a) In case of an approved institution or fund, from 1-4-2021 to 30-6-2021

b) In case of provisional approval, at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activities, whichever is earlier.

[Clause (i) or clause (iv) of first proviso to subsection (5) of section 80G and Rule 11AA(1)(a)]

3. In case of renewal of an approved Charitable Trust/NGO or a newly established trust or institution seeking final approval after being granted provisional approval is required to make an online application in Form No. 10AB. [Rule 11AA(1)(b)]

4. The online application in Form No. 10AB in the following cases is required to be made in the time limit mentioned below-

a) In case of a newly established trust, at least one month prior to commencement of the previous year relevant to the assessment year from which the said approval is sought.

c) In case of renewal of approval, at least six months prior to expiry of the validity period.

[Clause (ii) or clause (iii) of first proviso to subsection (5) of section 80G and Rule 11AA(1)(b)]

Note: Errors in the heading of Rule 11AA and Rule 11AA(1)(b)

In the heading of Rule 11AA, the expression “institution or fund“ is mentioned as “institution of fund”. Similarly, in Rule 11AA(1)(b), “clause (ii) or clause (iii)” is wrongly mentioned as “clause (ii) or clause (ii)”.

A corrigendum to this effect is expected from the CBDT.

Documents to be submitted while filing Form 10A/Form 10AB

The application in Form Nos. 10A or 10AB shall be accompanied by the following documents—

(a) where the applicant is created, or established, under an instrument, self-certified copy of the instrument;

(b) where the applicant is created, or established, otherwise than under an instrument, self-certified copy of the document evidencing the creation or establishment of the applicant;

(c) self-certified copy of registration with Registrar of Companies or Registrar of Firms and Societies or Registrar of Public Trusts, as the case may be;

(d) self-certified copy of registration under Foreign Contribution (Regulation) Act, 2010(42 of 2010), if the applicant is registered under such Act;

(e) self-certified copy of existing order granting registration under clause (vi) of subsection (5) of section 80G;

(f) self-certified copy of order of rejection of application for grant of approval under clause (vi) of sub-section (5) of section 80G, if any;

(g) where the applicant has been in existence during any year or years prior to the financial year in which the application for registration is made, self-certified copies of the annual accounts of the applicant relating to such prior year or years (not being more than three years immediately preceding the year in which the said application is made) for which such accounts have been made up;

(h) note on the activities of the applicant.

[Rule 11AA(2)]

Online furnishing and Verification of Form 10A/Form 10AB: Form Nos. 10A/10AB is required to be furnished online electronically.

Form No. 10A or 10AB shall be verified by the person who is authorised to verify the return of income under section 140 of the Act with digital signature (DSC) or EVC.

If the return of income of the applicant is required to be furnished under digital signature, then furnishing Form 10A/Form 10AB with DSC is compulsory else the forms can be furnished with EVC.

[Rule 11AA(3)/(4)]

Passing of Order in Form No. 10AC

On receipt of an application in Form No. 10A, the Principal Commissioner or Commissioner shall pass an order in writing granting approval under section 80G(5) in Form No. 10AC and issue a sixteen-digit alphanumeric Unique Registration Number (URN) to the applicants.

Order in Form 10AC is passed for granting approval under clause (i) or (iii) of the second proviso read with third proviso of sub-section (5) of section 80G.

Clause (i) of second proviso of section 80G(5) deals with the order granting approval to an existing approved institution or a fund before 1-4-2021. As per third proviso of section 80G(5), the Pr. CIT or CIT is required to pass the order within a period of three months from the end of the month in which application in Form 10A is made.

Clause (iii) of second proviso of section 80G(5) deals with the order granting approval to a newly established trust or institution or a fund. As per third proviso of section 80G(5), the Pr. CIT or CIT is required to pass the order within a period of one month from the end of the month in which application in Form 10A is made.

[Clause (i) or clause (iii) of second proviso to subsection (5) of section 80G and Rule 11AA(5)]

This shows that there will not be any inquiry or investigation by the Pr. CIT/CIT before granting the approval. In these two cases, granting of approval to the institution or fund will be instantaneous. In these cases, the income tax department cannot reject the application.

However, Rule 11AA(6) prescribes to cancel the approval granted in certain circumstances.

It is prescribed that if, at any point of time, it is noticed that Form No. 10A has not been duly filled in by not providing, fully or partly, or by providing false or incorrect information or documents required to be provided or by not complying with the requirements of sub- rule (3) or (4) related to online filing and verification respectively, the Principal Commissioner or Commissioner, after giving an opportunity of being heard, may cancel the approval granted in Form No. 10AC and Unique Registration Number (URN), so issued and such approval or such Unique Registration Number (URN) shall be deemed to have never been granted or issued.

Effective date of provisional approval

In case of an application made under clause (iv) of first proviso to sub-section(5) of section 80G (a newly established trust or institution), the provisional approval shall be effective from date of order passed by the Pr. CIT/CIT in Form No. 10AC as per Rule 11AA(5).

[Rule 11AA(7)]

Passing of Order in Form No. 10AD

On receipt of an application in Form No. 10AB, the Principal Commissioner or Commissioner shall pass an order of approval or rejection or cancellation under section 80G(5) in Form No. 10AD and shall issue a sixteen-digit alphanumeric Unique Registration Number (URN) only to the applicants to whom approval is granted.

Order in Form 10AD is passed under clause (ii) or clause (iii) of the first proviso read with third proviso of sub-section (5) of section 80G.

Clause (ii) of first proviso of section 80G(5) deals with application for renewal of approval where the institution or fund is approved and the period of such approval is due to expire. Such application is required to be made in Form 10AB at least six months prior to expiry of the said period.

Clause (iii) of first proviso of section 80G(5) deals application for final approval where the institution or fund has been provisionally approved. In this case, application for final approval is required to be made in Form 10AB at least six months prior to expiry of the period of the provisional approval or within six months of commencement of its activities, whichever is earlier.

Second proviso to section 80G(5) empowers the Principal Commissioner or Commissioner in the above two cases to all for such documents or information from it or make such inquiries as he thinks necessary in order to satisfy himself about—

(A) the genuineness of activities of such institution or fund; and

(B) the fulfilment of all the conditions laid down in clauses (i) to (v) of section 80G(5).

After satisfying himself about the genuineness of activities and the fulfilment of all the conditions-

(A) pass an order in writing in Form No. 10AD granting it approval for a period of five years; or

(B) if he is not so satisfied, pass an order in writing in Form no. 10AD rejecting such application and also cancelling its approval after affording it a reasonable opportunity of being heard;.

As per third proviso of section 80G(5), the Pr. CIT or CIT is required to pass the order within a period of six months from the end of the month in which application in Form 10AB is made.

[Clause (ii) or clause (iii) of first proviso to subsection (5) of section 80G and Rule 11AA(8)]

This shows that there will be extensive inquiry or investigation by the Pr. CIT/CIT before granting the approval. In these two cases, granting of approval to the institution or fund will be subject to satisfactory examination of the genuineness of activities and the fulfilment of all the conditions mentioned in Section 80G(5)(i) to (v).

Types of Forms and its uses

In the matter of approval of an institution or a fund, the followings Forms are in vogue as per Rule 11AA:

Note: It is prescribed for issuing of URN in case order granting approval passed in Form No. 10AC and Form No. 10AD. It is not clear whether both the URNs will remain the same or not. It seems the URN granted in Form No. 10AC will be continued in order passed in Form No. 10AD.

The final table of all the compliances and time limit for approval under section 80G

Step by Step Guide: How to online file Form 10A for Section 80G Approval

The step-by-step guide to online file Form 10A for obtaining approval under section 80G is given below-

1. The user (trust/NGO) is first required to log in to its account by entering the USER ID and password on the log-in page after visiting e-filing portal.

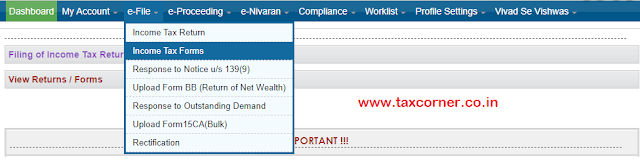

2. Click on the menu titled ‘e-File’ and then select ‘Income Tax Forms’.

This will land to this page-

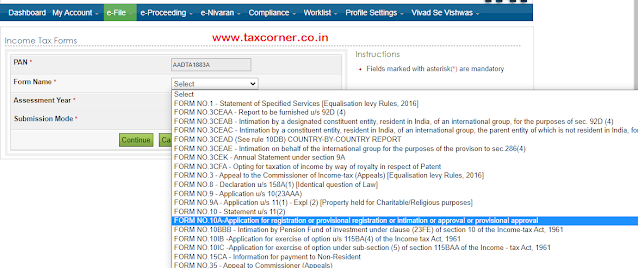

3. In the Form Name column, select ‘FORM NO. 10A-Application for registration or provisional registration or intimation or approval or provisional approval’.

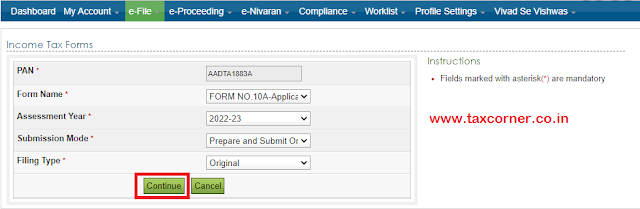

The value in the field ‘Assessment Year’ as 2022-23 will be prefilled and is not editable. Leave other prefilled fields intact.

5. Read the Instructions. These are 9 ‘General Instructions’ listed in the page. Important instructions are reproduced here-

Instructions

General Instructions:

1. While entering the data in online form, please do not click BACK button in browser or press BACKSPACE button. You will be logged out.

2. This Form is applicable to institutions, trusts. research associations. universities. colleges or other institutions, companies who wish to claim exemption under the following sections:

i) Sub clause (i) of Clause (ac) of Sub-section (1) of Section 12A.

ii) Sub clause (vi) of Clause (ac) of Sub-section (1) of Section 12A.

iii) Clause (i) of First proviso to Clause (23C) of Section 10,

iv) Clause (iv) of First proviso to Clause (23C) of Section 10.

v) Clause (i) of First proviso to Sub-section (5) of Section 80G,

vi) Clause (iv) of First proviso to Sub-section (5) of Section 80G,

vii) Fifth proviso to Sub-section (1) of Section 35 of the Income-tax Act, 1961.

3. E-verification is mandatory through DSC/EVC.

4. Please ensure that the details of Principal Contact or Authorized Signatory has been updated in the My Profile before submission of the form.

5. Please ensure that DSC of the Principal Contact or Authorized Signatory/Representative Assessee is registered before submission of the form.

6. It is a good practice to save your work frequently. Please use SAVE AS DRAFT option.

7. Attachments to the Form should be in pdf format only with scan clarity set at 300 DPI. If original document is illegible or in vernacular language, please ensure to upload a English translated version. neatly typed in A4 sheet. with 2.54 cms margin across all sides along with the original. The same can be attached at the time of upload.

8. Please verify the Form, accompanying attachments/documents before you submit.

9. All greyed out fields are either auto-filled or non-editable.

6. Click on Next Page titled ‘Form No. 10A’. This will open the main Form No. 10A. This is a one-page form.

7. The single-page Form 10A is divided into six parts and has 21 columns-namely,

Each Column is discussed below-

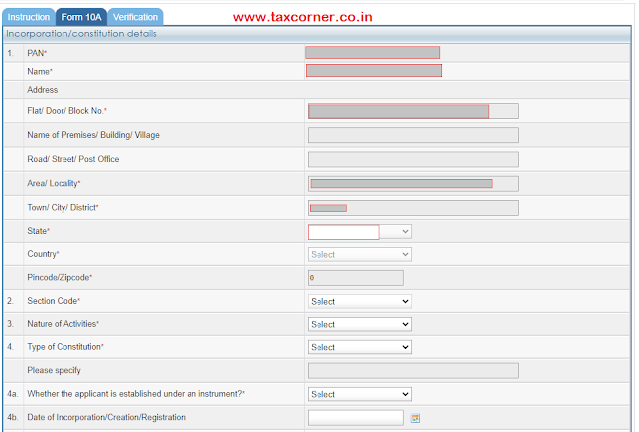

(1) The first part is general information in which most of the fields are auto-populated. Some fields are editable by the user. It contains the name, address, PAN of the applicant. This pulls the data from the profile settings. In case the address needs to be changed, the same is required to be modified in the menu namely ‘Profile Settings’> 'My Profile'. Then select ‘Address’ Tab to change the Address data. Once the data in user profile is changed, the address in Form 10A will be updated.

(2) The next column is Section Code. A drop-down box is provided to select the appropriate section code. There are 19 section codes listed in the column. In the context of section 80G, there are only two references in the section code column-

Select the appropriate section code either 11 or 12.

Note: Remember, one should be very careful in selecting the code since as per Rule 11AA(6) any approval so given is liable to be cancelled if any incorrect or false information is filled in Form 10A.

(3) The next information this form is asking is about the Nature of activity, whether the applicant's activity is Charitable or Religious cum Charitable. Select the appropriate one.

(4) The next information is related to the ‘Type of Constitution’ of the applicant viz., Trust, Society, Company and Others.

(4a to 4d) The details of registration under other laws is required to be given. For example if an NGO is registered as a Society, then the society registration number needs to be given. In the ‘Authority granting registration/incorporation’, it shall be the Registrar of Societies that needs to be filled up. Almost all the approved institutions are registered somewhere under any other law. All the details including date of registration/incorporation can be found from the registration document/certificate. In case of section 8 companies, it will be the Registrar of Companies. MCA.

(5) In column 5, the Form asks for ‘objects of the Applicant’. It has provided 8 objects which are based on the definition of ‘Charitable Purpose’ as per Income-tax Act, 1961. The 8th item is the residual one. The Form listed the following Objects-

The applicant can select more than one object.

(6) The column 6 is about the revocability of the trust. It requires an answer whether the applicant’s trust deed contains a clause that the trust is irrevocable. Since most all the trust has an irrevocability clause in the trust deed, the applicant needs to select ‘Yes’. This field is mandatory.

Remember that this column is made applicable for applicants which is registered as a ‘Trust’. But this form is required to be filled by a society, company also. There is no option to select ‘Not Applicable’ or alike. Hence, a society or a company shall also select ‘Yes’.

(7) This column asks for giving details of other registration under the following laws only-

(i) DARPAN registration

(ii) Registration under FCRA

(iii) Registration under Income Tax Act

In case of registration under the Income Tax Act, one should provide the existing registration details under section 10(46) and existing registration u/s 80G.

Section 10(46) exempts specified income of a body or authority or Board or Trust or Commission (by whatever name called) which is notified by the Central Government. For example, All India Council for Technical Education’, New Delhi, State Pollution Control Board, Odisha, Yamuna Expressway Industrial Development Authority, Uttar Pradesh, and many others are notified under this clause.

(8) Column No. 8 has two questions. One is asking whether in the past application for registration was rejected. Select ‘Yes’ or ‘No’, as applicable.

The next question in column 8b of Form 10A relates to claiming exemption under clause 21 of section 10 of the income Tax Act. Select yes if the applicant is claiming the exemption under section 10(21), else select ‘No’.

It should be remembered that section 10(21) is applicable to a research association approved for the purpose of clause (ii) or clause (iii) of sub-section (1) of section 35.

(9) It requires giving details of all the Author(s)/ Founder(s)/ Settlor(s)/Trustee(s)/ Members of society/Members of the Governing Council/Director(s)/Shareholders holding 5% or more of shareholding / Office Bearer(s) as on the date of application and their relation with the organization. The form has listed 18 types of relation whose information is required to be provided:

Managing Director

Director

Authorized Signatory

Trustee Author

Settlor

Founder

Member of society

Member of the Governing Council

Shareholder holding 5% or more of shareholding

Office Bearer

Principal Officer

Person Competent to Verify

Principal Secretary Secretary

Chief Executive Officer

Chief Financial Officer

Manager

Representative Assessee

Any other Principal Officer

In the field ‘ID Code’, any one of the followings can be provided:

01-Permanent Account Number

02-Aadhaar Number

03-Tax Identification Number

04-Passport number

05-Elector's photo identity number

06-Driving License number

07-Ration card number

08-Others

If in the ID Code selected is PAN and after entering the PAN in the field titled ‘Unique Identification Number’, the address will be auto-populated.

In this column, the Aadhaar Number of the members etc. is optional and not mandatory, unlike FCRA registration. In place of Aadhaar number PAN, etc can also be provided.

In Column 9b, in case if any of the persons (as mentioned in row 9a) is not an individual then provide the following details of the natural persons who are beneficial owners (5% or more) of such person as on the date of application.

(10 to 19) Details of assets and liabilities. In this case, if the last return is filed, it will be prefilled ‘Yes’ and other columns 11 to 20 will be greyed out which means no information needs to be filled.

(20) Details of income of the applicant.

(21) Column 21a and 21b require details of religious activities.

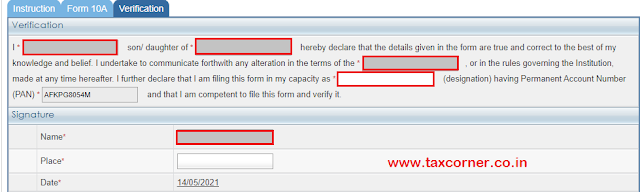

8. Verification: At last, the form is required to be verified by DSC or EVC as per Rule 11AA(3)/(4). The name, father’s name, nature of the constitution, as well as capacity, will be prefilled but the field capacity is editable. The applicant needs to fill the place only.

9. Attachment of documents: This section of the form requires the uploading of scanned documents. The documents must be scanned in 300 dpi. The documents may be scanned in colour or black and white. The total size of all the attachments shall not exceed 50 MB. Hence, the applicant shall try to reduce the size of the pdf files if exceeding the limit.

Further, only PDF file format can be uploaded. No JPG or other image file is allowed.

This page comes after clicking the submit button.

Note: Same Form No. 10A is required to be furnished for registration under section 12AB and for approval under section 80G. However, for both sections, Form 10A is required to be filed twice, one for section 12AB registration and the second time for section 80G approval. Certain options vary in some fields in Form No. 10A for section 12AB and section 80G.

Read Also:

How to file Statement of Donation in Form No. 10BD

How to issue Certificate of Donation in Form 10BE

CBDT Notifies Registration Procedure u/s 12AB for NGOs/Trust and Others

Key Highlights of Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020

Section 12AB: Amendments in Procedure for Registration of Charitable Trusts and NGOs

New Section 12AB to replace Section 12AA and Section 12A for Charitable Trust and NGO Budget 2020

An Insight into Amendments for Charitable Trusts –Budget 2020

3 Comments

I am unable to find 10A under my trust dashboard>efile. I will be grateful if you can please guide me to find it for filing 80G exemption. I am looking at the site updated on 13 July 2021.

ReplyDeleteIn the new e-filing portal filing of Form 10A is not happening now.

Deletethanking very much in enlightening me by your prompt reply

Delete