Income tax department is launching 'e-Filing Lite', a lighter version of e-Filing portal with a focus on filing of Income Tax Return (ITR) by the taxpayers. The same can be accessed by clicking 'e-Filing Lite' button in home page. The current e-Filing portal having all the services can be accessed by clicking on 'Portal Login' button.

Good News for income tax return filers.

The income tax department has launched a new lite version of its e-filing website for faster filing of ITR.

The following communication was displayed on the home page of the e-filing website on 1st August 2019.

One can log-in into the new lite site with the new log-in button under 'Registered Users'. A new yellow coloured background log-in button captioned 'e-Filing Lite' is placed along with the green coloured background log-in button captioned 'Portal Login'.

If a taxpayer wants to log-in into the old full website, one should log-in into the website with green coloured background log-in button captioned 'Portal Login'.

To log-in with the lite version, click on the yellow coloured background log-in button captioned 'e-Filing Lite'.

The lite version reduces the number of menus and options compared to the full version. The main objective of the lite version is to facilitate the fast filing of return even in a slow network connection.

The major menus or functionality in the lite version are listed below-

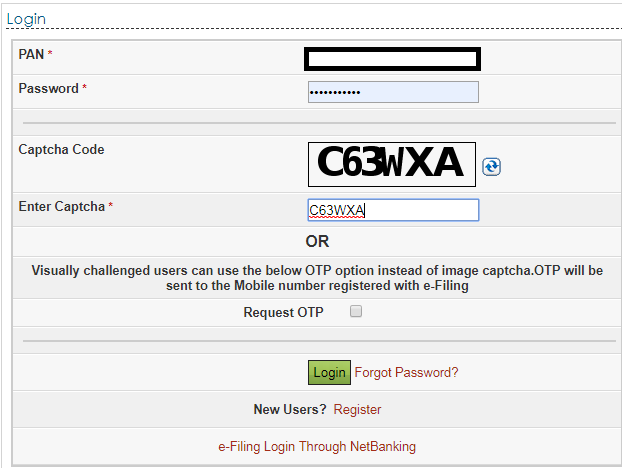

1. No change in log-in page - The log-in page in lite version is the same as that of the full version.

Log-in Page in Lite Version

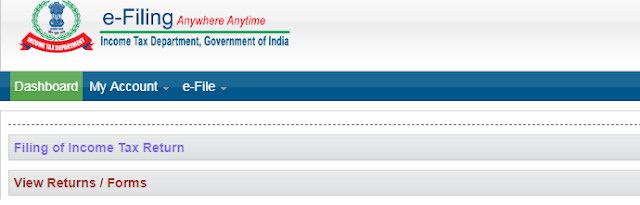

2. Less number of menus - Only three main menus are given in the lite version. These are:

I) Dashboard

II) My Account

III) e-File

The sub-menus are also reduced and only related to filings are given in the main menus.

Under 'My Account' only 'View 26AS', 'View e-Filed Returns/Forms' and 'Download Pre-fill XML' are given.

Under 'e-File', only 'Income Tax Return' is given to file ITR on the webpage for ITR 1 and ITR 4 and with the facility to upload XML file for other ITRs.

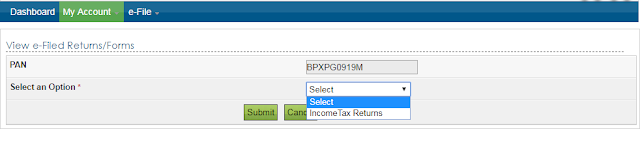

Under the 'View e-Filed Returns/Forms' only e-filed Income Tax Returns can be viewed. No other forms can be viewed in the lite version.

Since in the lite version, there is no 'Profile Settings' menu, no prevalidation of the bank account can be done. This has to be done in full version only.

However, if the bank account is already prevalidated and in other cases also, e-verify can be done after filing of the return.

It is expected that the lite version will give a smooth filing experience to taxpayers even during rush time. Indeed, a taxpayer-friendly measure from the income tax department.

Also Read:

Get all latest content delivered straight to your inbox

2 Comments

is digital signature for income tax compulsory or we can use addhar card

ReplyDeleteIn all cases digital signature is not compulsory. In tax audit cases and in case of ITR 6 (Companies ITR) digital signature is compulsory. In other cases, like ITR-1 or ITR 2 or ITR 3 for one can electronically verify the ITR by Aadhaar OTP. In case of Aadhaar OTP, mobile number must be linked to Adhaar number.

Delete