While filing ITR 1 we often face a problem in filling Sch TDS 2 titled "Details of Tax Deducted at Source from Income OTHER THAN Salary [As per Form 16 A issued by Deductor(s)]" for the two columns namely "Tax Deducted Col (5)" and "TDS credit out of (5) claimed this year [Col (6)]" . In this article, the concept of claiming the TDS and how to fill this Sch TDS 2 is explained.

At the outset, it is pertinent to understand the concept of TDS before we move to ITR to understand what does the column "TDS credit out of (5) claimed this year [Col (6)]" mean to enable a taxpayer to fill the column correctly.

TDS means Tax Deducted at Source. Under income tax law, a person is responsible for deduction of tax from the income he pays to any other person. Not all the income are subject to TDS. Only those incomes which are specified in the Income Tax Act for deduction of tax are subject to TDS.

The list of incomes which are subject to TDS is quite long. however, in the case of ITR 1, TDS on salary income, TDS on interest income, TDS on payment under a non-exempt life insurance policy, are mostly found.

A person is liable to deduct TDS on income paid to another person when the threshold amount is breached in a financial year. For example, in case of TDS on interest on Bank Fixed Deposit or Recurring Deposit, in case the payment of interest by the bank to depositor exceeds Rs. 10,000 during the FY 2018-19 then the bank will deduct TDS on the interest paid or credited.

Remember that TDS is a tax which is paid on behalf of the depositor by the bank. It is the tax liability of the depositor which is paid by the bank on behalf of the depositor. The TDS is not a tax on the bank or the deductor, but it is a tax payment of the depositor. The depositor will get the credit for the TDS against his tax liability on his other income if any. If the depositor has no tax liability after the end of the income because of lower income, then he will get the refund from the income tax department and not from the deductor. This is because the deductor has deposited the TDS into the government account.

Let's illustrate this with an example. Suppose, a person has kept a fixed deposit with a bank. The bank paid interest of Rs. 15,000 to the depositor in FY 2018-19. The bank had deducted TDS of Rs. 1,500 on the interest payment and credited net interest amount of Rs. 13,500 to the account of the depositor. This TDS of Rs.1,500 is not a loss to the depositor. It is actually a tax payment by the depositor. Instead of paying himself, the bank has paid the tax to the government on behalf of the depositor and for which he is entitled to get the credit against his tax liability for the FY 2018-19. Now if this is the only income of the depositor, he does not have to pay any tax in FY 2018-19 but he will get the credit of the TDS paid by filing the ITR. Thus he will get the refund of the TDS for Rs. 1,500. This is the concept of TDS.

Why TDS when a person can pay tax on his own?

A person can pay or discharge his tax liability in the following ways-

1. Advance Tax payment- a tax which is paid in the financial year itself.

2. Self Assessment Tax payment- a tax which is paid after the end of the financial year.

TDS is a type of Advance Tax.

Why there is TDS provision in Income Tax?

Under the income tax law, a person is liable to pay tax on his income earned during a financial year. Only after the end of the financial year, one can compute his income and the tax liability thereon and then he will pay the tax. Thus the government will get the tax only after the end of the financial year. A government also needs money to run. So it cannot wait till last time for collection of tax.

Secondly, a person may hide the income in his return of income on which no tax is deducted. If tax is deducted, the government will have the information about the income earned by the depositor. Therefore, it will not be easy to hide income.

Some of the legal provisions which are important to understand before Sch TDS of the ITRs are filled-

1. Section 191: If the deductor does not deduct the TDS, it does not mean the income is not liable to tax. In such a case, the person receiving the income shall pay the tax directly to the government as advance tax or self-assessment tax.

2. Section 198 of the Income Tax Act, 1961: Tax deducted is income received: Since the tax is deducted on the gross amount and the net income is paid or credited, the TDS forms a part of the income. In the above-mentioned depositor's case, the interest income for the FY 2018-19 is Rs. 15,000 and not Rs. 13,500. However, this rule does not apply to TDS on salary income.

2. Section 198 of the Income Tax Act, 1961: Tax deducted is income received: Since the tax is deducted on the gross amount and the net income is paid or credited, the TDS forms a part of the income. In the above-mentioned depositor's case, the interest income for the FY 2018-19 is Rs. 15,000 and not Rs. 13,500. However, this rule does not apply to TDS on salary income.

3.Section 199: Credit of TDS: This is the most important section to understand on which filling of Sch-TDS of an ITR depends.

This section states that credit of TDS shall be given to the person from whom tax is deducted and whose behalf tax is deposited to the government in the year in which the income is offered to tax.

The structure of Sch TDS in the ITR 1 for AY 2019-20 is shown below-

The TDS Schedule is given in the tab titled 'Tax Details' in the webpage version of ITR-1 form.

It contains different sections for the different type of TDS and a section for taxes paid by challan or directly by the taxpayer as Advance Tax or Self-Assessment Tax which are listed below-

Sections

|

Particulars

|

Tab Name

|

Tax Details

|

Sch TDS

1

|

TDS from

salary by employer

|

Sch TDS

2

|

Details

of TDS from non-salary income - for which TDS certificate is issued in Form 16A

|

Sch TDS

3

|

Details

of TDS on rent payments u/s 194IB

|

Sch TCS

|

Details

of TCS

|

Sch IT

|

Details

of Advance Tax and Self Assessment Tax payments

|

Sch-TDS 1: Details of Tax Deducted at Source from SALARY [AS per the FORM 16 issued by Employer(s)]

This is related to Salary income of the taxpayer. In case the ITR form is prefilled, the data will come in the relevant fields, else one needs to enter the data manually. In case of more than one employer, one needs to click on the '+Add' button to add a new row and fill the details. To delete a row, click on the Checkbox, circled in red, to select the row with a tick mark and then click the 'X Delete' button.

The Columns of this schedule are discussed below-

Column No. and title

|

Particulars

|

(1)

TAN

|

This is

the TAN of the employer and can be found in Form 16.

|

(2)

Name of the employer

|

No need

to explain it.

|

(3) Income chargeable under Salaries

|

The Gross Amount of salary paid to the employee

|

(4)

Total Tax Deducted

|

The TDS

by the employer for the employee in the previous year

|

In case of salary income since the entire amount of salary income is chargeable to tax in the year in which it is earned, the entire income will be included in the computation of income and thus a taxpayer can claim the entire amount of TDS in the current assessment year. There is no scope of carry-forward of TDS credit for subsequent year(s). For example, the salary income as shown in Form 16 for AY 2019-20 will be chargeable to tax in AY 2019-20 and the credit for entire TDS will be allowed in AY 2019-20 itself.

Once the credit is allowed, the same will reflect in column D12(iii) - 'Total TDS Claimed' of the next Tab titled 'Taxes Paid and Verification' and will be added to the column 'Total Taxes Paid' in D12(iv).

Sch-TDS 2: Details of Tax Deducted at Source from Income OTHER THAN SALARY [AS per the FORM 16A issued by Deductor(s)]

This is related to Non-Salary income of the taxpayer. In case the ITR form is prefilled, the data will come in the relevant fields, else one needs to enter the data manually. In case of more than one deductor, one needs to click on the '+Add' button to add a new row and fill the details. To delete a row, click on the Checkbox, circled in red,to select the row with a tick mark and then click the 'X Delete' button.

The Columns of this schedule are discussed below-

Column No. and Title

|

Particulars

|

(1)

TAN of the deductor

|

This is

the TAN of the deductor and can be found in Form 16A.

|

(2)

Name of the deductor

|

No need

to explain it.

|

(3)

Gross receipts which is subject to tax deduction

|

The

gross amount of salary paid to the employee

|

(4)

Year of Tax Deduction

|

A list

showing ‘Years’ in ‘yyyy’ format

|

(5)

Tax Deducted

|

TDS

amount by the deductor

|

(6)

TDS credit out of (5) claimed this year

|

Remains blank cell or field if pre-filled form.

|

The first two columns are simple to understand.

Columns (3) to (6) are inter-related and hence discussed separately.

To illustrate, suppose Mr. Rakesh has a Fixed Deposit of Rs 1 Lakh with Allahabad Bank on 1st April 2018. The interest amount is cumulative and will be paid to Rakesh at the time of maturity of the deposit. The Fixed Deposit was made for 5 years. The bank has credited interest amount of Rs. 28,147 for the FY 2018-19 in his fixed deposit account. The bank has deducted TDS of Rs. 190 from the interest amount and the same is reflecting in Rakesh's Form 26AS.

Case 1: Suppose Mr. Rakesh has no other income except the above interest income and he has offered the interest income of Rs. 28,147 to tax in the FY 2018-19 itself. So as per section 199, he will get the credit of TDS in FY 2018-19 itself. Therefore he will claim the credit of TDS in the Assessment Year or AY 2019-20. He will be allowed credit for the same in AY 2019-20 since the income is offered in AY 2019-20 itself.

Case 2: Suppose Mr. Rakesh has Salary Income and the above interest income and he has offered the interest income of Rs. 28,147 to tax in the FY 2018-19 itself along with the salary income. So as per section 199, he will get the credit of TDS in FY 2018-19 itself. Therefore he will claim the credit of TDS in the Assessment Year or AY 2019-20. He will be allowed credit for the same in AY 2019-20 since the income is offered in AY 2019-20 itself. Also if the employer has deducted any TDS he will get the credit of the same also. The aggregate of both the TDS will be allowed as a credit for the AY 2019-20.

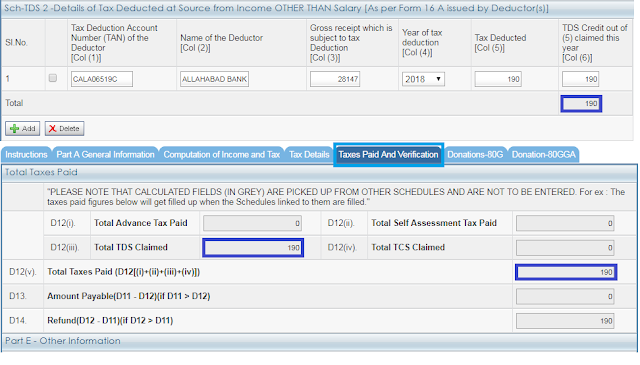

For cases 1 and 2: The column (3) will include the interest amount of Rs. 28,147 as a Gross receipt on which tax is deducted. This is the "Gross income' for the FY 2018-19 since in the column (4) FY 2018-19 is chosen. As per section 198 (discussed above), It is the Gross amount that will be considered as income and not the net amount after TDS, except for TDS on Salary income. Hence this column or cell will reflect Rs. 28,147 and not Rs. 27,957 (Rs. 28,147-Rs. 190).

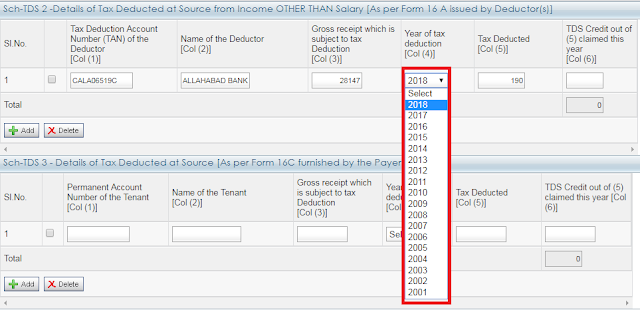

The column (4) will include 2018 as 'Year of tax deduction'. Since the tax was deducted by the Allahabad Bank in FY 2018-19, this will contain '2018', the first four digit of the financial year. (For the FY 2017-18, the value would be 2017 and so on.)

Column (5) will reflect the amount of TDS on the Gross amount reported in Col (3). In this case, it will be Rs. 190.

Column (6) denotes the amount of TDS which the taxpayer is claiming as TDS credit out of TDS amount reported in Col (5). A taxpayer can claim the TDS credit only if the corresponding income reported in Col (3) is included in the computation of income for the assessment year for which ITR is being filed. This is in accordance with section 199.

In the above illustration of Mr. Rakesh, the interest income as filled in Col (3) for Rs. 28,147 is offered to tax as 'Income from other sources' for AY 2019-20. Since the income is offered in AY 2019-20, the credit of tax deducted in 2018 can be claimed in AY 2019-20. Thus Rakesh can fill the TDS amount of Rs. 190 in Col(6) of Sch-TDS 2. This is how the "TDS credit out of (5) claimed this year [Col(6)]" works.

Please note filling the amount in Col(6) means that the taxpayer has offered the income and thus claiming the credit of TDS. Thus if the taxpayer has offered the income it is very important to claim the credit of TDS by filling the TDS amount from col(5) in the Col(6)- "TDS credit out of (5) claimed this year [Col(6)]" else system will not allow the credit automatically even though the taxpayer has included the income in the 'Income from other sources' or under any other head.

The Image-1 below shows the position when TDS is not claimed as credit in the Col(6)-"TDS credit out of (5) claimed this year [Col(6)]".

Image-1

From the above, it can be seen that if the taxpayer has not claimed the credit of TDS in Col(6) then in the next tab titled 'Taxes Paid and Verification' in Col D12(iii) 'Total TDS claimed' comes to '0' (zero).

The position differs when the TDS is claimed in Col(6) "TDS credit out of (5) claimed this year [Col(6)]". The image-2 below shows that when Col(6) is filled in Sch-TDS 2, the corresponding Col D12(iii) in the next tab titled 'Taxes Paid and Verification' is filled with the TDS amount. Col D12(iii) in the aggregate of all the TDS amount claimed in all the TDS schedules of 'Tax Details' tab.

Image-2

Case 3: Suppose Rakesh follows the cash basis of accounting and wants to offer the interest income in the year in which interest is actually received. As per terms of FD, the same will mature on 26.02.2022. The interest income will thus be realized in FY 2021-22.

In the ITR 1 for AY 2019-20, Rakesh will not offer the income of Rs. 28,147 under the head 'Income from Other Sources'. Following the rule in section 199 since no income is offered in the AY 2019-20, no credit of TDS can be claimed in the AY 2019-20. Thus, Rakesh cannot claim the credit of TDS of Rs. 190 in the AY 2019-20.

In such a case, the Col (6) will remain blank or fill with '0' (zero). Other columns will remain intact. This is called 'carry forward of TDS credit'. This credit will be claimed by Rakesh in AY 2022-23 when the interest income of Rs. 28,147 will be offered. In AY 2022-23, the Col (4) - 'Year of tax deduction' will contain value 2018 and not 2021.

Since now the credit of TDS is allowed by the computer system and not manually, the 'Year' 2018 will tell that the system that the claimed TDS of Rs. 190 is available in the Form 26AS of FY 2018-19 and not in the Form 26AS of FY 2021-22. The system will also check whether the credit for the TDS was claimed or not in the AY 2019-20. Then the system will allow the credit of TDS in AY 2022-23.

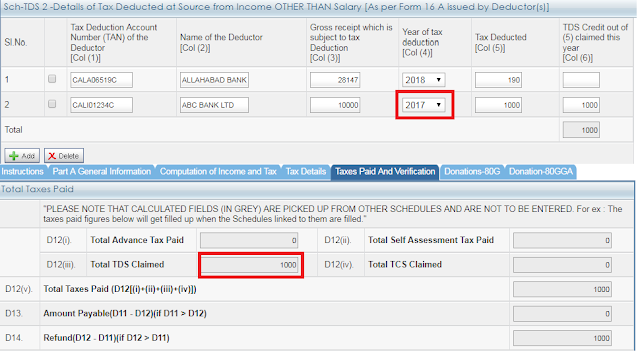

Similarly, in case the taxpayer had brought forward of TDS from an earlier year and offers the income in the AY 2019-10 then he can claim the TDS and then in the Col(4) select the appropriate year of deduction which can be earlier than 2018. Suppose, Rakesh did not offer interest income of Rs. 10,000 on which tax of Rs. 1,000 was deducted in FY 2017-18 but did not claim the credit of TDS while filing the ITR 1 for AY 2018-19. Since the interest income is now offered to tax in the AY 2019-20, he shall fill the Sch TDS 2 manually (it cannot be pre-filled) and put the year as 2017 in the Col (4) - 'Year of tax deduction', as shown below. ( To Add a new row, click on the '+Add' button.)

Once TDS is claimed in col (6) the credit will be allowed as can be seen in Col D 12(iii) of the tab 'Taxes Paid and Verification'.

This is what about the concept of "TDS credit out of (5) claimed this year [Col(6)]" in Sch-TDS 2 of ITR 1 for AY 2019-20. Moreover, do remember that the TDS amount claimed in Col(6) cannot exceed the TDS amount in Col(5). In the given example, the TDS amount in Col(6) cannot exceed Rs. 190.

Since in most of the cases, the income is offered in the same year in which tax is deducted, thus the value of Col (5) and Col (6) remains the same.

Other related articles:

Get all latest content delivered straight to your inbox

2 Comments

Tax Deducted at Source (TDS) is a means of collecting income tax in India, under the Indian Income Tax Act of 1961. Any payment covered under these provisions shall be paid after deducting a prescribed percentage. ... Returns states the TDS deducted & paid to government during the Quarter

ReplyDeleteTDS Interest!

sir,

ReplyDeletesuppose we pay brokerage to some one , in which case we deduct the TDS amount ( if the transaction is > 50 lacs) . Then the seller may or may not have TAN number . In this case how the commission receiver will fill . . He cannot fill TDS 3 22 (C )2 AS THIS IS NOT FROM RENT.

Pl explain sir.