CBDT vide Notification No. 94/2023 dated 31.10.2023 in G.S.R. 813(E) through Income-tax (Twenty-Seventh Amendment) Rules, 2023 notified certain changes in ITR-7 for the assessment year (AY) 2023-24.

These changes shall be deemed to have come into force from 1st day of April, 2023.

The changes are notified in Schedule Part B–TI and Part B–TTI of ITR-7 for AY 2023-24. Basically, the changes are correction of references in the column headers.

Changes in Part B–TI of ITR-7 for AY 2023-24

In this, changes are notified in Part B1, for Part B–TI in serial number 16 of ITR-7. Presently the said serial number 16 reads as follows-

The following changes are notified for this serial number 16-

16. Specified income chargeable u/s 115BBI, included in 13, to be taxed @ 30% (Sl. No 7 of Schedule 115BBI)

A new serial number 17 is inserted thereafter in the Part B-TI which is as follows-

17. Aggregate income to be taxed at normal rates (13-14-15-16) (including income other than specified income under section 115BBI)

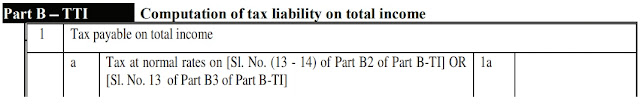

Changes in Part B–TTI of ITR-7 for AY 2023-24

In this, changes are notified in Part B–TTI in serial number 1 item a of ITR-7. Presently the said serial number 1a reads as follows-

The following changes are notified for this item a of serial number 1-

a. Tax at normal rates on [Sl. No. 17 of Part B1 of Part B-TI] OR [Sl. No. (13-14) of Part B2 of Part B-TI] OR [Sl. No. 13 of Part B3 of Part B-TI]

These changes are effective from 1st day of April, 2023 and applies to assessment year 2023-24 relevant to the previous year 2022-23

Read the full text of CBDT Notification No. 94/2023 dated 31.10.2023 on Changes in ITR-7 for AY 2023-24

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 31st October, 2023

G.S.R. 813(E).—In exercise of the powers by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:––

1. Short title and commencement.– (1) These rules may be called the Income-tax (Twenty-Seventh Amendment) Rules, 2023.

(2) They shall be deemed to have come into force from 1st day of April, 2023.

2. In the Income-tax Rules, 1962, in Appendix II, in Form ITR-7, in PART-B for the assessment year commencing on the 1st day of April, 2023—

(a) in Part B–TI, the Part B1, for serial number 16 and entries relating thereto, the following serial number and entries thereto shall be substituted, namely:—

“16 | Specified income chargeable u/s 115BBI, included in 13, to be taxed @ 30% (Sl. No 7 of Schedule 115BBI) | 16 |

|

17 | Aggregate income to be taxed at normal rates (13-14-15-16) (including income other than specified income under section 115BBI) | 17” |

|

(b) in Part B–TTI, against serial number 1, for item a and entries relating thereto, the following item and entried thereto, shall be substituted, namely:—

“a | Tax at normal rates on [Sl. No. 17 of Part B1 of Part B-TI] OR [Sl. No. (13-14) of Part B2 of Part B-TI] OR [Sl. No. 13 of Part B3 of Part B-TI] | 1a” |

|

[Notification No. 94/2023/ F.No. 370142/2/2023-TPL-Part (1)]

SURBENDU THAKUR, Under Secy.

Explanatory Memorandum: This amendment is effective from 1st day of April, 2023 and applies to assessment year 2023-24 relevant to the previous year 2022-23. It is hereby certified that no person is being adversely affected by giving retrospective effect to these rules.

Note:- The principal rules were published vide notification S.O. 969(E), dated the 26th March, 1962 and last amended vide notification G.S.R.786(E), dated the 19th October, 2023.

Download CBDT Notification No. 94/2023 dated 31.10.2023 on Changes in ITR-7 for AY 2023-24 in PDF format

0 Comments