The Government extends certain timelines to 30.06.2021 where the time limit was earlier extended to 30.04.2021 through various notifications issued under the Taxation and Other Laws (Relaxation) and Amendment of Certain Provisions Act, 2020.

This is informed by the CBDT by a press release. Though no notification is yet issued to extend the timeline, it is stated that the same will be issued in due course.

Govt grants respite to taxpayers in difficult COVID times. Extends certain timelines. Time barring dates extended to 30th June, 2021 for certain cases. Date for payment under the Direct Tax Vivad Se Vishwas Act, 2020 without additional amount also extended to 30th June, 2021.

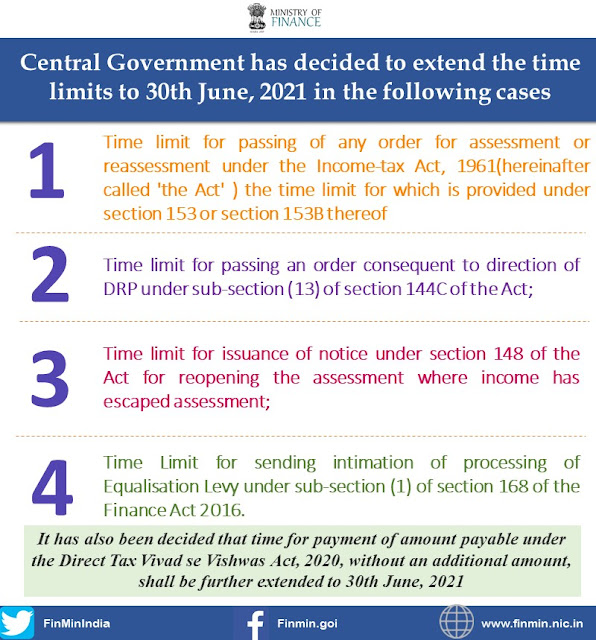

The Government has decided to extend the time limits to 30th June, 2021 in the following cases

1. Time limit for passing of any order for assessment or reassessment under the Income-tax Act, 1961(hereinafter called 'the Act' ) the time limit for which is provided under section 153 or section 153B thereof

2. Time limit for passing an order consequent to direction of DRP under sub-section (13) of section 144C of the Act;

3. Time limit for issuance of notice under section 148 of the Act for reopening the assessment where income has escaped assessment;

4. Time Limit for sending intimation of processing of Equalisation Levy under sub-section (1) of section 168 of the Finance Act 2016.

It has also been decided that time for payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020, without an additional amount, shall be further extended to 30th June, 2021

It should be noted that the extension is given only for compliance from the department end which is required to be completed by the departmental officers. That is no relaxation given in terms of extension of due date for taxpayers as such like extension in due date for payment of TDS, filing of TDS return, etc.

Read the full text of the press release dated 24.04.2021 on extension of due dates to 30.06 2021

Government of India

Department of Revenue

Ministry of Finance

Central Board of Direct Taxes

New Delhi, 24th April, 2021

PRESS RELEASE

Government extends certain timelines in light of the raging pandemic

In view of the severe Covid-19 pandemic raging unabated across the country affecting the lives of our people, and in view of requests received from taxpayers, tax consultants & other stakeholders that various time barring dates, which were earlier extended to 30th April, 2021 by various notifications, as well as under the Direct Tax Vivad se Vishwas Act, 2020, may be further extended, the Government has extended certain timelines today.

In the light of several representations received(supra) and to address the hardship being faced by various stakeholders, the Central Government has decided to extend the time limits to 30th June, 2021 in the following cases where the time limit was earlier extended to 30th, April 2021 through various notifications issued under the Taxation and Other Laws (Relaxation) and Amendment of Certain Provisions Act, 2020, namely:-

(i) Time limit for passing of any order for assessment or reassessment under the Income-tax Act, 1961(hereinafter called 'the Act' ) the time limit for which is provided under section 153 or section 153B thereof;

(ii) Time limit for passing an order consequent to direction of DRP under subsection (13) of section 144C of the Act;

(iii) Time limit for issuance of notice under section 148 of the Act for reopening the assessment where income has escaped assessment;

(iv) Time Limit for sending intimation of processing of Equalisation Levy under sub-section (1) of section 168 of the Finance Act 2016.

It has also been decided that time for payment of amount payable under the Direct Tax Vivad se Vishwas Act, 2020, without an additional amount, shall be further extended to 30th June, 2021.

Notifications to extend the above dates shall be issued in due course.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT

Download Copy of Press Release dated 24.04.2021 on the extension of due dates to 30.06 2021

0 Comments