MCA has published a message on its website to inform that Form CSR-1 is available for filing as eForm on its website and advised stakeholders may to take note of it and plan accordingly.

The message reads as follows-

“CSR-1 Form is now available for filing as eForm. Stakeholders may please take note and plan accordingly.”

The Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 (“New CSR Rules”) has introduced substantial changes in the specifications and procedure to be followed by the companies and the charitable organizations/NGOs while discharging their CSR obligations.

One of the major changes introduced for the NGOs is making registration compulsory for undertaking CSR activities on behalf of companies. Such registration is required to be taken in e-form CSR-1. The purpose of mandatory registration is for monitoring the activities of the NGOs and other agencies.

Agencies implementing CSR projects for companies should get themselves registered with the Central Government by filing the Form CSR-1 electronically. The system will automatically generate a unique CSR registration number.

The registration requirement will be effective from April 1, 2021.

Also, international organisations have been permitted to carry out designing, monitoring and evaluation of the CSR projects or programmes. However, they cannot act as implementing agencies.

An NGO shall be eligible to receive CSR funds from a company only if it is -

> A section 8 company, or

> A registered public trust, or

> A registered society,

registered under section 12A and 80G of the Income Tax and have at least 3 years of undertaking charitable activities. Hence, CSR spendings through an unregistered NGO is not eligible for counting towards CSR activities.

Rule 4(2) of the New Companies CSR Amendment Rules, 2021 specifies the following procedure for the registration of an NGO with MCA portal for accessing corporate CSR funds-

(a) Every entity as stated above, who intends to undertake any CSR activity, shall register itself with the Central Government by filing the form CSR-1 electronically with the Registrar, with effect from the 01st day of April 2021:

(b) Form CSR-1 shall be signed and submitted electronically by the entity and shall be verified digitally by a Chartered Accountant in practice or a Company Secretary in practice or a Cost Accountant in practice.

(c) On the submission of the Form CSR-1 on the portal, a unique CSR Registration Number shall be generated by the system automatically.

Documents required for CSR-1 Registration

There are no details released for the procedure for getting an NGO registered with MCA. It is only stated that the registration shall be taken by filing the CSR-1 form electronically. The form shall be required to file online with the MCA portal.

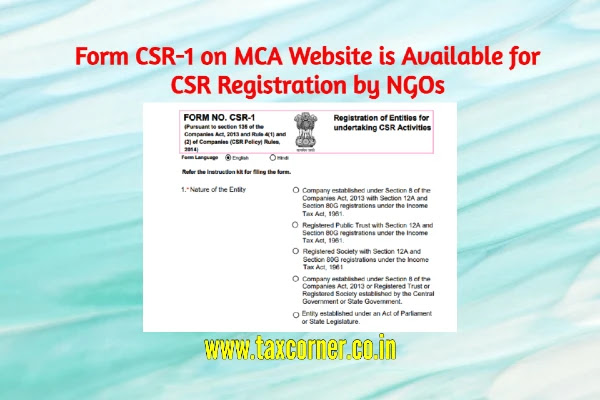

The New CSR Rules, 2021 notified the form CSR-1 titled as “Registration of Entities for undertaking CSR Activities”. A perusal of the notified form reveals that the form has two parts. One part relates to the information about the entity that intends to undertake the CSR activities. Another part of the Form CSR-1 is related to the certification by a practising professional.

Clause 1 of the Form CSR-1 requires to specify the nature of the entity which intends to register itself viz., a section 8 company or a registered public trust or a registered society with section 12A and section 80G registration, etc.

It further requires to input the basic details of the entity viz, its registration number, name, address, PAN, email-id, etc. [Clause 3]

Clause 4 requires details of the governing body of the entity along with their DIN/PAN and email-id.

The only documents required to be uploaded is a Copy of the registration certificate and a Copy of the PAN of the NGO with Form CSR-1.

Form CSR-1 is required to be signed digitally by the Secretary or Trustee or CEO of the Trust or Society.

Apart from the above, one needs to keep the following documents handy for filing the Form CSR-1-

How to Download Form CSR-1 from MCA website

One needs to download Form CSR-1 from the MCA website in the following described manner-

1. Visit MCA portal http://www.mca.gov.in/

2. Click on Forms & Downloads on the top of the webpage. See Pic-1.

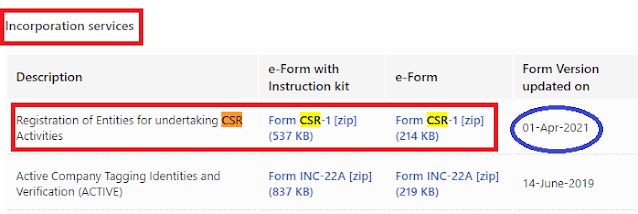

3. Scroll down the page till the topic ‘Incorporation services’ is reached. Else, press Ctrl+F on the web page and write ‘CSR’ and hit the ‘Enter’ key. You will be taken to the desired location. See Pic-2.

Pic. 2

4. Download the e-Form with or without Instruction. This will be downloaded in zip file format. Unzip it and extract the relevant pdf files.

Open the pdf file named ‘Form_CSR-1’. This is Form CSR-1 for registration of entities for undertaking CSR activities.

The e-Form CSR-1 is a fillable pdf form.

How to Register DSC of Secretary or Trustee of an NGO on MCA Portal

One needs to register the DSC or digital signature of the Secretary or the Trustee of the Society or Trust NGO on the MCA portal so that his DSC can be affixed in Form CSR-1.

The DSC of the NGO functionaries can be registered on the MCA portal in the following manner-

Step 1: Visit MCA portal http://www.mca.gov.in/

Step 2: Navigate to MCA Services>DSC Services>Associate DSC

Step 3: From the drop-down list titled ‘Select the Role’, select ‘Authorized Representative’.

Step 4: A New form will open which requires filling the Income-tax PAN of the person. Fill the personal details viz, Name of the individual, his date of birth and Father’s Name as per PAN Card of the individual. Fill the Address.

Step 5: Select the DSC. Before selecting the DSC, ensure that emsigner is running. For this, one needs to download and install the latest DSC web socket installer.

Instruction Kit for eForm CSR-1

(Registration of Entities for undertaking CSR Activities)

Part I – Law(s) Governing the eForm Section and Rule Number(s)

eForm CSR-1 is required to be filed pursuant to Section 135 of the Companies Act, 2013 and Rule 4 (1) and (2) of the Companies (Corporate Social Responsibility Policy) Rules, 2014.

Purpose of the eForm

In accordance with the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021, company can undertake CSR activities either itself or through entities defined under Rule 4 sub rule (1).

These companies/entities are required to mandatorily register themselves with the central government for undertaking any CSR activity by filing the e-form CSR-1 with the Registrar.

Part II – Instructions to fill the eForm

Specific Instructions to fill the eForm CSR-1 at Field Level

Instructions to fill the eForm are tabulated below at field level. Only important fields that require detailed instructions to be filled in eForm are explained. Self-explanatory fields are not discussed.

Common Instructions to fill eForm

Part III - Important Points for Successful Submission

Processing Type

The eForm will be processed in STP mode.

SRN Generation

On successful submission of the eForm CSR-1, SRN will be generated and shown to the user which will be used for future correspondence with MCA.

Email & Immunity Certificate

When an eForm is successfully processed, an acknowledgement of the same is sent to the user in the form of an email to the email id of the entity. Further, a digitally signed approval letter along with CSR Registration number with Format CSRXXXXXXXX where X represents system generated unique sequential number will be sent to the FO User as well as the email ID of the entity as entered in the eform.

Read Also:

Understanding CSR Expenditure and Deductions under Income Tax

0 Comments