Form 15CA and Form 15CB for foreign remittances or payment to non-resident: Whenever a person is required to make remittance to a non-resident the remitter is under a legal obligation to deduct income tax thereon. Since the remittance is done by a Bank on behalf of its customer, it is not possible for a bank to ascertain whether tax has been duly deducted or not. To check the compliance, a procedure is adopted to furnish Form 15CA and a certificate of a Chartered Accountant in Form 15CB which enables a bank to remit the amount abroad.

What is Form 15CA?

In general words, Form 15CA is nothing but a declaration by the remitter that tax has been duly deducted from the payments being made to a non-resident recipient. It is used as a tool for collecting information in respect of the payments being made to a non-resident by a resident. It is information collected in advance about the collection of tax since it becomes difficult to recover the taxes at a later stage.

What is Form 15CB?

In general words, Form 15CB is a certificate issued by a CA to certify the amount of tax-deductible in India with reference to the provisions of Income Tax Act or Double Tax Avoidance Agreement (DTAA) has been properly deducted.

In Form 15CB, a Chartered Accountant certifies details and nature of the payment being made to the non-resident, rate of TDS and deduction of income-tax as per Section 195 of the Income Tax Act and also whether Double Tax Avoidance Agreement (DTAA) is applicable or not.

Legal provisions for Form 15CA and Form 15CB

Finance Act, 2008 has amended section 195 of the Income Tax Act, 1961 and introduced a new sub-section (6) to section 195 which is as follows-

‘‘(6) The person referred to in sub-section (1) shall furnish the information relating to payment of any sum in such form and manner as may be prescribed by the Board.”.

Note: The above sub-section (6) was later on substituted by Finance Act, 2015. Discussed later in this post.

The provisions for furnishing information regarding deduction of tax at source under section 195(6) has made the legal basis under which CBDT notified Form 15CA and Form 15CB under the Income Tax Rules.

Section 195(6) deals with the furnishing of information in respect of payments made to the non-resident which empowers the Central Board of Direct Taxes to capture information, in respect of payments made to non-residents, whether chargeable to tax or not.

Section 195(1) requires any person responsible for paying any interest or any other sum chargeable to tax (except dividends and income under the head “salaries”) to a non-resident or to a foreign company, to deduct tax at source at the rates in force. Payments to a non-resident by way of royalty and payments for technical services are examples of sums chargeable to tax on which tax is required to be deducted at source under this section.

Prior to this position, a person making the remittance was required to furnish an undertaking (in duplicate) addressed to the Assessing Officer accompanied by a certificate from an Accountant in a specified format. This undertaking and certificate is submitted to the Reserve Bank of India or its authorized dealers who in turn are required to forward a copy to the Assessing Officer.

The purpose of the undertaking and the certificate was to collect taxes at the stage when the remittance is made as it may not be possible to recover the tax at a later stage from the non-residents. There had been a substantial increase in foreign remittances, making the manual handling and tracking of certificates difficult. To monitor and track transactions in a timely manner, it was proposed to introduce e-filing of the information in the certificate and undertaking. The amendment, therefore, provides that the person responsible for deduction of income-tax shall furnish the information relating to the payment of any sum to the non-resident or to a foreign company in a form and manner to be prescribed by the Board.

This amendment came into effect from the 1st April 2008.

The information under sub-section (6) of section 195 shall be furnished by the person responsible for making the payment to a non-resident including a foreign company.

Sub-section (6) of section 195 delegated the power to the CBDT to prescribe the form and manner of furnishing the information for foreign remittance to non-resident and by exercising this power read with section 295, the Board had notified Rule 37BB under the Income Tax Rules, 1962 vide Notification No. 30/2009 dated 25.03.2009.

For the first time, Rule 37BB was inserted in the Rules to prescribe for furnishing Form 15CA and a certificate from a Chartered Accountant in Form 15CB.

Form 15CA was compulsorily required to file electronically at the then designated website of the Tax Information Network www.tin-nsdl.com.

Form 15CA requires furnishing of information under sub-section (6) of Section 195 of the Income-tax Act, 1961 relating to remittance of payments to a non-resident or to a foreign company and Form 15CB is Certificate from a Chartered Accountant for ascertaining the nature of remittance and for determining the rate of deduction of tax at source as per provisions of sub-section (6) of section 195.

The Form 15CA was required to be furnished prior to remitting the payment to the non-resident.

Though the furnishing of Form 15CA was made online, however, the certificate from a CA in Form 15CB was manual at that time.

While remitting consular receipts abroad, diplomatic missions in India will be required to submit only a self-certified undertaking in Form No. 15CA to the remitter bank. They are not required to obtain a certificate from an accountant/certificate of Assessing Officer (Form 15CB). [Circular No. 9/2009 dated 30.11.2009]

However, with effect from February 12, 2014, the functionality of furnishing the foreign remittance details in Form 15CA and its related features have been discontinued from the TIN and same are made available on the e-filing portal of Income Tax Department www.incometaxindiaefiling.gov.in. Subsequently, the issue of a certificate in Form 15CB has also been made online in line of Form 15CA.

Rule 37BB was further amended in 2013 vide Notification No. 58/2013 dated 05.08.2013 to amend the format of Form 15CA and Form 15CB. The amended Rule has dispensed with the requirement of obtaining a certificate in Form 15CB from a CA in certain cases.

The amended Form 15CA has been split into three parts namely-

(1) Part A of Form 15CA: To furnish information if the amount of payment does not exceed Rs. 50,000 and the aggregate of the payments made during the financial year does not exceed Rs. 2,50,000.

If the amount of remittance to non-resident is covered in Part-A of the amended Form 15CA then there is no requirement to obtain a certificate from a CA in Form 15CB. Hence, smaller amount of payment was excluded from obtaining Form 15CB.

(2) Part B of Form 15CA: To furnish information if the amount of payment is not chargeable to tax and is covered under the nature of payments in the specified list of 39 items.

(3) Part C of Form 15CA: To furnish information if the nature of remittance is chargeable to tax and exceeds Rs. 50,000 and the aggregate of the payments made during the financial year exceeds Rs. 2,50,000.

In this case, the requirement of obtaining a CA certificate in Form 15CB was made compulsory.

The Specified List mentioned in the amended Rule 37BB is given below:

In short, as per the Notification No. 58/2013 dated 05.08.2013, Form 15CB was not required for 39 items of payment mentioned in the Specified List but required Form 15CA.

Thereafter, within a span of one month time, Rule 37BB was once again amended vide Notification No. 67/2013 dated 02.09.2013.

At that time, the new Form 15CA was changed to exclude the then existing Part-B of the Form 15CA. The new Form 15CA had only two parts namely,-

1. Part A of Form 15CA: To furnish information if the amount of payment does not exceed Rs. 50,000 and the aggregate of the payments made during the financial year does not exceed Rs. 2,50,000.

If the amount of remittance to non-resident is covered in Part-A of the new Form 15CA then there is no requirement to obtain a certificate from a CA in Form 15CB. Hence, small payments were excluded from obtaining Form 15CB, similar to then existing Part-A of Form 15CA.

2. Part B of Form 15CA: To furnish information if the nature of remittance is chargeable to tax and exceeds Rs. 50,000 and the aggregate of the payments made during the financial year exceeds Rs. 2,50,000.

In this case, the requirement of obtaining a CA certificate in Form 15CB was made compulsory. This part was similar to Part C of the then existing Form 15CA.

It was further provided in the Rule 37BB that no information was required to be furnished for the payments specified in the Specified List. Hence, as per Notification No. 67/2013 dated 02.09.2013, Form 15CA and Form 15CB were not required for 28 items of payments listed in Specified List.

It should be noted that Notification No. 67/2013 has reduced the number of items from 39 items to 28 items in the Specified List by removing the following 11 items of payments-

Hence, as per the amended Rule 37BB Form 15CA is required for any remittance outside India except for 28 items listed in the Specified List. Form 15CB is required only when remittance to a non-resident is chargeable to tax and exceeds the threshold limit of Rs. 50,000 and Rs 2,50,000 in aggregate during the financial year.

Present Rule 37BB in vogue

Rule 37BB was further amended vide Notification No. 93/2015 dated 16.12.2015 which is presently in force to strike a balance between reducing the burden of compliance and collection of information under section 195 of the Act. New Form 15CA and Form 15CB has also been notified under the said notification.

This time Form 15CA has been divided into four parts namely,-

I. Part A of Form 15CA: Information in this part is required to be filled up in case the amount of payment or aggregate of such payments made during the financial year does not exceed Rs. 5 Lakh. No Form 15CB is required to be obtained in this case.

II. Part B of Form 15CA: Information in this part is required to be filled up for payments (other than the payments referred to in Part A i.e. where the payment or aggregate of such payments made during the financial year exceeds Rs. 5 lakh) after obtaining a certificate from the Assessing officer under Section 197 or an order from the Assessing Officer under Sections 195(2) or 195(3).

III. Part C of Form 15CA: Information in this part is required to be filled up for payment (other than the payments referred in Part A i.e. where the payment or aggregate of such payments made during the financial year exceeds Rs. 5 lakh) after obtaining a certificate in Form 15CB from a Chartered Accountant.

IV. Part D of Form 15CA: Information in this part is required to be filled up for payment which is not chargeable under the provisions of the Income Tax Act.

However, information in Part D of Form 15CA is not required to be furnished in respect of any sum which is not chargeable to tax -

(i) if the remittance is made by an individual and it does not require prior approval of the Reserve Bank of India as per Section 5 of the Foreign Exchange Management Act read with Schedule II of the Foreign Exchange (Current Account Transactions) Rules, 2000 or,

(ii) if the remittance is of the nature of payment 33 items listed in in the Specified List as given below-

(Final Specified List listing 33 items of payments as per Notification No. 93/2015 dated 16.12.2015 which is at present in force)

In other words, no Form 15CA is required to be furnished if the payment is related to any of the above 33 items. The ‘specified List’ is also called an exemption list i.e. exemption from furnishing Form 15CA and Form 15CB.

For an individual, there is one more situation where there is no requirement of furnishing of Form 15CA if the remittance does not require prior approval of the RBI under FEMA.

Verification and Digital Signature for Form 15CA

The information in Form 15CA is required to be furnished electronically under digital signature. Prior to this notification of 2015, the digital signature was not mandatory for electronic furnishing of Form 15CA prior to remitting the payment. For TAN Users, DSC is Mandatory to file Form 15CA.

However, in certain cases, Form 15CA can be filed without a digital signature.

Form 15CA shall be verified by the person responsible for paying to a non-resident who maybe the director or any other employee of the company/firm or the assessee himself.

Similarly, the certificate by a CA in Form 15CB is also required to be issued electronically unlike manual certificates earlier.

The authorised dealers are also required to furnish a quarterly statement for each quarter of the financial year in Form 15CC to the income tax department electronically under digital signature within 15 days from the end of the quarter of the financial year to which such statements relate.

Hence, the summary of the new Rule 37BB which is in force as on today is outlined below-

(i) No Form 15CA and Form 15CB will be required to be furnished by an individual for remittance which do not require RBI approval under its Liberalised Remittance Scheme (LRS)

(ii) Further, the list of payments of specified nature mentioned in Rule 37 BB which do not require submission of Forms 15CA and Form 15CB has been expanded from 28 to 33 including payments for imports.

(iii) A CA certificate in Form No. 15CB will be required to be furnished only in respect of such payments made to non-residents which are chargeable to tax and the amount of payment during the year exceeds Rs. 5 lakh.

The amended Rules were made applicable from 01.04.2016.

In this context, it should be noted that the Finance Act, 2015 had substituted the sub-section (6) of section 195. The new present provision has substituted the words ‘person referred to in sub-section (1)’ with the words ‘person responsible for paying to a non-resident’. The impact is that earlier only those persons who were liable to deduct income tax u/s 195 were required to furnish the information in Form 15CA and Form 15CB. Now, all the persons making any payment to non-resident are required to furnish the information in Form 15CA and Form 15CB whether the payment is chargeable to tax or not.

The new substituted provision, which is presently in force, reads as follows-

“(6) The person responsible for paying to a non-resident, (not being a company), or to a foreign company, any sum, whether or not chargeable under the provisions of this Act, shall furnish the information relating to payment of such sum, in such form and manner, as may be prescribed.”

The intention behind the amendment in section 195(6) is stated as discussed below.

The existing provisions of sub-section (6) of section 195 of the Act provide that the person referred to in section 195(1) of the Act shall furnish prescribed information.

Section 195(1) of the Act provides that any person responsible for paying any interest( other than interest referred to in sections 194LB or 194LC or 194LD of the Act) or any sum chargeable to tax (not being salary income) to a non-resident, not being a company, or to a foreign company, shall deduct tax at the rates in force.

The mechanism of obtaining information in respect of remittances fulfils twin objectives of ensuring deduction of tax at the appropriate rate from taxable remittances as well as identifying the remittances on which the tax was deductible but the payer has failed to deduct the tax. Therefore, obtaining information only in respect of remittances which the remitter declared as taxable defeats one of the main principles of obtaining information for foreign remittances i.e. to identify the taxable remittances on which tax was deductible but was not deducted.

In view of this, it the provisions of section 195 of the Act was amended to provide that the person responsible for paying any sum, whether chargeable to tax or not, to a non-resident, not being a company, or to a foreign company, shall be required to furnish the information of the prescribed sum in such form and manner as may be prescribed.

Applicability of Form 15CA and Form 15CB in graphical format

Applicability of Form 15CA and Form 15CB for import of goods

As stated earlier, Form 15CA and Form 15CB is not applicable on payments listed in the exempted list., Form 15CA and Form 15CB was required for all type of payment. This will result into lesser compliances and paperwork for importers who are required to make payments to non-residents on a regular basis.

Rule 37BB has been amended by Notification No. 93/2015 issued by CBDT on 16th December 2015, effective 1st April 2016 to make import payments as a part of exempted list.

The following items of payments are mentioned in the ‘specified list’ for which exemption is provided from furnishing Form 15CA and Form 15CB-

Hence, Form 15CA and Form 15CB will not be required for import of goods transactions.

Applicability of Form 15CA and Form 15CB for remittance from NRO account by NRI

An NRI who earns income in India is credited to his NRO account. An NRI may have interest income from Indian investments, rent income from his house property in India, sale proceeds of immovable properties in India, and many more. Such investments or property might have been acquired while they were in India.

Such NRIs may be interested in taking back the money from India to the foreign country where they are presently residing. Banks allow repatriation of money from their NRO account.

Before repatriation of the amount by an NRI, he has to electronically furnish information in Form 15CA on the e-filing portal of the income tax department. Almost in all cases, banks ask for a copy of furnished Form 15CA with the income tax department.

Confusion prevails for submitting a copy of CA’s certificate in Form 15CB.In many cases, banks do not remit the money until the certificate in Form 15CB is provided.

As stated earlier, Form 15CB is not required when the single or aggregate amount remittance does not exceed Rs. 5,00,000 during a financial year. In this case, only Form 15CA is required. Form 15CB is also not required if a lower TDS certificate is received from the Assessing Officer under Section 197.

Both the Form 15CA and Form 15CB are not required for remittance which does not require RBI approval under its Liberalised Remittance (LRS) Scheme. In this case, Part-D of Form 15CA is required to be filled.

Further, where the nature of payment is covered by the Specified List or exemption list, then also no Form 15CA or Form 15CB is required. For example, in case of remittance by non-residents out of his savings or income in India towards family maintenance and savings (S1301) or remittance towards personal gifts and donations (S1302) is covered in the specified list. In case remittances are of these listed nature, then there is no requirement to furnish Form 15CA or Form 15CB in terms of exemption granted under Rule 37BB(3)(ii) of Income Tax Rules 1962.

Thus Form 15CB is required where only when the amount of remittance out of India is taxable in India and exceeds Rs. 5,00,000.

From the present Rule 37BB, it is clear that Form 15CB is required only when the amount of remittance is taxable in India. No Form 15CB is required if the same in the non-taxable transfer. However, due to frequent changes in the regulations and confusions, many banks even demand a certificate in FormCB before remitting the amount of the NRI. In many cases, even banks insist on filling a particular Part in Form 15CA with which the NRI remitter may differ.

Hence, any remittance of funds by an NRI from his NRO account to NRE account and remittance of even non-taxable funds may require the remitter to provide a certificate from a Chartered Accountant in Form 15CB along with Form 15CA. In practice, some banks may insist for providing Form 15CA and/or Form 15CB with or without additional documents to substantiate that income tax thereon has been duly paid in India before the funds are being remitted.

Penalty for failure to furnish Form 15CA and Form 15CB

Prior to 2015, there was no penalty for non-furnishing of Form 15CA and/or Form 15CB.

Further, then there was no provision for levying a penalty for non-submission/inaccurate submission of the prescribed information in respect of remittance to the non-resident.

For ensuring submission of accurate information in respect of remittance to the non-resident, a new provision section 271-I was inserted in the Income Tax Act to provide that in case of non-furnishing of information or furnishing of incorrect information under sub-section (6) of section 195, a penalty of Rs. 1,00,000 shall be levied. Consequent amendment to the provisions of section 273B was also made to provide that no penalty shall be imposed under this new provision if it is proved that there was reasonable cause for non-furnishing or incorrect furnishing of information under sub-section (6) of section 195.

Section 271-I reads as follows-

Penalty for failure to furnish information or furnishing inaccurate information under section 195.

271-I. If a person, who is required to furnish information under sub-section (6) of section 195, fails to furnish such information, or furnishes inaccurate information, the Assessing Officer may direct that such person shall pay, by way of penalty, a sum of one lakh rupees.

From the above provision, a penalty is leviable for not only failure to furnish Form 15CA/Form 15CB but also for providing wrong or false information in the furnished forms.

Quoting of Unique Acknowledgement of the e-filed Form No. 15CA in Form 27Q

CBDT has vide Notification No. 11/2013 dated 19.02.2013 mandated to quote the ‘Unique Acknowledgement of the corresponding Form No. 15CA’ in the Form 27Q. Form 27Q is the quarterly e-TDS statement furnished for TDS from payments to non-resident under section 200(3) read with Rule 31A.

Procedural aspects of Form 15CA and Form 15CB

How to file Form 15CA and Form 15CB

The process to be followed before any remittance to a non-resident are outlined below-

Any person making a payment to a Non-Resident has to furnish Form 15CA. Depending on the amount of payment and charge ability to tax, any of the following relevant parts of Form 15CA needs to be filled-

Note - Upload of Form 15CB is mandatory prior to filling Part C of Form 15CA. To prefill the details in Part C of Form 15CA, the Acknowledgment number of e-Filed Form 15CB should be provided

Steps required to be followed for filing Form 15CB

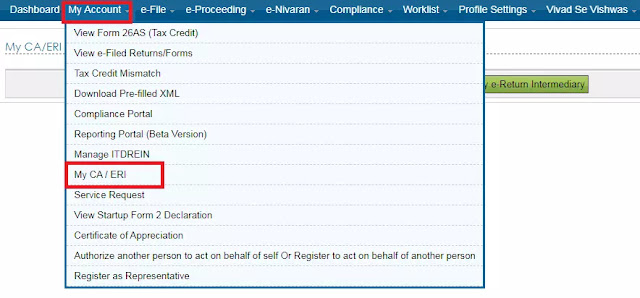

Step 1: Login to e-filing portal, Navigate to ‘My Account’, then click on ‘My CA/ERI’ and then click on ‘My Chartered Accountant’.

Step 2: Click on ‘Add’. Enter the ‘Membership Number’ of the Chartered Accountant. Name of the CA will be auto-populated. For this, the CA must himself register on the e-filing portal.

The page will also show the already ‘Added CA’ by the assessee.

Step 3: Select ‘Form No. 15CB - Certificate of an accountant as per Rule 37BB’ as Form Name and click on Submit. Once Form 15CB is selected, the field ‘Assessment Year’ on the page gets hidden.

Once CA is added by the assessee, the CA can file Form 15CB on behalf of the assessee.

To file the Form 15CB by the CA, one needs to download the utility from the downloads section of the e-filing portal. Fill the Form in the utility and generate the XML file. This XML file is then uploaded by the CA on the e-filing portal on behalf of the assessee.

The assessee can view the e-filed Form 15CB on his e-filing account.

On the ‘Dashboard’, click on ‘View Returns/Forms’.

From the drop down menu ‘Select an Option’, select Form 15CB.

Click ‘Submit’.

List of all the filed Form 15CB will be displayed.

Note: To upload the XML file of Form 15CB by the CA, digital signature of the CA is mandatory.

Steps required to be followed for filing Form 15CA

After filing the Form 15CB or where Form 15CB is not required, one has to file the Form 15CA. Form 15CA needs to be filed by the assessee from his e-filing account.

The steps to e-File Form 15CA released by the Income Tax Department (e-filing portal) is given below.

Withdrawal of e-filed Form 15 CA

Form 15CA once filed successfully can be withdrawn within 7 days. A “Withdraw Form 15CA” link will be available to users to withdraw the uploaded FORM 15CA. Users can withdraw within 7 days of submission of Form 15CA. However, there is no method of withdrawal of Form 15CB.

Once a Form 15CA is successfully withdrawn, the status of the Form will be changed to ‘Form 15CA Withdrawn’.

Download Form 15CA in pdf format

Download Form 15CB in pdf format

Get all latest content delivered straight to your inbox

1 Comments

Your guide to Form15CA & CB by Sujit Talukdar is a wonderful and informative Article. I hope we can see more such articled on your Income Tax diary. I Understand that NRI & OCIs can remit up to $ one Million from their NRO accounts by providing Form 15CA & CB. Please give more information about that scheme.

ReplyDelete