The income tax department has enabled the online filing of Form 1 and Form 2 on its e-filing portal after the government notified the Direct Tax Vivad se Vishwas Rules, 2020 and the corresponding forms to be filed under the scheme on 18.03.2020.

Pursuant to the enactment of the Direct Tax Vivad se Vishwas Act, 2020 (DTVSV Act, 2020) on 17.3.2020, the Direct Tax Vivad se Vishwas Rules, 2020 along with Form 1 to Form 5 have been notified on 18.3.2020 vide Notification No. 18 of 2020.

The following 5 types of Forms have been notified under the Rules.

The following 5 types of Forms have been notified under the Rules.

Form No.

|

Purpose of Forms

|

Form-1

|

Form for filing declaration

|

Form-2

|

Undertaking u/s 4(5) of the Direct Tax Vivad Se Vishwas Act, 2020

|

Form-3

|

Form of Certificate u/s 5(1) of the Direct Tax Vivad Se Vishwas Act, 2020

|

Form-4

|

Intimation of payment u/s 5(2) of the Direct Tax Vivad Se Vishwas Act, 2020

|

Form-5

|

Order for Full and Final Settlement of Tax Arrear under section 5(2) read with section 6 of The Direct Tax Vivad Se Vishwas Act, 2020

|

The Form-1 and Form-2 referred to in rule 3 and Form-4 referred to in rule 5 shall be furnished electronically under digital signature, if the return of income is required to be furnished under digital signature or, in other cases through electronic verification code. No paper or manual/physical form will be accepted.

For a taxpayer, Form 1 and Form 2 are relevant initially. The declarant shall be required to file a declaration under the Vivad Se Vishwas Scheme (VSVS) in Form 1 and relevant schedules. Another Form-5 is required to be filed by the taxpayer after the payment of disputed tax is made.

Form 3 and Form 5 will be used by the designated authority.

One needs to log in to his e-filing account on the e-filing portal.

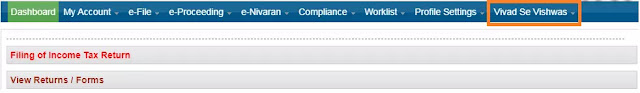

A new menu namely 'Vivad Se Vishwas' is inscribed after the 'Profile Settings' as shown in Pic-1.

It has three sub-menus namely-

(i) Prepare and Submit DTVSV Forms

(ii) View DTVSV Forms

(iii) Resources

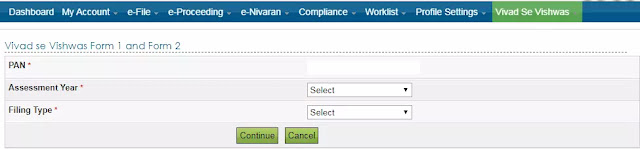

For the first time, a taxpayer has to use the first sub-menu 'Prepare and Submit DTVSV Forms'. It will open up a form for selecting the assessment year and filing type. The assessment year begins from 1961-62 to 2019-20. The filing type requires to select 'original/revised'.

User needs to click 'Continue' to proceed further or click 'Cancel' to abort the process.

On Clicking 'Continue', the next Form-1 and Form-2 come up on the screen.AS per the procedure prescribed, Form-1 and Form-2 have to be filed together. Hence, the undertaking in Form-2 shall be required to be filed along with Form-1.

It must be remembered that a declaration once filed under the VSV Scheme cannot be withdrawn.

On clicking sub-menu titled 'View DTVSV Forms' will show the submitted forms. If not form is submitted, it will show 'No records found'.

The 'Resources' contains the following information-

1. DTVSV Act, 2020

2. Notification

3. Frequently Asked Questions(FAQS)

4. Brief on DTVSV scheme

5. Instructions

The first one in The Direct Tax Vivad Se Vishwas Act, 2020 (the notified Bare Act). The 'Notification' refers to the Direct Tax Vivad Se Vishwas Rules, 2020 and FAQs refer to the CBDT Circular No. 7/2020 issued on 04.03.2020. The 'Brief on DTVSV scheme' refers to the PowerPoint presentation that was sent to the taxpayers as discussed here.

The Designated Authority shall intimate the tax payable by or refundable to the declarant in Form 3.

The declarant shall be required to intimate the details of payment in Form-4 along with proof of withdrawal of the relevant appeal, writ, arbitration, etc.

The Designated Authority shall issue the order regarding the full and final settlement of the dispute in Form-5.

Read the 37-page Instructions to fill the forms - Form 1 and Form-2 under the Vivad Se Vishwas Scheme.

For a taxpayer, Form 1 and Form 2 are relevant initially. The declarant shall be required to file a declaration under the Vivad Se Vishwas Scheme (VSVS) in Form 1 and relevant schedules. Another Form-5 is required to be filed by the taxpayer after the payment of disputed tax is made.

Form 3 and Form 5 will be used by the designated authority.

One needs to log in to his e-filing account on the e-filing portal.

A new menu namely 'Vivad Se Vishwas' is inscribed after the 'Profile Settings' as shown in Pic-1.

|

| Pic-1 |

(i) Prepare and Submit DTVSV Forms

(ii) View DTVSV Forms

(iii) Resources

|

| Pic-2 |

For the first time, a taxpayer has to use the first sub-menu 'Prepare and Submit DTVSV Forms'. It will open up a form for selecting the assessment year and filing type. The assessment year begins from 1961-62 to 2019-20. The filing type requires to select 'original/revised'.

|

| Pic-3 |

User needs to click 'Continue' to proceed further or click 'Cancel' to abort the process.

On Clicking 'Continue', the next Form-1 and Form-2 come up on the screen.AS per the procedure prescribed, Form-1 and Form-2 have to be filed together. Hence, the undertaking in Form-2 shall be required to be filed along with Form-1.

It must be remembered that a declaration once filed under the VSV Scheme cannot be withdrawn.

|

| Pic-4 |

On clicking sub-menu titled 'View DTVSV Forms' will show the submitted forms. If not form is submitted, it will show 'No records found'.

The 'Resources' contains the following information-

1. DTVSV Act, 2020

2. Notification

3. Frequently Asked Questions(FAQS)

4. Brief on DTVSV scheme

5. Instructions

The first one in The Direct Tax Vivad Se Vishwas Act, 2020 (the notified Bare Act). The 'Notification' refers to the Direct Tax Vivad Se Vishwas Rules, 2020 and FAQs refer to the CBDT Circular No. 7/2020 issued on 04.03.2020. The 'Brief on DTVSV scheme' refers to the PowerPoint presentation that was sent to the taxpayers as discussed here.

The Designated Authority shall intimate the tax payable by or refundable to the declarant in Form 3.

The declarant shall be required to intimate the details of payment in Form-4 along with proof of withdrawal of the relevant appeal, writ, arbitration, etc.

The Designated Authority shall issue the order regarding the full and final settlement of the dispute in Form-5.

Read the 37-page Instructions to fill the forms - Form 1 and Form-2 under the Vivad Se Vishwas Scheme.

Suggested

Readings:

Get all latest content delivered straight to your inbox

0 Comments