ITAT Kolkata in the case of Chandra Prakash Jhunjhunwala vs DCIT held that the third proviso to section 50C which allows for variation of 5 percent between the stamp duty value and the actual sales consideration must be given retrospective effect from the point of time when the related legal provision was introduced despite the fact that the same was introduced by Finance Act, 2018 and was made effective from 01-04-2019.

It should be noted that Section 50C was inserted by Finance Act, 2002 w.e.f. 1-4-2003 and was inserted as a deeming provision to substitute actual sales consideration with the stamp duty value.

Read the case details.

Case Title

|

Chandra Prakash Jhunjhunwala Vs. DCIT-CC-3(4),Kol

|

Court

|

ITAT, Kolkata Bench, Kolkata

|

Appeal No./Citation

|

ITA No. 2351/Kol/2017

|

Section covered

|

50C, 10(38)

|

Order Result

|

Appeal allowed. Decided in favour of assessee.

|

Date of judgment

|

09.08.2019

|

Facts of the case:

The assessee is an Individual and filed his return of income for AY 2014-15 declaring loss of Rs. 1,19,46,383/-. The assessee had declared long term capital gain (LTCG) of Rs. 1,22,63,576/- against the sale of a property at Pretoria Street, Kolkata on 14.12.2013. Scrutiny assessment notice under section 143(2) along with a questionnaire was served on the assessee.

On perusal of the submissions, the AO found that the market value of the said property as per stamp duty authority was Rs. 3,27,01,950/-. The assessee was asked why the provisions of section 50C of the Act should not be invoked in his case.

In reply, the assessee objected to the valuation of the stamp duty authority and requested the AO to refer the valuation of the property to a DVO.

The AO referred the valuation to a DVO on 05.12.2016 for determination of the fair market value of the said property u/s 55A read with section 50C(2). But no report had been received from the DVO before the assessment was getting time-barred.

Hence, the AO in the assessment order added an amount of Rs. 12,01,950/- being the difference of Rs. 3,27,01,950/- and Rs. 3,15,00,000/- to the total income of the assessee by invoking section 50C.

Aggrieved by the order of the Assessing Officer, the assessee carried the matter in appeal before the ld. CIT(A), who has confirmed the addition made by the Assessing Officer.

Aggrieved by the order of the ld. CIT(A) the assessee has filed an appeal before the ITAT.

Issues:

Whether the addition of Rs. 12,01,950/- u/s 50C is tenable in law considering the fact that the difference does not exceed 5 percent of actual sales consideration with the market value as determined by the stamp duty authority?

Arguments of the assessee:

Before the Tribunal, the Ld. A/R relied on the submissions made before the authorities below.

Arguments of the department:

Before the Tribunal, the Ld. D/R reiterated the stand taken by the Assessing Officer.

The Decision:

The Tribunal, after considering the submissions and other decided cases on the matter held that insertion of the third proviso to Section 50C of the Act is declaratory and curative in nature, hence it is not a substantive amendment, it is only a procedural amendment.

The third proviso to Section 50C should be treated as curative in nature and with retrospective effect from 1st April 2003, i.e. the date effective from which Section 50C was introduced a curative amendment to avoid unintended consequences is to be treated as retrospective in nature even though it may not state so specifically.

Analysis:

This is indeed a landmark judgment on the matter. The Tribunal has after discussing all the relevant laws and precedents rightly held that the third proviso to section 50C allowing 5 percent variation between stamp value and sales consideration as retrospective in nature and not prospective. This will definitely provide great relief to the ailing real estate sector and to those whose similar cases are pending at any appellate stage.

Further, the Finance Bill, 2020 has proposed to increase the safe harbour limit of 5 percent to 10 percent. Though the provides the increased limit will be applicable from 01.04.2021 (AY 2021-22), however, going by the ratio of this judgment, the same shall be taken as retrospective in nature.

Further, the Finance Bill, 2020 has proposed to increase the safe harbour limit of 5 percent to 10 percent. Though the provides the increased limit will be applicable from 01.04.2021 (AY 2021-22), however, going by the ratio of this judgment, the same shall be taken as retrospective in nature.

Update:

Also see decision of ITAT Mumbai in Maria Fernandes Cheryl vs. ITO (ITA No. 4850/Mum/2019) decided on January 15, 2021

Full text of the judgment:

IN THE INCOME TAX APPELLATE TRIBUNAL

“B” BENCH, KOLKATA

BEFORE SHRI A. T. VARKEY, JM & DR. A.L.SAINI, AM

I.T.A. No. 2351/Kol/2017

(Assessment Year: 2014-15)

Chandra Prakash Jhunjhunwala

22/S, Nalini Ranjan Avenue,

Block-A, New Alipore, Kolkata- 700053 |

Vs

|

DCIT, CC-3(4), Kolkata

|

PAN/GIR No.

| ||

(Assessee)

|

(Revenue)

| |

Assessee by

|

:

|

Shri ManojKataruka, Advocate

|

Revenue by

|

:

|

Shri Robin Chowdhury, Addl. CIT Sr. DR

|

Date of Hearing

|

:

|

18/06/2019

|

Date of Pronouncement

|

:

|

09/08/2019

|

O R D E R

The captioned appeal filed by the Assessee, pertaining to assessment year 2014-15, is directed against the order passed by the Commissioner of Income Tax (Appeal)-21, Kolkata, which in turn arises out of an assessment order passed by the Assessing Officer u/s 143(3) of the Income Tax Act, 1961 (in short the ‘Act’) dated 30/12/2016.

2. The grounds of appeal raised by the assessee are as follows:

3. Ground No. 1 raised by the assessee relates to addition made by the Assessing Officer of Rs. 12,01,950/- u/s 50C of the Act.

4. Brief facts qua the issue are that the assessee has filed his return of income declaring total income of Rs. NIL and claimed current year loss of Rs. 1,19,46,383/-. The assessee’s case has been selected for scrutiny through CASS. Notice u/s 143(2) was issued on 22.04.2016 along with questionnaires and served upon the assessee. During the course of assessment proceedings, on perusal of the profit & loss account of the assessee for the year ended 31.03.2014 along with its computation of income for the A.Y. 2014-15, it was noticed by Assessing Officer that, the assessee had declared long term capital gain of Rs. 1,22,63,576/- against sale of property at Pretoria Street, Kolkata on 14.12.2013. During the course of assessment proceeding, the assessee was asked to furnish the details of property sold along with copy of sale deed and other relevant supporting documents regarding the indexation cost claimed while computing long term capital gain. The A.R. of the assessee through his letter dated 21.04.2016 submitted the copy of sale deed of the said property. Ongoing through, the details submitted by the assessee, it was noticed by the AO that the assessee had sold a property on 14.12.2013 to M/s Srishti Properties (partnership firm), for a total sale consideration of Rs. 3,15,00,000/-. The assessee stated that divided and demarcated portion measuring about 3300 sq. ft. super built up area consisting of 2952 sq. ft. covered super built up area and 348 sq. ft open terrace on the 4th Floor of the building built and constructed on land measuring about 2 bighas and 2 cottahs together with structures standing thereon situated at Municipal premises no. 7B, Harendra Kumar Sarani (formerly Pretoria Street), P.S. Shakespeare Sarani, Kolkata-700071 along with one no. covered car parking space bearing no. 1 on ground floor. Further it was found that the market value of the said property as per stamp duty authority is Rs. 3,27,01,950/-.

5. The Assessing Officer noticed that in light of the above findings, the issue of sale of property by the assessee attracts the provision of section 50C of the Act as the sale consideration received as a result of the transfer of a capital asset is less than the market value as per stamp duty valuation. The assessee was asked in course of hearing to explain as to why the provisions of section 50C of the Act should not be invoked in case of the assessee regarding the sale property at Pretoria Street, Kolkata and why the full value of consideration received as a result of the said transfer should not be taken at Rs. 3,27,01,950/- (market value as per stamp duty authority) in place of Rs. 3,15,00,000/- (sale consideration received as per the assessee).

In response, the assessee furnished his submission dated 20.06.2016. Relevant extract of the said reply is furnished as under:

The submission of the assessee had been perused by Assessing Officer and accordingly a reference had been made on 5.12.2016 to the DVO for determination of fair market value of the said property u/s 55A read with section 50C(2) of the Act. But no report had been received from the DVO within the time sought for. Hence the provision of section 50C of the Act is being invoked in case of the assessee and the value as per stamp duty authority is being adopted as the full value of consideration received for the purpose of computation long term capital gain. Hence, in the case of the assessee, the market value of Rs. 3,27,01,950/- (as per stamp duty valuation) was concerned as the full value of consideration received as a result of the transfer / sale of property by the assessee. So, an amount of Rs. 12,01,950/- (difference of Rs. 3,27,01,950/- - Rs. 3,15,00,000/-) was added to the total income of the assessee by invoking section 50C of the Act.

6. Aggrieved by the order of the Assessing Officer, the assessee carried the matter in appeal before the ld. CIT(A) who has confirmed the addition made by the Assessing Officer. Aggrieved by the order of the ld. CIT(A) the assessee is in appeal before us.

7. The ld. DR has primarily reiterated the stand taken by the Assessing Officer which we have already noted in our earlier para and the same is not being repeated for the sake of brevity and on the other hand the ld. Counsel has relied on the submissions made before the authorities below.

8. We have heard both the parties and perused the material available on record.First of all, it is worthwhile to go through the provisions of section 50C of the Income Tax Act 1961, which is given below to the extent applicable for our discussion:

“Section 50C: Special provision for full value of consideration in certain cases.

(1) Where the consideration received or accruing as a result of the transfer by an assessee of a capital asset, being land or building or both, is less than the value adopted or assessed or assessable, by any authority of a State Government (hereafter in this section referred to as the “stamp valuation authority) for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed or assessable shall, for the purposes of section 48, be deemed to be the full value of the consideration received or accruing as a result of such transfer.

Provided that where the date of the agreement fixing the amount of consideration and the date of registration for the transfer of the capital asset are not the same, the value adopted or assessed or assessable by the stamp valuation authority on the date of agreement may be taken for the purposes of computing full value of consideration for such transfer:

Provided further that the first proviso shall apply only in a case where the amount of consideration, or a part thereof, has been received by way of an account payee cheque or account payee bank draft or by use of electronic clearing system through a bank account, on or before the date of the agreement for transfer.

The following proviso shall be ins. by Finance Act, 2018 (w.e.f. 1-4-2019):

Provided also that where the value adopted or assessed or assessable by the stamp valuation authority does not exceed one hundred and five per cent of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purposes of section 48, be deemed to be the full value of the consideration.

This amendment, (by way of insertion of third proviso in section 50C of the Act), was explained, in the Memorandum Explaining the Provisions of Finance Bill 2018, as follows:

“At present while taxing income from capital gains (section 50C), business profits (section 43CA) and other sources (section 56) arising out of transactions in immovable property, the sale consideration or stamp duty value, whichever is higher is adopted. The difference is taxed as income both in the hands of the purchaser and the seller. It has been pointed out that this variation can occur in respect of similar properties in the same area because of a variety of factors, including shape of the plot or location. In order to minimize hardship in case of genuine transactions in the real estate sector, it is proposed to provide that no adjustments shall be made in a case where the variation between stamp duty value and the sale consideration is not more that five per cent of the sale consideration. These amendments will take effect from 1st April, 2019, and will, accordingly, apply in relation to the assessment year 2019-20 and the subsequent assessment years.”

We note that the fundamental purpose of introducing section 50C was to counter suppression of sale consideration on sale of immovable properties, and this section was introduced in the light of widespread belief that sale transactions of land and building are often undervalued resulting in leakage of legitimate tax revenues. We note that the variation between stamp duty value and the sale consideration arises because of many factors, some of them are given below:

(i).Location of property.

(ii).Near by public amenities.

(iii).Forced sale

(iv). Size of land and building

(v). Nearby public highway/Rail facilities

(vi).Shape of the plot or location

We note that difference between the value as per sale deed and the value as per stamp duty valuation, arises as a result of many factors, some of them we have explained above.We note that stamp duty value and the sale consideration, that is, these two values represent the values at two different points of time. In a situation in which there is significant difference between the point of time when agreement to sell is executed and when the sale deed is executed, therefore, should ideally be between the sale consideration as per registered sale deed, which is fixed by way of the agreement to sell, vis-à-vis the stamp duty valuation as at the point of time when agreement to sell, whereby sale consideration was in fact fixed, because, if at all any suppression of sale consideration should be assumed, it should be on the basis of stamp duty valuation as at the point of time when the sale consideration was fixed. Section 50C makes a special provision for determining the full value of consideration in cases of transfer of immovable property. It provides that where the consideration declared to be received or accruing as a result of the transfer of land or building or both, is less than the value adopted or assessed or assessable by any authority of a State Government (i.e. "stamp valuation authority") for the purpose of payment of stamp duty in respect of such transfer, the value so adopted or assessed or assessable shall be deemed to be the full value of the consideration, and capital gains shall be computed on the basis of such consideration under section 48 of the Income-tax Act.

9. We note that at present while taxing income from capital gains (section 50C), business profits (section 43CA) and other sources (section 56) arising out of transactions in immovable property, the sale consideration or stamp duty value, whichever is higher is adopted. The difference is taxed as income both in the hands of the purchaser and the seller. It has been pointed out that this variation can occur in respect of similar properties in the same area because of a variety of factors, including shape of the plot or location. In order to minimize hardship in case of genuine transactions in the real estate sector, it was proposed by the Finance Act 2018, that no adjustments shall be made in a case where the variation between stamp duty value and the sale consideration is not more that five per cent of the sale consideration. These amendments will take effect from 1st April, 2019, and will, accordingly, apply in relation to the assessment year 2019-20 and subsequent years.While the Government has thus recognized the genuine and intended hardship in the cases in which there is minor variation between stamp duty value and the sale consideration. That is why,the Finance Act 2018 introduced welcome amendments to the statue to take the remedial measures. However, we note that this brings no relief to the assessee as the amendment is introduced only with prospective effect from 1st April 2019. There cannot be any dispute that this amendment in the scheme of Section 50C has been made to remove an incongruity, resulting in undue hardship to the assessee, as is evident from the observation of Memorandum Explaining the Provisions of Finance Bill 2018, as noted above in para No. 8 of this order. The incongruity in the statute was glaring and undue hardship not in dispute. Once it is not in dispute that a statutory amendment is being made to remove an undue hardship to the assessee or to remove an apparent incongruity, such an amendment has to be treated as effective from the date on which the law, containing such an undue hardship or incongruity, was introduced. In support of this proposition, we find support from Hon'ble Delhi High Court's judgment in the case of CIT v. Ansal Landmark Township (P.) Ltd. [2015] 377 ITR 635/234 Taxman 825/61 taxmann.com 45,

10. We note that now the legislature has been compassionate enough to cure these shortcomings of provision, and thus obviate the unintended hardships, such an amendment in law, in view of the well settled legal position to the effect that a curative amendment to avoid unintended consequences is to be treated as retrospective in nature even though it may not state so specifically. Hence the insertion of third proviso to section 50C must be given retrospective effect from the point of time when the related legal provision was introduced, as this amendment is procedural one to compute the value of property. At the cost of repetition, we again reproduce the third proviso to section 50C as follows:

The following proviso shall be ins. by Finance Act, 2018 (w.e.f. 1-4-2019):

Provided also that where the value adopted or assessed or assessable by the stamp valuation authority does not exceed one hundred and five per cent of the consideration received or accruing as a result of the transfer, the consideration so received or accruing as a result of the transfer shall, for the purposes of section 48, be deemed to be the full value of the consideration.

We note that this third proviso relates to determination of value of property therefore it cannot be a substantive amendment. Normally substantive amendments in law in applicable prospective. In view of these discussions, as also for the detailed reasons set out earlier, it is a procedural amendment in law to help the assessee to determine the value or to compute the value of property hence this amendment is not to punish the assessee just because there is minor variation between stamp duty value and the sale consideration. We note that the statute such an amendment in law, in view of the well settled legal position to the effect that a curative amendment to avoid unintended consequences is to be treated as retrospective in nature even though it may not state so specifically, for that we rely on the judgment of the Hon`ble Supreme Court in the case of Alom Extrusions Ltd 185 Taxman 416 (SC) wherein it was held as follows:

“8. On reading the above provisions, it becomes clear that the assessee(s)-employer(s) would be entitled to deduction only if the contribution stands credited on or before the due date given in the Provident Fund Act. However, the second proviso once again created further difficulties. In many of the companies, financial year ended on 31st March, which did not coincide with the accounting period of R.P.F.C. For example, in many cases, the time to make contribution to R.P.F.C. ended after due date for filing of returns. Therefore, the industry once again made representation to the Ministry of Finance and, taking cognizance of this difficulty, the Parliament inserted one more amendment vide Finance Act, 2003, which, as stated above, came into force with effect from 1-4-2004. In other words, after 1-4-2004, two changes were made, namely, deletion of the second proviso and further amendment in the first proviso, quoted above. By the Finance Act, 2003, the amendment made in the first proviso equated in terms of the benefit of deduction of tax, duty, cess and fee on the one hand with contributions to Employees' Provident Fund, superannuation fund and other welfare funds on the other. However, the Finance Act, 2003, bringing about this uniformity came into force with effect from 1-4-2004. Therefore, the argument of the assessee(s) is that the Finance Act, 2003, was curative in nature, it was not amendatory and, therefore, it applied retrospectively from 1-4-1988, whereas the argument of the Department was that Finance Act, 2003, was amendatory and it applied prospectively, particularly when the Parliament had expressly made the Finance Act, 2003, applicable only with effect from 14-2004. It was also argued on behalf of the Department that even between 1-4-1988 and 1-4-2004, Parliament had maintained a clear dichotomy between payment of tax, duty, cess or fee on one hand and payment of contributions to the welfare funds on the other. According to the Department, that dichotomy continued up to 1-4-2004, hence, looking to this aspect, the Parliament consciously kept that dichotomy alive up to 1-4-2004, by making Finance Act, 2003, come into force only with effect from 1-4-2004. Hence, according to the Department, Finance Act, 2003 should be read as amendatory and not as curative [retrospective] with effect from 1-4-1988.

From the above chart, it transpires that the assessee has purchased the above scrips at a very high rate and has sold out the same at a very low price within a short span of approximately two months thereby incurring a huge loss (short term capital loss) of Rs. 31,46,527/-. But since the two scrips are penny stocks which has been further supported by the thin volume of trade and bell shaped movement of its price. Further, the Bombay Stock Exchange through its notice dated 01.01.2015 has suspended trading in the scrip viz. Shree Shaleen Textile Ltd. w.e.f 07.01.2015 as per direction received from SEBI. From the above the discussion, an inference could be drawn that, the loss said to be incurred by the assessee through sale of the above two scrips is nothing but a make believe transaction which serves no commercial purpose and is a pre-arranged transaction to book loss for setting off with taxable profit of the assessee. Hence, the same was treated as a fiscal nullity and the STCL (u/s 111A) of Rs. 31,46,527/- was being disallowed.

15. Aggrieved by the order of the Assessing Officer, the assessee carried the matter in appeal before the ld. CIT(A) who has confirmed the addition made by the Assessing Officer. Aggrieved by the order of the ld. CIT(A) the assessee is in appeal before us.

16. The ld. DR has primarily reiterated the stand taken by the Assessing Officer which we have already noted in our earlier para and the same is not being repeated for the sake of brevity and on the other hand the ld. Counsel for the assessee has relied on the submissions made before the authorities below.

17. We have heard both the parties and perused the material available on record. We note that the assessee incurred short term capital loss of Rs.31,46,527/- on purchase and sale of shares of Luminaire Technologies Ltd. and Shree Shaleen Textiles Limited. In respect of the above scrips, during the course ofhearings, the assessee had submitted following details and evidences, which are as follows:

(a) Brokers ledger account (pb 58) (b) Contract notes for both purchase and sale of the shares. (pb 72 to 78) (c) DMAT holding statement (79 to 82) (d) Copy of the bank statement for sale proceeds (pb 83 to 84) (e) Copy of the ledger account of stock broker Baljit Securities Pvt. Ltd(pb58). (f). Copy of the Bank Statement wherein the sale proceeds of shares luminaire Technologies limited shares and Shree Shaleen Textiles limited shares were received and credited to the account. (g) Copy of income tax return (pb 10) (h). Copy of Balance Sheet and profit and loss account (pb 11 to 29)

Based on similar documents and evidences and based on the identical facts and circumstances narrated above, we note that the Co-ordinate Bench of ITAT Kolkata in the case of Sanjib Kumar Patwari(HUF) in I.T.A. No.205/Kol/2018 for A.Y. 2014-15, has deleted the addition. The detailed findings of the Coordinate Bench is given below:

“12. We have heard both the parties and perused the material available on record. We note that the assessee is a regular investor in shares and has been investing in shares since past several years. The said fact is evident from the details given below:

Thus, from the above table, it is abundantly clear that the assessee is a regular investor in shares and is having a substantial amount of investments. During the year under consideration, the assessee has sold the impugned three scrips and earned capital gains on the same which is claimed year after year consistently. The details of long term capital gain earned by the assessee is given below:

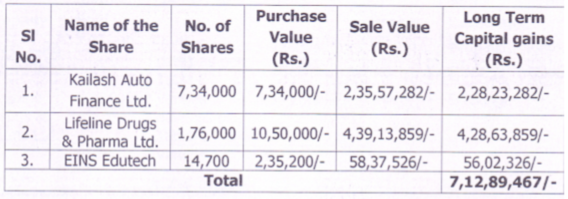

We note that the assessee claimed exemption of LTCG of Rs.7,12,89,467/- u/s 10(38) of the Act, since the shares purchased and sold were listed shares and were purchased and sold through stock broker in Stock Exchange and STT was deducted at the time of sale. The details of purchase and sales transaction made by the assessee is given below:

Therefore, the details of LTCG of Rs. 7,12,89,467/- earned during the financial year on account of sale of shares through a registered stock broker in a recognized Stock Exchange and claimed as exempt u/s 10(38) of the Act is as under:

i

We note that the AO in his order has discussed about the interim order of SEBI, where SEBI has restrained some persons including assesee from accessing the securities market. However, SEBI in its final order did not give adverse comment.The same was revoked by SEB1, vide its final order, SEB1/WTM/MPB/EFD-DRA- 1/31/2017 dated 21.09.2017, (page nos. 69-84). Assessee's name is at S.N. 154 (at page no. 80) read with para 7 of Page no. 83. The AO has made some other general allegations including the statement of an alleged entry operator Sri Sunil Dokania at page no. 22 of the assessment order. However, no copy of such statement was given to the assessee nor any opportunity of cross examination of the party was allowed to the assessee. Further, the AO did not brought any corroborative evidence on record to substantiate the contents of the statement relied on.We note that not allowing the assessee to cross examine the witness by the adjudicating authority though the statements of those witness were made the basis of the impugned order is a serious flaw which makes the order nullity. We note that same view expressed by the Hon`ble Calcutta High Court in the case of Eastern Commercial Enterprises 210 ITR 103 (Cal), wherein it was held that it is a trite law that cross examination is the sine qua non of due process of taking evidence and no adverse inference can be drawn against the party unless the party is put on notice of the case made out against him. Therefore, the addition made by the assessing officer based on thestatement of an alleged entry operator Sri Sunil Dokaniais not sustainable in law, as the assessing officer did not provide an opportunity to the assessee to cross examine the statement of Sri Sunil Dokania.

13. Now, coming to the merits of the assessee`s case, we note that ld Counsel for the assessee submitted before us paper book which contain the documents and evidences in support of the Purchase and sale of shares on which the long term capital gain(LTCG) arose to the assessee. These all documents and evidences were available before the ld CIT(A) as well as before the ld AO. The Assessee submitted before us following documents and evidences in respect of Kailash Auto Finance Ltd.

(1) KAILASH AUTO FINANCE LTD.

i) Copy of purchase bill dated 12.02.2012, reflecting the purchase of 3,20,000 shares of Careful Projects Advisory Ltd. from Trump Traders Pvt. Ltd. (Paper Book Page No. 4)

ii) Copy of purchase bill dated 09.10.2012 reflecting the purchase of 9,00,000 shares of Careful Projects Advisory Ltd. from Trump Traders Pvt. Ltd. (Paper Book Page No. 5)

iii) Copy of Bank Statement reflecting the debit transaction of the amount of Rs. 3,20,000/- paid for the purchase of shares by cheque no. 729958 on 10.02.2012 (Paper Book Page No. 9)

iv) Copy of Bank Statement reflecting the debit transaction of the amount of Rs. 9,00,000/- paid for the purchase of shares by cheque no. 037633 on 09.10.2012 (Paper Book Page No. 8)

v) Copy of statement of DEMAT account evidencing the debit of shares of Kailash Auto Finance Ltd. on 07.04.2014, 09.04.2014, 10,04,2014, 11.04.2014, 15.04.2014, 16.04.2014 and so on; (Paper Book page no. 64- 65)

vi) Copy of order approving the Scheme of Amalgamation passed by the Hon'ble High Court in relation to merger of Kailash Auto Finance Ltd. and Careful Projects Advisory Ltd. and Panchshul Marketing Ltd. (Paper Book page No. 85-115).

vii) Copy of Contract Notes evidencing the sale of shares of Kailash Auto Finance Ltd.

viii) Copy of bank statement reflecting the transactions of sale of shares of Kailash Auto Finance Ltd. (Paper Book page No. 59-61)

ix) SEB1 by its interim order dated 29.03.2016 restrained 246 entities from accessing the securities market and from dealing and buying & selling in securities, directly or indirectly in any manner whatsoever till any further directions (Page No. 69) and included Kailash Auto Finance Ltd. and assessee at Serial No. 1 and Serial No. 156 (Page Nos. 70 & 74 respectively) .

x) The same was revoked by SEB1 vide its order SEB1/WTM/MPB/EFD-DRA- 1/31/2017 dated 21.09.2017 (page nos. 69-84). Assessee's name is at S.N. 154 (at page no. 80) read with para 7 of Page no. 83.

(2) LIFELINE DRUG & PHARMA LTD.

i) Copy of Allotment Advice dated 05.10.2012 reflecting the purchase of 20,000 shares of Lifeline Drugs & Pharma Ltd. (Paper Book Page No. 6) (Later, 20,000 shares of Rs. 10 each were split to 2,00,000 shares of Rs. 1 each)

ii) Copy of Bank Statement reflecting the debit transaction of the amount of Rs. 12,00,000/- paid for the purchase of shares,by cheque no. 037632 on 01.10.2012 (Paper Book Page No. 8)

iii) Copy of statement of DEMAT account evidencing the debit of shares of Lifeline Drugs & Pharma Ltd. on 01.07.2014, 08.07.2014, 11.07.2014, 15.07.2014, 21.07.2014 and so on; (Paper Book Page No. 66-67)

iv) Copy of Contract Notes evidencing the sale of shares of Lifeline Drugs & Pharma Ltd.;

v) Copy of bank statement reflecting the transactions of sale of shares of Lifeline Drugs & Pharma Ltd. (Paper Book page No. 59-61)

(3) EINS EDUTCEHLTD. (Now Aplaya Creations Ltd.)

i)Copy of purchase bill dated 10.08.2013, reflecting the purchase of 50,000 shares of EINS Edutech Ltd. from Neptune Financial Advisory Pvt. Ltd. (Paper Book Page No.7);

ii) Copy of Bank Statement reflecting the debit transaction of the amount of Rs. 8,00,000/- paid for the purchase of shares by cheque no. 37644 on 01.08.2013 (Paper Book Page No. 10)

iii) Copy of statement of DEMAT account evidencing the debit of shares of EINS Edutech Ltd. on 01.12.2014, 02.12.2014, 06.12.2014, 11.12.2014 and so on; (Paper Book Page No. 63)

iv) Copy of Contract Notes evidencing the sale of shares of E1NS Edutech Ltd.;

v).Copy of bank statement reflecting the transactions of sale of shares of EINS Edutech Ltd. (Paper Book page No. 59-61) .

Therefore, by submitting these plethora documents and evidences, the ld Counsel for the assessee claimed that long term capital gain (LTCG) earned in respect of the scrips, namely: Kailash Auto Finance Ltd., Lifeline Drug & Pharma Ltd, and EinsEdutceh Ltd. (Now Aplaya Creations Ltd.) are genuine. We also note that the Securities Exchange Board of India (SEBI) also declared these scrips and shares as genuine and the interim order passed by the SEBI was revoked by SEB1 itself, vide its order SEB1/WTM/MPB/EFD-DRA- 1/31/2017 dated 21.09.2017 (page nos. 69-84). Assessee's name is at S.N. 154 (at page no. 80) read with para 7 of Page no. 83. Hence, we note that since these shares/scrips were traded on the platform of recognized stock exchange and the Securities Exchange Board of India (SEBI) did not give any adverse report therefore, long term capital gain arise or earned by the assessee should be genuine and it should not be bogus by any stretch of imagination. Moreover, the assessing officer did not doubt on the documents and evidences as noted by us above. The assessing officer mainly made addition based on suspicion, and probability. As we have noted that in the course of assessment proceedings, all the relevant details and documents requisitioned by the ld. Assessing Officer in notice u/s 142(1) was filed before him. The assessee has submitted the details of LTCG, copy of contract notes, bank statements, allotment advise, copy of bills, DEMAT account and other necessary details before AO and the AO failed to bring any cogent evidence on record to show that these documents and evidences were false and untrue.

14. We would like to mention some important salient features of the LTCG transaction entered into by the assessee, which is given below:

(i) The assessee is a regular investor in shares and securities as evident from past assessment records.

(ii) The shares were purchased and sold through a Registered Broker named "Eureka Stock & Share Broking Services Ltd." in the Stock Exchange.

(iii) The shares were purchased and sold based on the prevailing market condition.

(iv) The purchase and sale of shares are supported by contract notes. The payments were received through proper banking channel.

(v) The purchase and sale transactions were subjected to Security Transaction Tax, Service Tax, Brokerage charges and Stamp duty.

(vi) The share purchase and sale transactions are reflected in the D-mat account.

(vii) The purchase of shares (Investments) was not disputed in earlier year, where assessment is completed u/s. 143(3) of the Income Tax Act.

(viii) These facts are verifiable from the regular books of accounts.

(ix) The transactions can also be verified from the Stock Exchange.

(x) The SEBI has cleared these shares and scrips from the allegation of Market Rigging.

Hence, the genuineness of the transaction cannot be doubted.

15. Now coming to the allegations made by the Assessing Officer for making the addition. The Assessing Officer alleged in the assessment order that on the basis of information received from the investigation wing, Kolkata, the claim of LTCG u/s 10(38) by the assessee is bogus. In the assessment order, the ld. Assessing Officer has mentioned the story that the list of 84 scrips identified by the investigation wing where price rigging have been found which includes the name of the scrips in which the assessee has earned Long Term Capital Gain. The Assessing Officer alleged that the transactions were pre-arranged to book such gain in the hands of the pre-fixed beneficiaries. The above allegations are generalized and not specific to the case of the assessee. The assessee was asked to show cause, vide letter dated 14.12.2017, as to why the Long Term Capital Gain booked by way of transaction in the aforesaid scrips would not be considered bogus, and consequently, be added to his total income. The assessee duly replied to the show cause notice vide his letter dated 22.12.2017 thereby giving all the details and reasons as required by the AO to prove that the LTCG incurred by the assessee on sale of above mentioned shares are genuine and cannot be considered as bogus. However, the Ld. AO did not consider the submission of the assessee and made the addition of LTCG in the hands of the assessee treating the same to be unexplained. We note that it appears from the show cause notice that the Ld. AO has relied on the following information for arriving at such conclusion:

(a) Information received from the office of DIT(Inv), Kol regarding entry of bogus LTCG.

(b) Statement given by Sri Sunil Dokania, an alleged entry operator who was involved in price rigging and providing Bogus LTCG through penny stocks.

So far first allegation of AO is concerned, we note that the assessee has purchased the shares from the recognized stock exchange through his broker i.e. Eureka Stock & Share Broking Services Ltd. on various dates. The assessee submitted Contract Notes. This transaction is not through any preferential allotment or offline sale. All the transactions are made through proper banking channels. The shares were sold through registered share broker, M/s Eureka Stock & Share Broking Services Ltd. In the course of assessment proceedings, the assessee has submitted all the details and documents that were necessary for allowing the claim of the assessee. In the assessment order u/s. 143(3), Ld. AO has stated that there was inflow of some information from the Investigation wing alleging that the assessee was involved in selling of so called "penny stock". In this regard it was submitted by the assessee before the assessing officer as follows:

i) The assessee is a regular investor in shares and securities as evident from past assessment records.

ii) The shares were purchased and sold through a Registered Broker named "Eureka Stock & Share Broking Services Ltd." in the Stock Exchange.

iii) The shares were purchased and sold based on the prevailing market condition.

iv) The purchase and sale of shares are supported by contract notes. The payments were received through proper banking channel.

v) The purchase and sale transactions were subjected to Security Transaction Tax, Service Tax, Brokerage charges and Stamp duty.

vi) The share purchase and sale transactions are reflected in the d-mat account.

vii) The purchase of shares (Investments) was not disputed in earlier year, where assessment is completed u/s. 143(3) of the Income Tax Act.

viii) These facts are verifiable from the regular books of accounts.

ix) The transactions can also be verified from the Stock Exchange.

x) The interim order of SEBI about which the AO has discussed in his order, has been reversed by the final order of SEBI dated 21.09.2017,where the SEBI has cleared the assessee from the allegation of Market Rigging.

Therefore, so far first allegation of the assessing officer is concerned, the assessee has proved beyond any doubt that assessee is a regular investor in shares and securities. The shares were purchased and sold through a Registered Broker named "Eureka Stock & Share Broking Services Ltd." in the Stock Exchange. The shares were purchased and sold based on the prevailing market condition. The payments were received through proper banking channel. The purchase and sale transactions were subjected to Security Transaction Tax, Service Tax, Brokerage charges and Stamp duty. The share purchase and sale transactions are reflected in the d-mat account. The purchase of shares (Investments) was not disputed in earlier year, where assessment is completed u/s. 143(3) of the Income Tax Act. These facts are verifiable from the regular books of accounts. The transactions can also be verified from the Stock Exchange. Therefore, we do not agree with the assessing officer and hence the addition made by assessing officer needs to be deleted.

So far second allegation of the assessing officer is concerned, we note thatassessing officer has relied on the statement given by Sri Sunil Dokania, an alleged entry operator. We note that the AO has made general allegations about the alleged entry operator, Sri Sunil Dokania, vide page no. 22 of the assessment order. We note that no copy of such statement was given to the assessee nor any opportunity of cross examination of the party was allowed to the assessee. Further, the AO did not brought any corroborative evidence on record to substantiate the contents of the statement relied on. We note that not allowing the assessee to cross examine the witness by the adjudicating authority though the statements of those witness were made the basis of the impugned order is a serious flaw which makes the order nullity. We note that same view expressed by the Hon`ble Calcutta High Court in the case of Eastern Commercial Enterprises 210 ITR 103 (Cal), wherein it was held that it is a trite law that cross examination is the sine qua non of due process of taking evidence and no adverse inference can be drawn against the party unless the party is put on notice of the case made out against him.

We note that the fact that neither the statement relied on bythe authorities below were provided to the assessee nor any cross examination was allowed to prove the veracity of the statement. We note that the fact that in the statement of third party, the name of the assessee was not implicated. Even otherwise, according to Learned Counsel, no adverse inference could be drawn against the assessee on the basis of untested statements without allowing opportunity of cross-examination. For that we rely on the following judgements in support of the aforesaid view:-

(i) Andman Timber Industries vs. CCE – [2015] 62 taxmann.com 3 (SC)

(ii) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agr/2009 (Agra ITAT)

(iii) ACIT vs. Amita Agarwal & Others – ITA No. 247/(Kol) of 2011 (Kol ITAT)

(iv) ITO vs. BijayaGanguly- ITA Nos. 624 & 625/Kol/2011 (Kol ITAT)

(v) GaneshmullBijay Singh Baid HUF vs. DCIT – ITA Nos. 544/Kol/2013 (Kolkata ITAT)

(vi) Rita Devi & Others vs. DCIT – IT(SS))A Nos. 22-26/Kol/2011 (Kol-ITAT)

(vii) Malti Ghanshyambhai Patadia vs. ITO - ITA No.3400/Ahd/2015Ahmedabad ITAT)

(viii) Pratik Suryakant Shah vs. ITO – [2017] 77 taxmann.com 260 (Ahmedabad ITAT)

Therefore, the addition made by the assessing officer based on thestatement of an alleged entry operator Sri Sunil Dokaniais not sustainable in law, as the assessing officer did not provide an opportunity to the assessee to cross examine the statement of Sri Sunil Dokania. Coupled with this, the CBDT’s circular dated 10.03.2003 itself made it clear that such admissions or statements without anytangible evidence found during search carry no significance.

16. We note that Securities Exchange Board of India (SEBI) is an authority which regulates the listed companies. The SEBI controls listed companies and makes rules and regulations and the listed companies are supposed to follow the rules, regulations and directions given by SEBI. We note that SEB1 by its interim order dated 29.03.2016 restrained 246 entities from accessing the securities market and from dealing and buying & selling in securities, directly or indirectly in any manner whatsoever till any further directions (Page No. 69) and included Kailash Auto Finance Ltd. and assessee at Serial No. 1 and Serial No. 156 (Page Nos. 70 & 74 respectively).

However, the same was revoked by SEB1 vide its order SEB1/WTM/MPB/EFDDRA- 1/31/2017 dated 21.09.2017 (page nos. 69-84). Assessee's name is at S.N. 154 (at page no. 80) read with para 7 of Page no. 83. We note that the SEBI by its order bearing reference no. SEBI/WTM/MPB/EFD- DRA-I/31/2017, dated 21.03.2017, has held as under:

“6. Considering the fact that there are no adverse findings against the aforementioned 244 entities with respect to their role in the manipulation of the scrip of Kailash Auto, I am of the considered view that the directions issued against them vide interim order dated March 29, 2016 and confirmatory orders dated June 15, 2016, September 30, 2016, October 21, 2016, October 27, 2016 and July 13, 2017 are liable to be revoked.

In view of the foregoing, in exercise of the powers conferred upon us under Section 19 of the Securities and Exchange Board of India Act, 1992 read with Sections 11, 11(4) and 11B of the SEBI Act, hereby revoke the interim order dated March 29, 2016 and confirmatory orders dated June 15, 2016, September 30,2016, October 21,2016, October 27,2016 and July 13, 2017 qua aforesaid 244 entities (paragraph 5 above) with immediate effect.

The revocation of the directions issued vide the above mentioned orders (at paragraph 7) is only in respect of the entities mentioned at paragraph 5 of this order in the matter of Kailash Auto. As regards remaining entities in the scrip of Kailash Auto, violations under SEBI Act, PFUTP Regulations, etc., were observed and SEBI shall continue its proceedings against them. Hence, the directions issued vide confirmatory order dated June 15, 2016 against the remaining 2 entities shall continue. This revocation order is without prejudice to any other action SEBI may initiate as per law."

We note that in the above order of the SEBI, the name of the assessee is also mentioned in the serial no. 154. Therefore, the SEBI itself has freed the assessee from market rigging allegation and thus the assessee is proved to be a bona-fide investor not involved in any malicious activities.Hence, considering the above, it is abundantly clear that no doubt can be arisen about the shares being penny stock.

17. We note that the assessee had never entered into any transaction with Sri Sunil Dokania against whom investigation wing had allegedly made inquiry. We also note that in the extracts of the statement of Sri Sunil Dokania given in the Show Cause notice, it is nowhere mentioned that the alleged person has provided any entry to the assessee directly. The statement talks about the entries provided by him to preferential allottees and the modus operandi adopted by him for providing the bogus LTCG. The assessee being a genuine investor was unaware of the fact that any such activity was undertaken in the scrips purchased by him. He was nowhere, associated with the person alleged to provide the entries as alleged by the AO. We also note that SEBI has given a clean chit to the company and has freed it from the allegation of market rigging. Therefore, the allegation of the AO itself becomes infructuous.Further, the assessee had also requested for an opportunity to cross examine Sri Sunil Dokania, whose statement has been relied on by the AO for making the addition. However, the Ld. AO did not provide any opportunity for cross examine the so-called operators. It is well established law that no adverse view can be taken against an assessee on the basis of statement recorded by department of any person without providing copy of the statement to the assessee and also without providing opportunity for cross examination of the said person.

18. We note that Hon’ble Bombay High Court in the case of CIT vs. Lavanya Land Pvt. Ltd. [2017] 83taxmann.com 161 (Bom) held that there was no evidence whatsoever toallege that money changed hands between the assessee and the broker or any other person including the alleged exit provider whatsoever to convert unaccounted money for getting benefit of LTCG as alleged. In the said case, theHon’ble High Court at Para 21 held that in absence of any material to show thathuge cash was transferred from one side to another, addition cannot be sustained.

19. We note that all the observations, conclusions and findings of the lower authorities are based on suspicion, surmises and rumor. It is trite law that the suspicion howsoever strong cannot partake the character of legal evidence. Reference was made to the judgement of Hon’ble Supreme Court in the case of Lalchand Bhagat Ambica Ram vs. CIT (1959) 37ITR 288 (SC, Umacharan Shaw 37 ITR 271 and Omar Salay Mohamed Sait 37ITR 151. We note that the entire case of the revenue is based upon the presumption that the assessee has ploughed back his own unaccounted money in the form of bogus LTCG. However, this presumption or suspicion howsoever strong it may appear to be, but needs to be corroborated by some evidence to establish a link that the assessee had brought back his unaccounted income in theform of LTCG.

20. We note that since the purchase and sale transactions are supported and evidenced by Bills, Contract Notes, Demat statements and bank statements etc., and when the transactions of purchase of shares were accepted by the ld AO in earlier years, the same could not be treated as bogus simply on the basis of some reports of the Investigation Wing and/or the orders of SEBI and/or the statements of third parties. In support of the aforesaid submissions, the ldCounsel, in addition to the aforesaid judgements, has referred to and relied on the following cases:-

(i) Baijnath Agarwal vs. ACIT – [2010] 40 SOT 475 (Agra (TM)

(ii) ITO vs. Bibi Rani Bansal – [2011] 44 SOT 500 (Agra) (TM)

(iii) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agra/2009 (Agra ITAT)

(iv) ACIT vs. Amita Agarwal & Others – ITA Nos. 247/(Kol)/ of 2011 (Kol ITAT)

(v) Rita Devi & Others vs. DCIT – IT(SS))A Nos. 22-26/Kol/2p11 (Kol ITAT) (vi) Surya Prakash Toshniwal vs. ITO – ITA No. 1213/Kol/2016 (Kol ITAT)

(vii) Sunita Jain vs. ITO – ITA No. 201 & 502/Ahd/2016 (Ahmedabad ITAT)

(viii) Ms. Farrah Marker vs. ITO – ITA No. 3801/Mum/2011 (Mumbai ITAT)

(ix) Anil Nandkishore Goyal vs. ACIT – ITA Nos. 1256/PN/2012 (Pune ITAT)

(x) CIT vs. Sudeep Goenka – [2013] 29 taxmann.com 402 (Allahabad HC)

(xi) CIT vs. Udit Narain Agarwal – [2013] 29 taxmann.com 76 (Allahabad HC)

(xii) CIT vs. Jamnadevi Agarwal [2012] 20 taxmann.com 529 (Bombay HC)

(xiii) CIT vs. Himani M. Vakil – [2014] 41 taxmann.com 425 (Gujarat HC)

(xiv) CIT vs. Maheshchandra G. Vakil – [2013] 40 taxmann.com 326 (Gujarat HC)

(xv) CIT vs. Sumitra Devi [2014] 49 Taxmann.com 37 (Rajasthan HC) (xvi) GaneshmullBijay Singh Baid HUF vs. DCIT – ITA Nos. 544/Kol/2013 (Kolkata ITAT)

(xvii) Meena Devi Gupta & Others vs. ACIT – ITA Nos. 4512 & 4513/Ahd/2007 (Ahmedabad ITAT)

(xviii) Manish Kumar Baid ITA 1236/Kol/2017 (Kolkata ITAT)

(xix) Mahendra Kumar Baid ITA 1237/Kol/2017 (Kolkata ITAT)

21. The ldCounsel also brought to our notice that once the assessee has furnished all evidences in support of the genuineness of the transactions, the onus to disprove the same is on revenue. He referred to the judgement of Hon’ble Supreme Court in the case of Krishnanand Agnihotri vs. The State of Madhya Pradesh [1977] 1 SCC 816 (SC). In this case the Hon’ble Apex Court held that the burden of showing that a particular transaction is benami and the assessee owner is not the real owner always rests on the person asserting it to be so and the burden has to be strictly discharged by adducing evidence of a definite character which would directly prove the fact of benami or establish circumstances unerringly and reasonably raising inference of that fact. The Hon’ble Apex Court further held that it is not enough to show circumstances which might create suspicion because the court cannot decide on the basis of suspicion. It has to act on legal grounds established by evidence. The ld AR submitted that similar view has been taken in the following judgments while deciding the issue relating to exemption claimed by the assessee on LTCG on alleged Penny Socks.

(i) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agr/2009 (Agra ITAT)

(ii) ACIT vs. J. C. Agarwal HUF – ITA No. 32/Agr/2007 (Agra ITAT)

22. Moreover it was submitted before us by ld Counsel that the AO was not justified in taking an adverse view against the assessee on the ground of abnormal price rise of the shares and alleging price rigging. It was submitted that there is no allegation in orders of SEBI and/or the enquiry report of the Investigation Wing to the effect that the assessee, the Companies dealt in and/or his broker was a party to the price rigging or manipulation of price in BSE/CSE. The ld AR referred to the following judgments in support of this contention wherein under similar facts of the case it was held that the AO was not justified in refusing to allow the benefit under section 10(38) of the Act and to assess the sale proceeds of shares as undisclosed income of the assessee under section 68 of the Act :-

(i) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agr/2009 (Agra ITAT)

(ii) ACIT vs.Amita Agarwal & Others - ITA Nos. 247/(Kol)/ of 2011 (Kol ITAT)

(iii) Lalit Mohan Jalan (HUF) vs. ACIT – ITA No. 693/Kol/2009 (Kol ITAT)

(iv) Mukesh R. Marolia vs. Addl. CIT – [2006] 6 SOT 247 (Mum)

23. We note that the ld. D.R. for the Revenue had heavily relied upon the decision of the Hon’ble Bombay High Court in the case of Bimalchand Jain in Tax Appeal No. 18 of 2017. We note that in the case relied upon by the ld. D.R, we find that the facts are different from the facts of the case in hand. Firstly, in that case, the purchases were made by the assessee in cash for acquisition of shares of companies and the purchase of shares of the companies was done through the broker and the address of the broker was incidentally the address of the company. The profit earned by the assessee was shown as capital gains which was not accepted by the A.O. and the gains were treated as business profit of the assessee by treating the sales of the shares within the ambit of adventure in nature of trade. Thus, it can be seen that in the decision relied upon by the ld. DR, the dispute was whether the profit earned on sale of shares was capital gains or business profit.

24. We note that when the transactions were as per norms prescribed by SEBI and concerned stock exchange and suffered STT, brokerage, service tax, and cess. There is no iota of evidence over the transactions as it were reflected in demat account. AO did not doubt the genuineness of the documents submitted by assessee. The ld AO failed to bring on record any evidence to suggest that the sale of shares by the Assessee were not genuine. The assessee produced the contract notes, details of demat accounts and produced documents showing all payments were received by the assessee through banks. In these circumstances, the long term capital gain (LTCG) earned by the assessee should not be treated as bogus, as held by the jurisdictional Hon`ble Calcutta High court in various cases, as mentioned below:

(i) . CIT V. Shreyashi Ganguli [ITA No. 196 of 2012] (Cal- HC)

In this case the Hon’ble Calcutta High Court held that the Assessing Officer doubted the transactions since the selling broker was subjected to SEBI’s action. However, the transactions were as per norms and suffered STT, brokerage, service tax, and cess. There is no iota of evidence over the transactions as it were reflected in demat account. The appeal filed by the revenue was dismissed.

(ii) CIT V. Rungta Properties Private Limited [ITA No. 105 of 2016] (Cal- HC)

In this case the Hon’ble Calcutta High Court affirmed the decision of this tribunal, wherein, the tribunal allowed the appeal of the assessee where the ld AO did not accept the explanation of the assesseein respect of his transactions in alleged penny stocks. The Tribunal found that the ld AO disallowed the loss on trading of penny stock on the basis of some information received by him. However, it was also found that the ld AO did not doubt the genuineness of the documents submitted by the assessee. The Tribunal held that the ld AO’s conclusions are merely based on the information received by him. The appeal filed by the revenue was dismissed.

(iii) CIT V. Andaman Timbers Industries Ltd [ITA No. 721of 2008] (Cal-HC)

In this case the Hon’ble Calcutta High Court affirmedthe decision of this Tribunal wherein the loss suffered by the Assesseewasallowed since the ld AO failed to bring on record any evidence to suggest that the sale of shares by the Assessee were not genuine.

(iv) CIT V. Bhagwati Prasad Agarwal [2009- TMI-34738 (Cal- HC) in ITA No. 22 of 2009 dated 29.4.2009]

In this case the Assessee claimed exemption of income from Long Term Capital Gains. However, the ld AO, based on the information received by him from Calcutta Stock Exchange found that the transactions were not recorded thereat. He therefore held that the transactions were bogus. The Hon’ble Jurisdictional High Court, affirmed the decision of the Tribunal wherein it was found that the claim of transactions entered into by the assessee have been proved, accounted for, documented and supported by evidence. It was also found that the assessee produced the contract notes, details of demat accounts and produced documents showing all payments were received by the assessee through banks. On these facts, the appeal of the revenue was summarily dismissed by High Court.

(v).The Hon’ble High Court of Calcutta in the case of ALPINE INVESTMENTS ITA 620 of 2008, dated 26thAugust 2008, held as follows:

“It appears that the share loss and the whole transactions were supported by contract notes, bills and were carried out through recognized stockbroker of the Calcutta Stock Exchange and all the payments made to the stockbroker and all the payments received from stockbroker through account payee instruments, which were also filed in accordance with the assessment.

It appears from the facts and materials placed before the Tribunal and after examining the same the Tribunal came to the conclusion and allowed the appeal filed by the assessee. In doing so, the Tribunal held that the transaction fully supported by the documentary evidences could not be brushed aside on suspicion and surmises. However, it was held that the transactions of share are genuine. Therefore, we do not find that there is any reason to hold that there is any substantial question of law involved in this matter. Hence, the appeal being ITA No.620 of 2008 is dismissed.”

(vi) The Hon'ble Calcutta High Court in the case of Principal Commissioner Of Income vs M/S. Blb Cables And Conductors; ITAT No.78 of 2017, GA No.747 of 2017; dt. 19 June, 2018, had upheld the order of the Tribunal by observing as follows:- "4. We have heard both the side and perused the materials available on record. The ld. AR submitted two papers books. First book is running in pages no. 1 to 88 and 2nd paper book is running in pages 1 to 34. Before us the ld. AR submitted that the order of the AO is silent about the date from which the broker was expelled.

There is no law that the off market transactions should be informed to stock exchange. All the transactions are duly recorded in the accounts of both the parties and supported with the account payee cheques. The ld. AR has also submitted the IT return, ledger copy, letter to AO and PAN of the broker in support of his claim which is placed at pages 72 to 75 of the paper book. The ld. AR produced the purchase & sale contracts notes which are placed on pages 28 to 69 of the paper book. The purchase and sales registers were also submitted in the form of the paper book which is placed at pages 76 to 87. The Board resolution passed by the company for the transactions in commodity was placed at page 88 of the paper book. On the other hand, the ld. DR relied in the order of the lower authorities.

4.1 From the aforesaid discussion we find that the assessee has incurred losses from the off market commodity transactions and the AO held such loss as bogus and inadmissible in the eyes of the law. The same loss was also confirmed by the ld. CIT(A). However, we find that all the transactions through the broker were duly recorded in the books of the assessee. The broker has also declared in its books of accounts and offered for taxation. In our view to hold a transaction as bogus, there has to be some concrete evidence where the transactions cannot be proved with the supportive evidence.”

(vii).M/s Classic Growers Ltd. vs. CIT [ITA No. 129 of 2012] (Cal- HC)

In this case the ld AO found that the formal evidences produced by the assessee to support huge losses claimed in the transactions of purchase and sale of shares were stage managed. The Hon’ble High Court held that the opinion of the AO that the assessee generated a sizeable amount of loss out of prearranged transactions so as to reduce the quantum of income liable for tax might have been the view expressed by the ld AO but he miserably failed to substantiate that. The High Court held that the transactions were at the prevailing price and therefore the suspicion of the AO was misplaced and not substantiated.

(viii)CIT V. Lakshmangarh Estate & Trading Co. Limited [2013] 40 taxmann.com 439 (Cal) – In this case the Hon’ble Calcutta High Court held that on the basis of a suspicion howsoever strong it is not possible to record any finding of fact. As a matter of fact suspicion can never take the place of proof. It was further held that in absence of any evidence on record, it is difficult if not impossible, to hold that the transactions of buying or selling of shares were colourable transactions or were resorted to with ulterior motive.

We note that above mentioned judgments of Hon`ble Calcutta High Court, by and large held that where the whole transactions were supported by contract notes, bills and were carried out through recognized stockbroker of Stock Exchange and all the payments made to the stockbroker and all the payments received rom stockbroker through account payee cheques, then in these facts and circumstances addition made by assessing officer on account of bogus long term capital gain should be deleted. We note that unless and until the order of Jurisdictional Hon`ble High Court is reversed by Hon`ble Supreme Court, the same has to be given due effect. Judicial discipline demands that once an order has been passed in the assessee’s own case, by the Jurisdictional High court, the Tribunal is duty bound to act in accordance with the same.

We note that in the case of Union of India v. Raghubir Singh (1989) 178 ITR 548 (SC), the Supreme Court held that the doctrine of binding precedent has merit of promoting certainty and consistency in judicial decisions. As per the doctrine of precedent, all lower Courts, Tribunals and authorities exercising judicial or quasijudicial functions are bound by the decisions of the High Court within whose territorial jurisdiction these Courts, Tribunals &authorities functions. Therefore, respectfully following the judgments of the Jurisdictional, Hon`ble High Court of Calcutta, on similar and identical facts, the addition made by assessing officer should be deleted.

25. We note that when the transactions were as per norms prescribed by SEBI and concerned stock exchange and suffered STT, brokerage, service tax, and cess. There is no iota of evidence over the transactions as it were reflected in demat account. AO did not doubt the genuineness of the documents submitted by assessee. The ld AO failed to bring on record any evidence to suggest that the sale of shares by the Assessee were not genuine. The assessee produced the contract notes, details of demat accounts and produced documents showing all payments were received by the assessee through banks. In these circumstances, the long term capital gain (LTCG) earned by the assessee should not be treated as bogus, as held by the Coordinate Benches of ITAT Kolkata, in the following cases:

(i). Mr. Sanjiv Shroff, I.T.A. No. 1197/Kol/2018, Assessment Year: 2014-15, order dated, 02.01.2019

“28. We note that since the purchase and sale transactions are supported and evidenced by Bills, Contract Notes, Demat statements and bank statements etc., and when the transactions of purchase of shares were accepted by the ld AO in earlier years, the same could not be treated as bogus simply on the basis of some reports of the Investigation Wing and/or the orders of SEBI and/or the statements of third parties. In support of the aforesaid submissions, the ld AR, in addition to the aforesaid judgements, has referred to and relied on the following cases:-

(xx) Baijnath Agarwal vs. ACIT – [2010] 40 SOT 475 (Agra (TM)

(xxi) ITO vs. Bibi Rani Bansal – [2011] 44 SOT 500 (Agra) (TM)

(xxii) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agra/2009 (Agra ITAT)

(xxiii) ACIT vs. Amita Agarwal & Others – ITA Nos. 247/(Kol)/ of 2011 (Kol ITAT)

(xxiv) Rita Devi & Others vs. DCIT – IT(SS))A Nos. 22-26/Kol/2p11 (Kol ITAT)

(xxv) Surya Prakash Toshniwal vs. ITO – ITA No. 1213/Kol/2016 (Kol ITAT)

(xxvi) Sunita Jain vs. ITO – ITA No. 201 & 502/Ahd/2016 (Ahmedabad ITAT)

(xxvii) Ms. Farrah Marker vs. ITO – ITA No. 3801/Mum/2011 (Mumbai ITAT)

(xxviii) Anil Nandkishore Goyal vs. ACIT – ITA Nos. 1256/PN/2012 (Pune ITAT)

(xxix) CIT vs. Sudeep Goenka – [2013] 29 taxmann.com 402 (Allahabad HC)

(xxx) CIT vs. Udit Narain Agarwal – [2013] 29 taxmann.com 76 (Allahabad HC)

(xxxi) CIT vs. Jamnadevi Agarwal [2012] 20 taxmann.com 529 (Bombay HC)

(xxxii) CIT vs. Himani M. Vakil – [2014] 41 taxmann.com 425 (Gujarat HC)

(xxxiii) CIT vs. Maheshchandra G. Vakil – [2013] 40 taxmann.com 326 (Gujarat HC)

(xxxiv) CIT vs. Sumitra Devi [2014] 49 Taxmann.com 37 (Rajasthan HC)

(xxxv) GaneshmullBijay Singh Baid HUF vs. DCIT – ITA Nos. 544/Kol/2013 (Kolkata ITAT)

(xxxvi) Meena Devi Gupta & Others vs. ACIT – ITA Nos. 4512 & 4513/Ahd/2007 (Ahmedabad ITAT)

(xxxvii) Manish Kumar Baid ITA 1236/Kol/2017 (Kolkata ITAT) (xxxviii) Mahendra Kumar Baid ITA 1237/Kol/2017 (Kolkata ITAT)

29. The ld AR also brought to our notice that once the assessee has furnished all evidences in support of the genuineness of the transactions, the onus to disprove the same is on revenue. He referred to the judgement of Hon’ble Supreme Court in the case of Krishnanand Agnihotri vs. The State of Madhya Pradesh [1977] 1 SCC 816 (SC). In this case the Hon’ble Apex Court held that the burden of showing that a particular transaction is benami and the assessee owner is not the real owner always rests on the person asserting it to be so and the burden has to be strictly discharged by adducing evidence of a definite character which would directly prove the fact of benami or establish circumstances unerringly and reasonably raising inference of that fact. The Hon’ble Apex Court further held that it is not enough to show circumstances which might create suspicion because the court cannot decide on the basis of suspicion. It has to act on legal grounds established by evidence. The ld AR submitted that similar view has been taken in the following judgments while deciding the issue relating to exemption claimed by the assessee on LTCG on alleged Penny Socks.

(iii) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agr/2009 (Agra ITAT)

(iv) ACIT vs. J. C. Agarwal HUF – ITYA No. 32/Agr/2007 (Agra ITAT)

30. Moreover, it was submitted before us by ld AR that the AO was not justified in taking an adverse view against the assessee on the ground of abnormal price rise of the shares and alleging price rigging. It was submitted that there is no allegation in orders of SEBI and/or the enquiry report of the Investigation Wing to the effect that the assessee, the Companies dealt in and/or his broker was a party to the price rigging or manipulation of price in CSE. The ld AR referred to the following judgments in support of this contention wherein under similar facts of the case it was held that the AO was not justified in refusing to allow the benefit under section 10(38) of the Act and to assess the sale proceeds of shares as undisclosed income of the assessee under section 68 of the Act :-

(v) ITO vs. Ashok Kumar Bansal – ITA No. 289/Agr/2009 (Agra ITAT)

(vi) ACIT vs.Amita Agarwal & Others - ITA Nos. 247/(Kol)/ of 2011 (Kol ITAT)

(vii) Lalit Mohan Jalan (HUF) vs. ACIT – ITA No. 693/Kol/2009 (Kol ITAT)

(viii) Mukesh R. Marolia vs. Addl. CIT – [2006] 6 SOT 247 (Mum)

31. We note that the ld. D.R. had heavily relied upon the decision of the Hon’ble Bombay High Court in the case of Bimalchand Jain in Tax Appeal No. 18 of 2017. We note that in the case relied upon by the ld. D.R, we find that the facts are different from the facts of the case in hand. Firstly, in that case, the purchases were made by the assessee in cash for acquisition of shares of companies and the purchase of shares of the companies was done through the broker and the address of the broker was incidentally the address of the company. The profit earned by the assessee was shown as capital gains which was not accepted by the A.O. and the gains were treated as business profit of the assessee by treating the sales of the shares within the ambit of adventure in nature of trade. Thus, it can be seen that in the decision relied upon by the ld. DR, the dispute was whether the profit earned on sale of shares was capital gains or business profit.

32. It is clear from the above that the facts of the case of the assessee are identical with the facts in the cases wherein the co-ordinate bench of the Tribunal has deleted the addition and allowed the claim of LTCG on sale of shares of M/s KAFL. We, therefore, respectfully following the same, and set aside the order of Ld. CIT(A) and direct the AO not to treat the long term capital as bogus and delete the consequential addition.”

(ii) Jagmohan Agarwal Vs. ACIT, ITA No.604/Kol/2018, order dated 05.09.2018.

“35. In the light of the documents stated in para 30 at Page14(supra) we find that there is absolutely no adverse material to implicate the assessee to the entire gamut of unfounded/unwarranted allegations leveled by the AO against the assessee, which in our considered opinion has no legs to stand and therefore has to fall. We take note that the ld. DR could not controvert the facts which are supported with material evidences furnished by the assessee which are on record and could only rely on the orders of the AO/CIT(A). We note that the allegations that the assessee/brokers got involved in price rigging/manipulation of shares must therefore consequently fail. At the cost of repetition, we note that the assessee had furnished all relevant evidence in the form of bills, contract notes, demat statement and bank account to prove the genuineness of the transactions relevant to the purchase and sale of shares resulting in long term capital gain. Neither these evidences were found by the AO nor by the ld. CIT(A) to be false or fictitious or bogus nor the AO had issued any notice to the brokers for confirmation. The facts of the case and the evidence in support of the evidence clearly support the claim of the assessee that the transactions of the assessee were genuine and the authorities below was not justified in rejecting the claim of the assessee exempted u/s 10(38) of the Act on the basis of suspicion, surmises and conjectures. It is to be kept in mind that suspicion how so ever strong, cannot partake the character of legal evidence. In the aforesaid facts and circumstance, for allowing the appeal we rely on the decision of the Hon’ble Calcutta High Court in the case of M/s. Alipine Investments in ITA No.620 of 2008 dated 26th August, 2008 wherein the High Court held as follows:

“It appears that there was loss and the whole transactions were supported by the contract notes, bills and were carried out through recognized stock broker of the Calcutta Stock Exchange and all the bills were received from the share broker through account payee which are also filed in accordance with the assessment.

It appears from the facts and materials placed before the Tribunal and after examining the same, the tribunal allowed the appeal by the assessee.

In doing so the tribunal held that the transactions cannot be brushed aside on suspicion and surmises. However it was held that the transactions of the shares are genuine. Therefore we do not find that there is any reason to hold that there is no substantial question of law held in this matter. Hence the appeal being ITA No.620 of 2008 is dismissed.”

36. We note that the ld. AR cited plethora of the case laws to bolster his claim which are not being repeated again since it has already been incorporated in the submissions of the ld. AR (supra) and have been duly considered to arrive at our conclusion. The ld. DR could not bring to our notice any case laws to support the impugned decision of the ld. CIT(A)/AO. In the aforesaid facts and circumstances of the case, we hold that the ld. CIT(A) was not justified in upholding the addition of sale proceeds of the shares as undisclosed income of the assessee u/s 68 of the Act. We therefore direct the AO to delete the addition.”

(iii).Navneet Agarwal, ITA No.2281/Kol/ 2017, order dated 05.09.2018

“The assessee in this case had stated that the assessee was allotted of 50000 equity shares of SCITIL. The payment for the allotment of shares was made through an account payee cheque (copy of the bank statement evidencing the source of money). Annual return no. 20B was filed with Registrar of companies by SCITIL showing the assessee's name as shareholder. The assessee lodged the said shares with the Depository ESSBSL with a Demat request. The said shares were dematerialized and copy of demat request slip along with the transaction statement is placed on record. Later on, the High Court approved the scheme of amalgamation of SCITIL with CSL. In accordance with the said scheme of amalgamation, the assessee was allotted 50000 equity shares of CSL. The demat shares are reflected in the transaction statement of the period from 1-11-2011 to 31-12-2013. The assessee sold 50000 shares through her broker SKP which was a SEBI registered broker and earned a Long Term Capital Gain. Copy of Form No. 10DB issued by the broker, in support of charging of S.T.T. in respect of the transactions appearing in the ledger is placed on record. The holding period of the said scrip is more than one year (above 500 days) through in order to get the benefit of claim of Long Term Capital Gain the holding period is required to be 365 days The Assessing Officer as well as the Commissioner (Appeals) have rejected these evidences filed by the assessee by referring to 'Modus Operandi' of persons for earning long term capital gains which is exempt from income tax. All these observations of Investigation wing were general in nature and were applied across the board to all the 60,000 or more assessees who fall in this category. Specific evidences produced by the assessee were not controverted by the revenue authorities. No evidence collected from third parties was confronted to the assessees. No opportunity of cross-examination of persons, on whose statements the revenue relied to make the addition, was provided to the assessee. The addition is made based on a report from the investigation wing.

The issue for consideration is whether, in such cases, the legal evidence produced by the assessee has to guide decision in the matter or the general observations based on statements, probabilities, human behaviour and discovery of the modus operandi adopted in earning alleged bogus LTCG and STCG, that have surfaced during investigations, should guide the authorities in arriving at a conclusion as to whether the claim is genuine or not. An alleged scam might have taken place on LTCG etc. But it has to be established in each case, by the party alleging so, that this assessee in question was part of this scam. The chain of events and the live link of the assessee's action giving her involvement in the scam should be established. The allegation imply that cash was paid by the assessee and in return the assessee received LTCG, which is income exempt from income tax, by way of cheque through Banking channels. This allegation that cash had changed hands, has to be proved with evidence, by the revenue. Evidence gathered by the Director Investigation's office by way of statements recorded etc. has to also be brought on record in each case, when such a statement, evidence etc. is relied upon by the revenue to make any additions. Opportunity of cross examination has to be provided to the assessee, if the Assessing Officer relies on any statements or third party as evidence to make an addition. If any material or evidence was sought to be relied upon by the Assessing Officer, he has to confront the assessee with such material. The claim of the assessee cannot be rejected based on mere conjectures unverified by evidence under the pretentious garb of preponderance of human probabilities and theory of human behaviour by the department.

It is well settled that evidence collected from third parties cannot be used against an assessee unless this evidence is put before him and he is given an opportunity to controvert the evidence. In this case, the Assessing Officer relied only on a report as the basis for the addition. The evidence based on which the DDIT report was prepared is not brought on record by the Assessing Officer nor is it put before the assessee. The submission of the assessee that she is just an investor and as she received some tips and she chose to invest based on these market tips and had taken a calculated risk and had gained in the process and that she is not party to the scam etc., has to be controverted by the revenue with evidence. When a person claims that she has done these transactions in a bona fide and genuine manner and was benefitted, one cannot reject this submission based on surmises and conjectures. As the report of investigation wing suggests, there are more than 60,000 beneficiaries of LTCG. Each case has to be assessed based on legal principles of legal import laid down by the Courts of law